Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

There are two sides to every argument, and this post will present the one side that seems to be absent from the street protests in Europe and America.

The other side is free to argue its logical and factual points, and we’ll print them, but please, no swearing or insults:

Forget that Hamas aims its rockets at civilian areas.

Forget that Hamas intentionally places its citizens in harms way, by storing armaments in schools and hospitals, and encouraging people to remain in targeted areas.

Forget that Hamas also fires rockets from civilian areas in an attempt to encourage return fire that will kill citizens.

Forget that, contrary to popular wisdom, all of Gaza is not crowded with civilians, but rather that there are many acres of open areas from which rockets could be fired — but Hamas prefers to use their civilians as human shields, and even encourages their citizens to stay in dangerous areas.

Forget that Hamas fighters look exactly like Gazan civilians, there being no uniforms to differentiate them in street fighting.

Forget that Israel, alone among all nations, actually has tried to limit civilian casualties, and even warned civilians of coming raids. Who does that?

Forget that every war in world history has killed many, many civilians. Consider WWI, WWII, Korea, Vietnam, and all the civil wars in the middle east, all of which involved the deaths of innocents, yet Israel alone is criticized for wartime fatalities.

Forget that Palestinian suicide bombers intentionally murdered Israeli civilians, and only a wall was able to prevent more murders. Where were the street protests in Western nations?

Forget that the so-called “blockade” of Gaza applies only to weapons, and that Israel, in a humanitarian gesture, supplies Gaza with electricity, water and water pumps, gas, food, medicine, and all non-military items, much of which has not been paid for by Gaza.

Forget that “trading Gazan land for peace” did not bring Israel any more peace — in fact it brought less, a launching platform for rockets at Israel — and that not one nation on earth is willing to guarantee Israel that providing Palestinians with more Left Bank land would bring peace to Israel.

Forget that the misery in Gaza has been caused by Hamas, which used the millions of dollars worth of assets it has been given to build a war machine, not to help the people.

Forget those expensive tunnels made specifically to attack Israel, and to kidnap Israeli citizens, so to trade them for terrorists.

Forget that Hamas has been judged to be a terrorist organization, and fighting terrorists is every nation’s obligation.

Forget that Israel accepted a cease fire, which Hamas rejected and continued to fire rockets into Israel.

Forget that Israel repeatedly has been attacked by Arab and Muslim nations — populations that outnumber Israel 1000 to 1 — again and again and again.

Forget that Israel owns a minuscule sliver of land compared to the millions of acres owned by Arab nations, yet none of these nations has volunteered any of that land to the Palestinians.

Forget that it is impossible to negotiate with someone who denies your right to exist.

Forget that Hadassah hospital, the best hospital in the middle east, paid for by Jews, has many non-Jewish patients, nurses, doctors and other employees– including Arabs.

Forget that Jews historically have been discriminated against, tortured and murdered in Arab and Muslim countries.

Forget that Jews settled Palestine more than 3,000 years ago, and have more claim to that land than any other religion.

Forget that the borders of almost every nation on earth (including America) were determined in wars, yet there is no call for these nations to “return” any land.

Forget that as a result of the “Arab Spring,” hundreds of thousands of Arabs have been killed – by other Arabs — yet there are no protests in Western countries.

Forget that Hamas not only kills Jews, but also kills Christians, while Christians live in peace, in Israel.

Forget all those things, because after all Israel is judged on a different standard from any other nation on earth.

Why Israel is judged on a different standard from any other nation on earth?

Hmmm . . . Pretty obvious, isn’t it?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

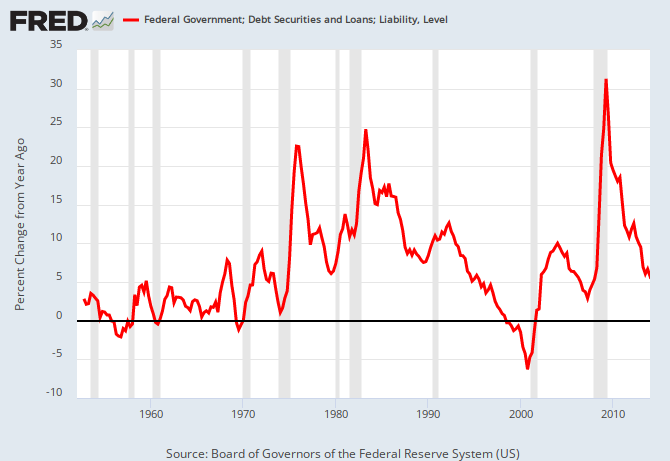

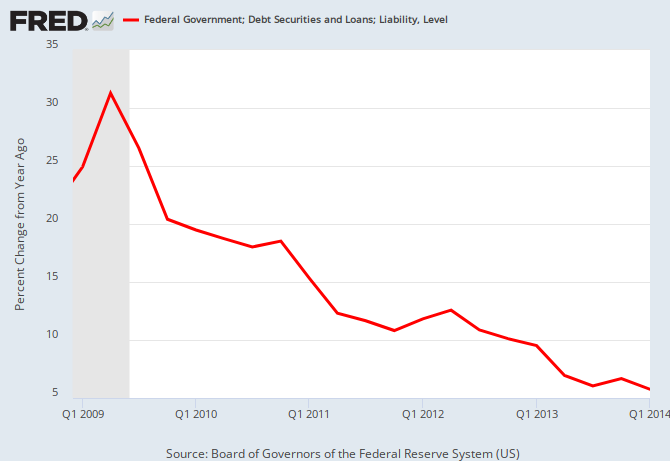

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY