Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

It’s that time again, and again we are treated to the phony food fight, between the right wing (Obama Democrats) and the extreme right wing (Tea Republicans), to decide the best way to destroy the American economy.

Will the nation be forced to renege on its debts, ruining our credit world-wide and annihilating the dollar’s value (Tea Republican’s choice), or to impose on the middle-class a crushing “Grand Bargain” that would impoverish millions (Obama Democrat’s choice)?

An economics writer named “Joe Firestone,” wrote an excellent article titled: Stop the Kabuki: It’s About “the Great Betrayal” I urge you to read it.

In the article, Firestone lists five methods by which Obama could free himself, and the nation, from the shackles of debt ceiling nonsense. (It’s nonsense simply because a Monetarily Sovereign government like the U.S., never can run short of its sovereign currency. That’s what “Monetarily Sovereign” means.)

Every one of these five methods would solve the problem, end the battle, and set America on a course for growth. Obama will adopt none of them.

Everything in economics devolves to motive, and Firestone lists as Obama’s motive:

All of this high drama is necessary for him (Obama) to pretend to his base that he was forced to do what he’s been trying to do for years: sacrifice old people since he perversely believes that “reforming” Social Security and Medicare will get him brownie points in the presidential legacy ledger.

I believe Mr. Firestone is wrong. I do not believe “legacy” is the prime motive for the Chicago politician who miraculously was lifted from nowhere to become our President.

Obama’s entire, political career has been based on the Chicago truth that money talks, and the wise politician listens. He was an undistinguished community organizer (whatever that is), an undistinguished attorney and an undistinguished teacher, who somehow found the money to become an undistinguished state senator, and found even more money to become an undistinguished national Senator.

He quickly learned to follow the money from fundraiser, friend and convicted felon, Tony Rezko. It was the money that plucked Obama from relative obscurity to become President.

As a comment to Mr. Firestone’s article, I wrote:

Missing from this excellent article is the answer to this fundamental question: “WHY will President Obama refuse to solve the problem? Why does he prefer the Grand Bargain?”

Without disclosing motive, the whole plot makes no sense. Everything in economics devolves to motive

The answer: President Obama has been bribed by the rich, to widen the gap between the rich and the rest. (See: Don’t be shy, MMT. It’s bribery, pure and simple. )

He has been bribed via campaign contributions and promises of lucrative employment — great wealth for him and his family. (Call it the “Clinton syndrome.”)

He has been bribed by the promise of a huge Obama Library. (Call it the “Pritzker syndrome.”)

This leads to the question, “Why have the rich bribed President Obama to impose the Grand Bargain?”

The motive: The rich do not care about their income or their wealth; they care only about the gap. It is the gap that makes them rich.

If there were no gap, no on would be rich, and the larger the gap, the richer they are.

Think of all the things for which the federal government spends. Social Security, Medicare, Medicaid, roads, bridges, education, the military, regulation of food, medicine, the financial markets, etc., etc..

Cuts in federal spending invariably affect the poor far more than the rich. Cuts in federal spending widen the gap.

Then there is “broadening the tax base,” that euphemism for taxing the poor more.

Obama has been bribed to widen the gap, and like a good Chicago politician, he bends to the money.

That is the motive.

Now the drama of a brave, resolute Obama, fighting against the forces of right wing evil, will play out, bolstered by the fact that the right wing really is evil.

You will be told that Obama is battling to save America, but that his hands are tied, and all he can do is cut spending on whatever benefits the middle- and lower-classes, because he has no choice.

Read Firestone’s article and you’ll see he has plenty of choices. But he won’t use them. By contrast, we have two choices. We can voice our displeasure, by contacting our politicians and the media.

Or we can sit back and enjoy Obama’s phony food fight.

For, we are the food.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

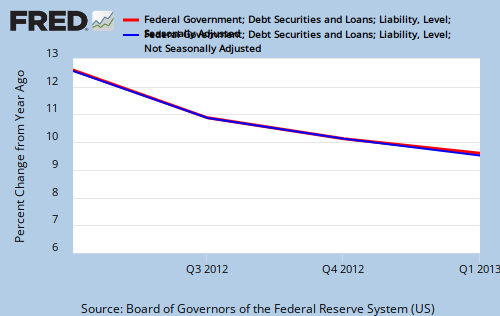

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY