- A Monetarily Sovereign entity has the unlimited ability to create its own sovereign currency. It cannot unintentionally run short, of its money, even if it has zero income.

- By contrast, the economy does not have the unlimited ability to create money, and when it runs short of money it has recessions and depressions.

- The United States government is Monetarily Sovereign. Therefore it has neither need for, nor use of tax dollars. In fact, the U.S. Treasury destroys all federal tax dollars. Upon receipt, they cease to exist in any money supply measure.

- Economic growth requires money growth. Gross Domestic Product, the most common measure of the economy, is based on spending by the public and by the federal government. GDP growth requires federal deficit spending.

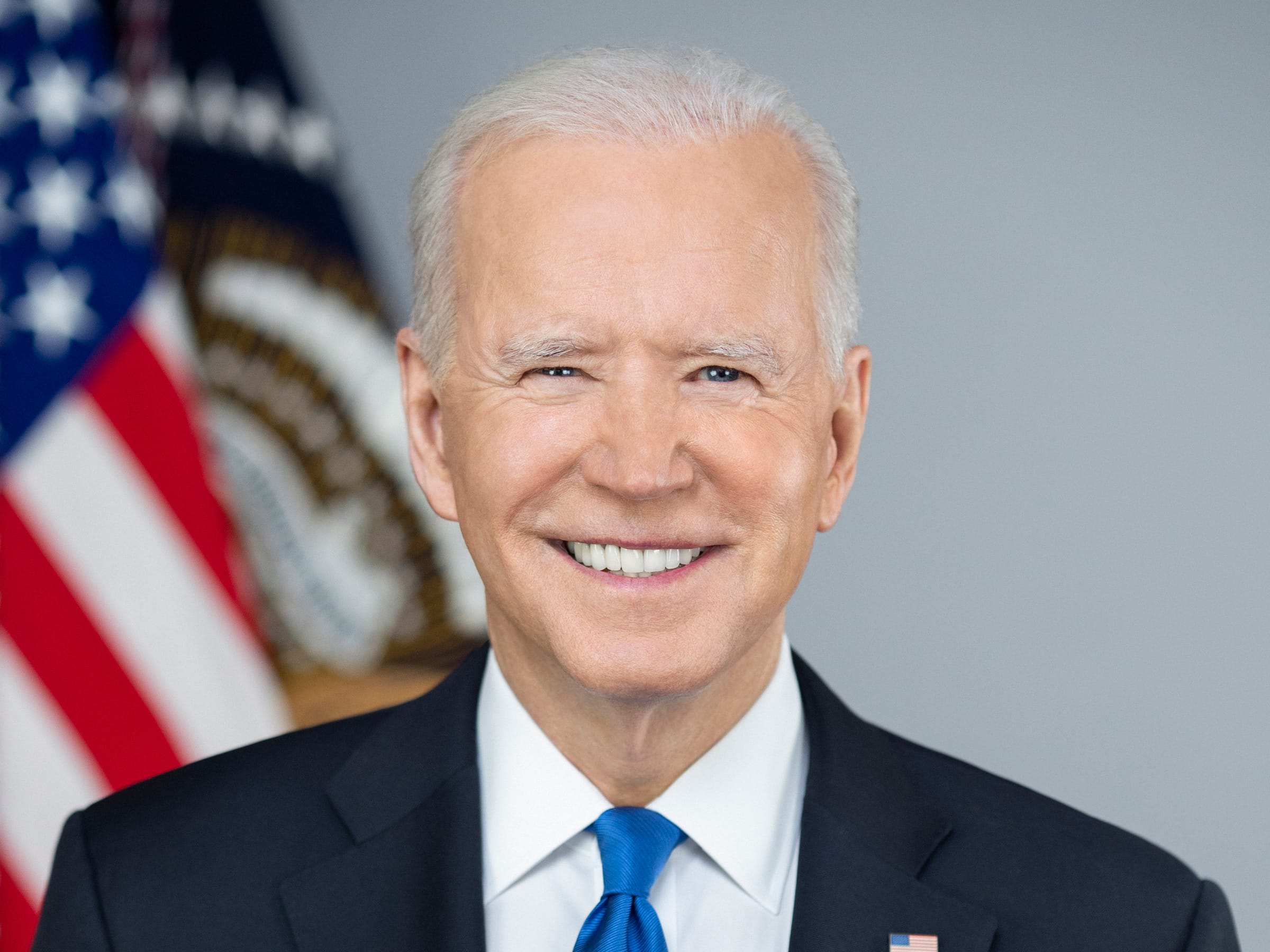

“President Biden spoke about his plan to close tax loopholes on major corporations and the wealthy during a speech Friday on this month’s job numbers.“Fair share” sounds so . . . well, fair . . . but it is utter nonsense, considering that all federal taxes are unnecessary and useless, some more so than others. By “fair,” Biden means that while you are forced to pay useless and economically damaging federal taxes, rich corporations and rich people pay comparitively less useless and economically damaging taxes. So his solution is to continue forcing you to pay those taxes, and to pretend to force rich people and companies to pay more. (I say “pretend,” because raising tax rates, the course charlatan politicians usually take, does nothing if there always are special breaks for the rich.)“PRESIDENT JOE BIDEN: The fact of the matter is though, that it is about time they begin to pay their fair share.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

No, Mr. President, the real unfairness is that the poor and middle-classes are forced to pay any federal taxes at all, thereby starving them and the economy, and benefiting no one.No one would be helped by corporations being forced to pay federal taxes. NO ONE, least of all the federal government, which has the unlimited ability to create dollars. Those “billions of dollars” would be deducted from the private sector, i.e. the U.S. economy, and destroyed. They would not help the government pay its bills, which it does by creating new dollars, ad hoc.“For example, you heard me say it before and I will say it again, it’s the best example of what to say to people. 55 of the largest corporations in America last year paid zero, zero, in federal taxes. I don’t care what your position is.

It’s just time to pay their fair share. Just pay a little bit here and it comes out to billions of dollars, if they pay.

It is the height of stupidity to take precious dollars from the the economy and to give them to an entity (aka “the federal government”), that has infinite dollars.

To solve that problem, simply stop taking dollars from the “vast majority of Americans who are struggling.”The irony of ironies is during the recession and the pandemic, you heard me say this before, when the vast majority of Americans are struggling to just hang out, the number of billionaires actually grew.

Do you want a “fair tax system”? Then immediately stop collecting FICA (one of the most regressive taxes in America), and provide Medicare for All and Social Security for all. Those would be three good steps toward fairness.Right now, the House and the Senate are working on my plan to generate a fair tax system and close big loopholes big corporations and the superwealthy use to pay less.

“We” is who? The federal government that already has infinite money? So, stop taking tax dollars from those “typical, hard working Americans.” Problem solved.There is a group of experts left, right, and center who estimate that we lose more than $100 billion a year in tax revenue owed from the top 1% of taxpayers alone. Not because of low tax rates, but because the wealthy people are not paying the taxes they owe.

We’re going to change that, so they pay taxes just like typical hard-working Americans right now.

No, you will not use the money you collect, for anything. Nor do you need to. The federal government already has infinite money. And don’t just give tax “cuts” to the middle-class families. Collect zero federal taxes from them.We will use the money we collect to give tax cuts for to give tax cuts to middle-class families. To make it easier to raise kids and take care of your aging parents. And so much more.

“Somebody has to pay,” and that “somebody” is the federal government, which pays all its bills by tapping a few computer keys and thus, creating dollars, ad hoc. Republicans won’t support the plan, for two reasons:What is going on in Congress? Not a single Republican supports this plan. They support the bipartisan plan, but not this plan. Not one.

And some big corporations are spending billions, legitimately, they’re lobbying, to try to escape their obligation to pay the taxes they owe, leading working families to pay a larger share of the burden.

Somebody has to pay. And when those who can afford to pay aren’t paying near their fair share, it means you all pay more.

- The GOP is the party of the rich, and only supports tax cuts and benefits for the rich. They despise the poor, and want to cut the minimal benefits the poor already receive.

- The GOP will not support Democrat’s plans, simply because Donald Trump is terrified of anything that makes Democrats “look good.” Today’s GOP is more loyal to Trump than to America.

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

MONETARY SOVEREIGNTY