Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

If you have been reading this blog, you know about the BIG LIE, the tale told by the rich, that federal financing is like personal financing.

According to the BIG LIE, our Monetarily Sovereign government, and its agencies, can run short of its own sovereign currency, unless taxes are increased or spending decreased.

The President of the United States repeatedly has expressed the BIG LIE (“Washington has to live within its means . . . Both parties agree that we need to reduce the deficit. . . “). Speaker of the House, John Boehner, famously expressed the BIG LIE when he said, “Let’s be honest. We’re broke.”

Of course, a government having the unlimited ability to create its own sovereign currency, cannot run out of that currency, so cannot be broke, and does not have a “means” to live within.

The purpose of the BIG LIE is to make you believe your social benefits (Social Security, Medicare, Medicaid, food stamps et al) must be reduced, while regressive taxes (FICA, sales taxes) must be increased.

The BIG LIE is sponsored by the rich to widen the Gap between the rich and the rest.

There are other lies sponsored by the rich. There’s the myth that the rich are the “makers” while the poor are the “takers.” (Never mind that the rich take all those gigantic tax-saving government benefits and hide their fortunes in foreign islands.)

And there’s the myth that obscenely high salaries are necessary to attract the best business talent. (Never mind that the Highest-Paid CEOs Are The Worst Performers)

But there is one other lie, you often have heard or read — a lie that seems to be accepted on its face, though it is wrong, wrong, wrong. The lie was expressed by that notorious, right-wing shill, John Kass, in the September 5th edition of the Chicago Tribune.

In discussing the merits of Bruce Rauner, the billionaire Republican candidate for Governor of Illinois, Kass said:

“A guy that rich can’t be bought.”

So there you have it, the “rich-guy’s favorite lie: Rich people are honest, while poor people are criminals.

It is a most wonderful lie. It provides one of the excuses for refusing to allow poor Latinos entrance into the U.S., and for deporting them. (How many rich people are refused entrance or deported?)

It is a lie that provides the excuse for Florida’s criminal governor, Rick Scott, to drug test the poor before they could receive poverty benefits.

It is a lie that ignores the wealthy traders (yet to be prosecuted), whose unlimited and ongoing greed caused the Great Recession, and the greed of the wealthy politicians who solicit campaign contributions.

Remember, Rauner is a billionaire, who easily could afford to finance his entire campaign out of his own pocket, but whose personal greed causes him to ask for contributions from people who have much less money than he does.

The rich love to pose as pure and clean, as people who are above avarice and criminality. It is the poor, filthy masses who can’t be trusted.

The fact: There is no amount of money, no amount of wealth, no amount of power that will satisfy a glutton, no matter how much that person already has.

The sole difference between the rich and the rest: The rich know how to avoid punishment for their enormous thefts.

Just ask the Department of Justice about bankers.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

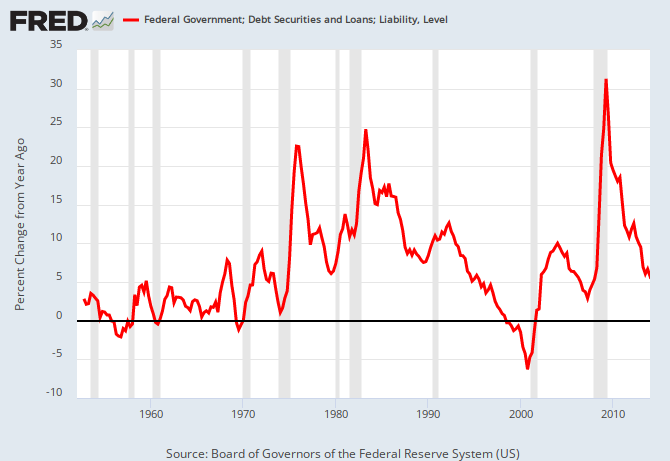

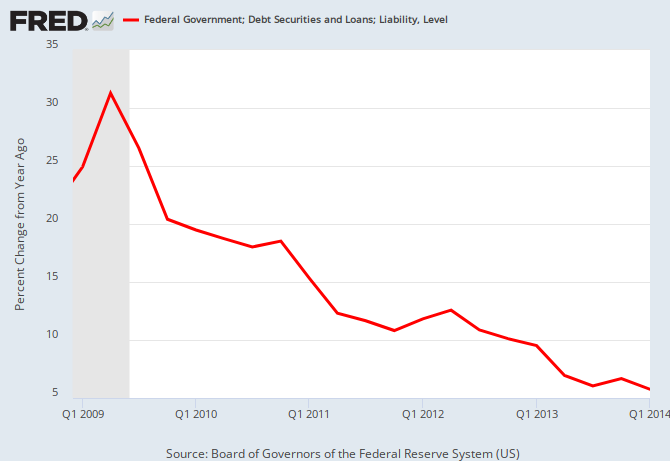

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY