Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

======================================================================================================================================================================================

Yes, it’s time again for collecting big campaign money, you know, what the Scalia Supreme Court euphemistically calls “free speech.”

First the good news:

House Republicans adding to debt as balanced budget commitment wavers

Tax measures, spending bills not offset, costs hidden with accounting gimmicksMore than a dozen bills with costs that are not fully offset elsewhere in the budget have passed the Republican-controlled House and threaten to add nearly $1 trillion to federal debt over the next decade.

Adding to the misnamed “debt” will send many billions into our economy. Federal Deficits = Private Sector Income. That is a good thing.

But of course, there is expected news:

The measures include a slew of tax breaks known as tax extenders. Among them are a $155 billion research and development tax credit [benefits to companies], a $90 billion expansion of the child tax credit to higher-income families and a $2 billion enhanced tax deduction for businesses that make charitable food donations.

O.K., we like federal tax deductions. They add dollars to the economy. But did the right-wing pols really have to widen the gap between the rich and the rest? Isn’t the gap too wide, already? How much greed is enough?

Republicans have demanded that spending increases, including for disaster relief and other crises, be funded or offset in the budget.

Yes, of course, because those things benefit the lower income/wealth/power groups, and can narrow the gap between the rich and the rest — the last thing the rich want.

When Republicans dropped the pay-as-you-go rhetoric in favor of tax breaks and funding for programs they support, such as $6 billion to restore military pensions, Democrats accused Republicans of applying a double standard.

If there’s one thing the right-wing loves as much as guns, it’s the military. Must be a genetic thing.

Republicans recoiled from President Obama’s $3.7 billion request to help resolve the border crisis.

What? Spend money to help children escape from the horrific living (dying?) conditions in their home countries? Unthinkable. Deport ’em all.

Rep. Tom Cole, Oklahoma Republican and member of the House Budget Committee, said, “I’m not going to apologize because Republicans believe in low taxes and less regulation. I think that’s why God made Republicans.”

I revise my previous statement. They love guns, the military and God. As for loving poor people, not really.

House Republicans last week threw their support behind a $14 billion bill to reform the Department of Veterans Affairs [there’s that military, again].

It is partially offset by about $4 billion with a budget trick called pension smoothing, which allows companies to temporarily put less money into pension accounts resulting in higher [net] profits and bigger tax bills for the companies.

It’s another good/bad thing. It’s good that companies get higher net profits, but it’s bad that more taxes are taken out of the economy.

Said Maya MacGuineas, CEO of the Committee for a Responsible Federal Budget. “The real test of fiscal responsibility is the willingness to make the tough choices to pay for your own priorities. If you believe a policy is worthwhile, you should be willing to pay for it.”

By now, you must know of Maya MacGuineas, the well-paid shill for the screw-the-poor movement and vocal purveyor of the Big Lie. If she’s in on it, hang on to your wallet, unless you’re part of the upper .1%

So cough up plutocrats. If you expect Republican votes — votes that go against Republican cut-the-deficit electioneering — you’ll have to come up with plenty of campaign cash.

And by the way, my daughter needs a big job when she graduates college.

And so will I.

================================

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

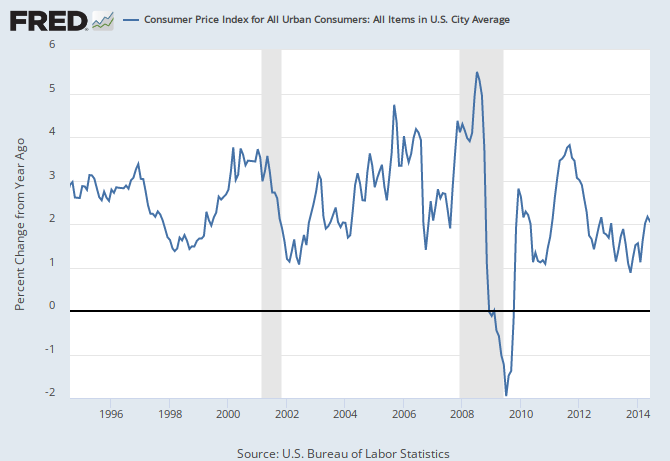

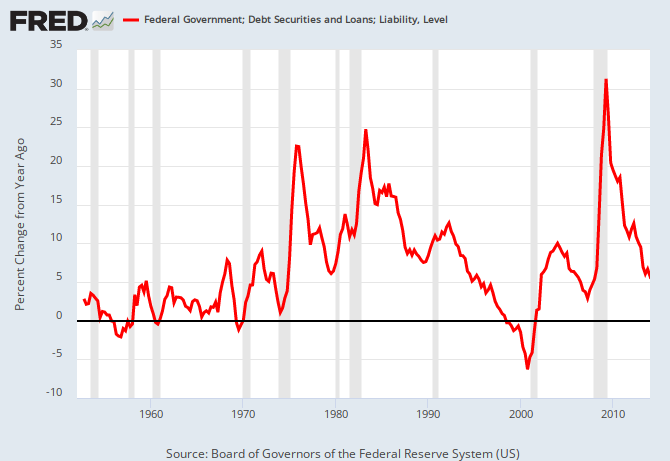

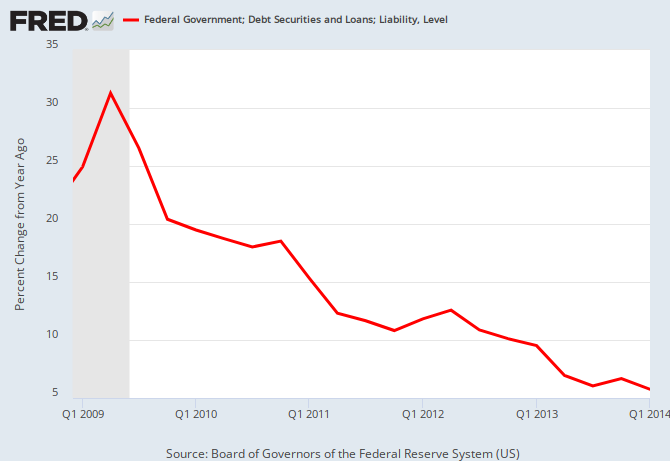

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY