In 1647, the Massachusetts “Old Deluder Satan Act” required towns in colonial New England to hire teachers. The schools were funded by local taxes to promote literacy, so people could read the Bible.

This is widely regarded as the first law that mandated publicly funded education in what would later become the United States. By the early 1800s, this idea had spread, with other New England states adopting similar town-funded schools, although southern states did not follow suit.

In the 1830s to 1850s, modern free public schooling took shape. In Massachusetts in 1837, Horace Mann championed free, universal education funded by taxes and implemented by professional teachers.

By around 1850, most Northern states had established free public elementary schools funded by property taxes. These schools were accessible to most white children, as racial equality was achieved much later.

High schools came in 1821. The Boston English High School became the first free public high school in the U.S.

By the late 1800s to early 1900s, free public high schools became widespread. Compulsory attendance laws began in 1880–1918, and segregation ended (legally): 1954, Brown v. Board of Education. Truly universal access began in the mid-20th century.

Why was free schooling mandated in the past, while free advanced education is often discouraged today? The answer, as usual, involves Monetary Sovereignty and Gap Psychology,

Our Monetarily Sovereign federal government has an unlimited ability to create dollars with just a keystroke. It never can go bankrupt or run out of money. However, it often chooses to fund tax breaks for the wealthy rather than allocate resources to education for those who are less fortunate.

Gap Psychology describes a common, almost universal desire to distance oneself from those lower on the income, wealth, and power scale while trying to associate more with those above. This mindset is the primary way the wealthy maintain and increase their wealth. It also ensures that people continue to work even after they receive higher pay.

NEWS BRIEFING Borrowers in default on student loans may see wages garnished

WASHINGTON — The Trump administration said Tuesday that it will begin garnishing the wages of student loan borrowers who are in default early next year.

The department said it will send notices to about 1,000 borrowers the week of Jan. 7, with more notices to come at an increasing scale each month.

Millions of borrowers are considered in default, meaning they are 270 days past due on their payments. The department must give borrowers 30 days’ notice before garnishing their wages.

The department said it will begin collection activities, “only after student and parent borrowers have been provided sufficient notice and opportunity to repay their loans.”

In May, the Trump administration ended the pandemic-era pause on student loan payments and began collecting on defaulted debt by withholding tax refunds and other federal payments from borrowers.

The move ended a period of leniency for student loan borrowers. Payments resumed in October 2023, but the Biden administration extended a one-year grace period. Since March 2020, no federal student loans had been referred for collection, including those in default, until the Trump administration’s changes earlier this year.

The Biden administration tried multiple times to offer broad student loan forgiveness, but those efforts were eventually halted by courts.

Persis Yu, deputy executive director of the Student Borrower Protection Center, criticized the decision to begin wage garnishment and said the department had failed to sufficiently help borrowers find affordable payment options.

Given that:- Educated young people are vital for America’s advancement and security.

- The federal government does not need or even use any form of income.

- The federal government has the infinite ability to create dollars and fund anything it wishes.

Why does the government fund free elementary and high school — in fact, make attendance compulsory — but garnish the wages of our single most valuable future resource, college students?

Free basic schooling still reinforces the social hierarchy. It still supports the Gap. Early public education has been sold as moral and obedience training, workforce preparation, and national cohesion.

It teaches punctuality, deference to authority, and literacy sufficient for labor, not power.

Even in our early days, basic schooling did not threaten the Gap. Elites benefit because it make for more productive workers, fewer unruly poor, and cultural conformity

But college education for the poor is exactly what the rich do not want.

- It reduces the fear of losing one’s job, thus:

- It increases labor’s bargaining power (which is why the rich hate unions), and

- It puts “the rabble” on a par with the rich and weakens employers’ control.

Free college would narrow the Gap.

In this context, a federally sponsored, comprehensive, no-deductible Medicare program that covers every man, woman, and child in America would help close the healthcare Gap.

In contrast, business-sponsored healthcare insurance for workers tends to reinforce this Gap. Millions of workers fear leaving their jobs or making demands of their employers because they worry about losing their healthcare coverage.

The federal government easily could afford to provide healthcare insurance to everyone. However, instead of doing this, it offers businesses tax incentives to provide less comprehensive coverage—just enough to keep employees dependent on their jobs for healthcare.

Finally, the same would hold for federally sponsored, living-wage Social Security for everyone, of all ages. The rich make three false excuses:

- It would require tax increases (aka “Who would pay for it”?)

- It would cause inflation by adding growth dollars to the economy (Federal spending isn’t inflationary.)

- If given a bare minimum stipend, no one would work because the poor have no ambition. (aka, “Keep ’em poor so they have to accept low-pay jobs and bad working conditions.:”)

And things will have to get much worse before the populace begins to understand how Monetary Sovereignty and Gap Psychology are used against them.

Only a nation of fools would give a tax break to religion but not to science and education.

Rodger Malcolm Mitchell

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell;

MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell;

……………………………………………………………………..

A Government’s Sole Purpose is to Improve and Protect The People’s Lives.

MONETARY SOVEREIGNTY

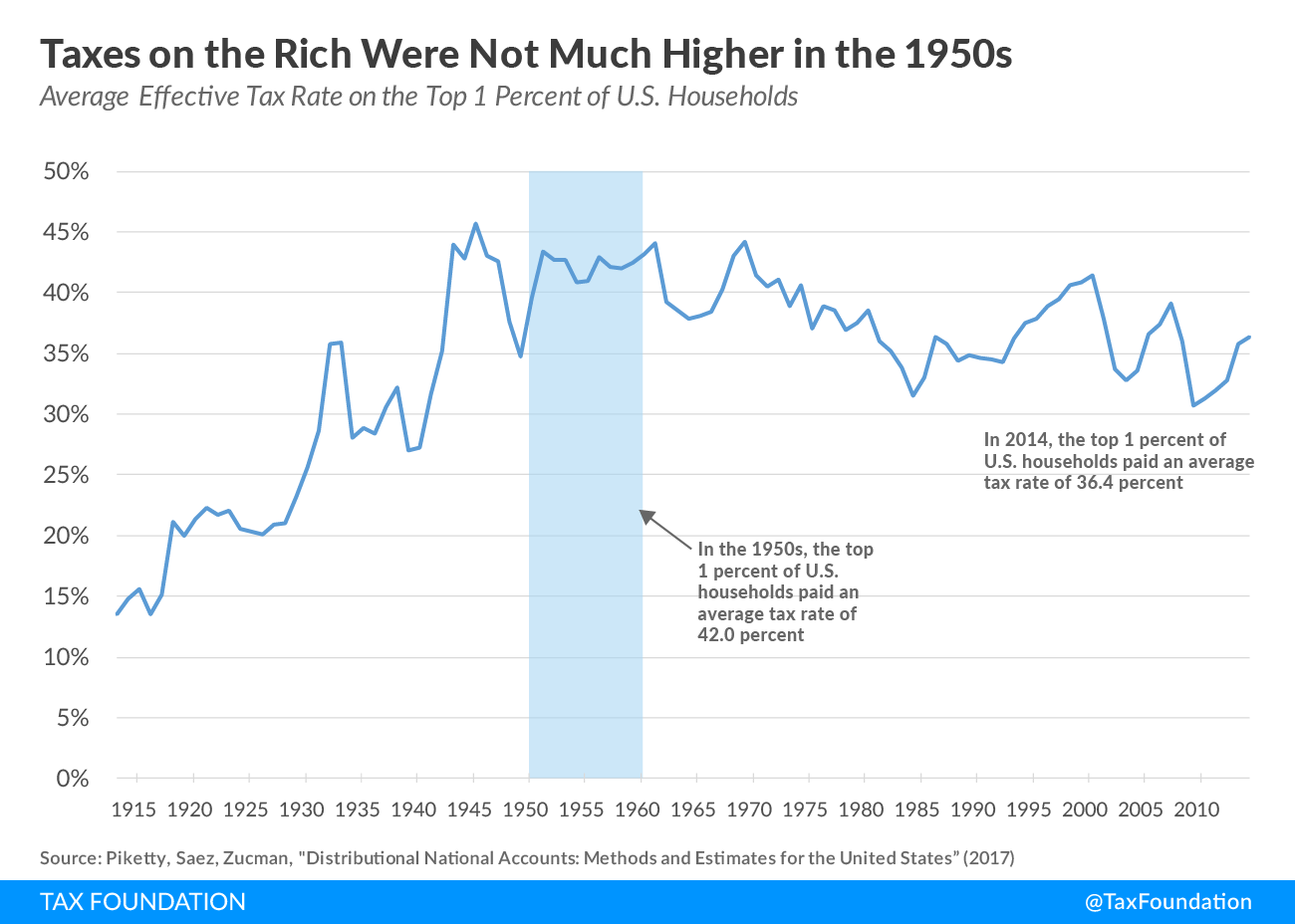

Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is

Considering that the top tax rate in the 1950s was 90%, the rich did not pay much more in that period than they do now. And some of the richest among us pay little if anything.

For example, Donald Trump paid no income taxes at all, during ten of the fifteen years, 2000-2015, despite being a billionaire. Tax laws, favorable to the rich, gave him the ability to claim losses on investments that an ordinary taxpayer may not look at as “losing” money.

In summary, using federal taxation of the rich to narrow the Gap is bad economics. History shows the rich would find ways to avoid paying higher rates.

But, even if the rich were forced to pay more, the higher rates would take dollars out of the economy and recess the economy. Option #1 is a “heads-you-lose (the rich don’t pay more), tails-you-lose” (GDP falls) plan.

Sadly, that is the plan Biden seems to have chosen, and it will cost him the November election.

The electorate may be ignorant about economics, but the rich would make sure the voters understood that raising taxes — anyone’s taxes — would hurt the economy.

It’s simple math. The more the federal government takes out of the economy, the less the economy (GDP) has.

Reducing federal taxes and/or providing supplementary benefits to those who are not rich, (#2 and #3) are the sole economically sensible ways to narrow the income/wealth/power Gap.

Sadly this sensible approach is blocked by the non-sensible belief that federal deficit spending is