Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

**Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

**The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

**Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

**The single most important problem in economics is the gap between rich and poor.

**Austerity is the government’s method for widening the gap between rich and poor.

**Until the 99% understand the need for federal deficits, the upper 1% will rule.

**To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

**Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Congratulations Greece, you have voted against eternal austerity and slavery to the troika.

Now, if you do it right, you will be among the most prosperous of European nations, while the rest of the euro zone either fades into depression or follows your lead.

Greeks defy Europe with overwhelming referendum ‘No’

ATHENS (Reuters) – Greeks voted overwhelmingly on Sunday to reject terms of a bailout, risking financial ruin in a show of defiance that could splinter Europe.

Financial “ruin” is what Greece has now, and what the troika proposes — endless, ongoing, unpayable debt, impoverishing the Greeks, their children and their grandchildren, forever.

But yes, it may deservedly splinter Europe, with the wise nations re-adopting their own sovereign currencies, and the rest dying the slow death of austerity.

It leaves Greece in uncharted waters: risking financial and political isolation within the euro zone and a banking collapse if creditors refuse further aid.

A Monetarily Sovereign nation need never have a “banking collapse,” so long as it doesn’t succumb to the “borrow-borrow-borrow” siren song of the troika loan sharks.

But for millions of Greeks the outcome was an angry message to creditors that Greece can longer accept repeated rounds of austerity that, in five years, had left one in four without a job. Prime Minister Alexis Tsipras has denounced the price paid for aid as “blackmail” and a national “humiliation”.

Better late than never to come to that realization.

Officials from the Greek government, which had argued that a ‘No’ vote would strengthen its hand to secure a better deal from international creditors after months of wrangling, immediately said they would try to restart talks with European partners.

Oh, no! Oh, no! You Greeks don’t need to “restart talks with European ‘partners.'” They are not partners of yours any more than a Mafia loan shark is a “partner” with his victims.

Issue your own sovereign currency. Become Monetarily Sovereign, again. Demand that your creditors accept your currency in payment, or they will receive nothing.

Pay for health care, education, food for the poor, housing for the poor, your needed goods and services — all with your own sovereign currency.

Tell your citizens to pay taxes in their own sovereign currency.

Go back to where you were before the ill-fated euro experiment in torture began.

But euro zone officials shot down any prospect of a quick resumption of talks. One official said there were no plans for an emergency meeting of euro zone finance ministers on Monday, adding the vote outcome meant the ministers “would not know what to discuss”.

Give those fools the Greek, open-handed “Nah.”

The result also delivers a hammer blow to the European Union’s grand single currency project. Intended to be permanent and unbreakable when it was created 15 years ago, the euro zone could now be on the point of losing its first member with the risk of further unraveling to come.

Yes, the money-lenders are wetting their pants from they won’t be able to keep the Greek people in debt-slavery.

Unable to borrow money on capital markets, Greece has one of the world’s highest levels of public debt. The International Monetary Fund warned last week that it would need massive debt relief and 50 billion euros in fresh funds.

For a Monetarily Sovereign nation, borrowing from foreigners is 100% unnecessary. But that is not what they want you to believe. They want you to think you need their loans.

But, exhausted and angry after five years of cuts, falling living standards and rising taxes imposed under successive bailout programs, many appear to have shrugged off the warnings of disaster, trusting that a deal can still be reached.

The only “deal” Greece needs is a return to Monetary Sovereignty. It will require strong, smart leadership. I can suggest a couple people who could help Greece with that.

Much good luck.

Stay strong and you’ll be strong.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

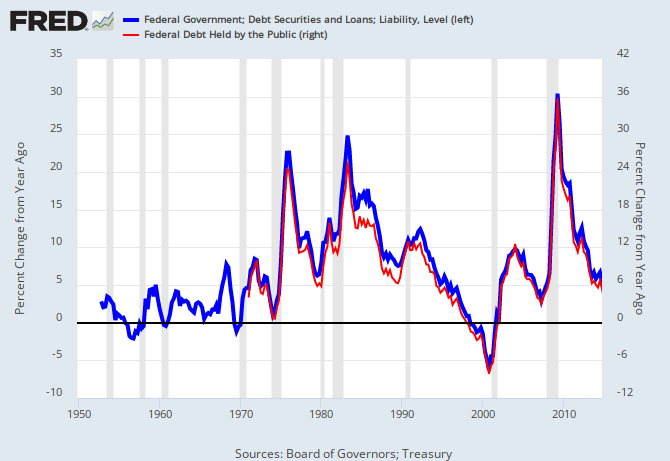

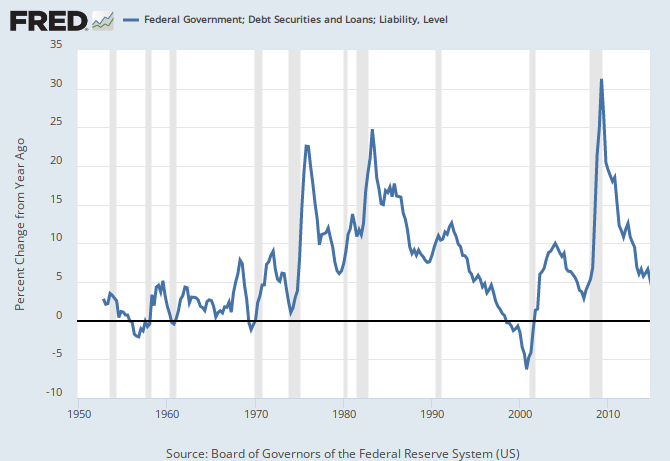

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY