Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==============================================================================================================================================================================

Word-search the post titles on the left side of this blog, and you will find several posts that include the words, “Never will know.”

They all allude to the same phenomenon: It’s hard to identify when something is missing. For instance, when the federal government unnecessarily “saves” money by cutting funds for Research & Development, there is no way to know what that has cost you.

The politicians love to talk about federal “savings,” but never mention what has been lost — because neither they, nor you, can identify those losses. R&D is done on faith. Some R&D produces value; most doesn’t.

But every scientific advance in human history has resulted from some sort of R&D, for which there were no guaranteed returns.

Case Study: Lilly Jaffe

Lilly Jaffe, of Chicago, was diagnosed with type 1 diabetes more than ten years ago, at the tender age of one month. What has happened to Lilly over the past few years is remarkable….

In 2006, her parents Laurie and Mike had attended the annual meeting of Juvenile Diabetes Research Foundation’s Illinois Chapter, where Dr. Louis Philipson, of the University of Chicago, presented an update in diabetes research.

He mentioned a study out of the U.K. that showed that some children diagnosed with diabetes in their first six months of life actually don’t have type 1 autoimmune diabetes, but instead have diabetes characterized by a rare genetic mutation that in about half the cases can be treated with a common oral medication.

A month after that, Lilly was admitted to the University of Chicago’s Clinical Research Center to begin a week-long program to see if the oral treatment could work for her.

She began a small dose of the medicine and her insulin dose was cut in half. Over the course of the week, her oral medication was increased each day, and her insulin dose was decreased.

After a week, tests began showing that, indeed, Lilly had begun to produce insulin on her own — for the first time in her six and half years of life! Lilly_Jaffe

The Jaffes left the hospital that night — with Lilly still on a pump, but using dramatically less insulin.

About five days later, the pump came off, and Lilly had taken the last insulin shot she’ll ever need; that was four years ago. Since then well over 200 individuals around the world have been diagnosed with very similar mutations, close to 100 in the United States alone.

Here was a child whose parents had to test her blood sugar 10 times a day, waking up in the middle of the night, every night, pricking her with painful needles.

Lilly says, “I used to run away from my Mom. I’d be like, ‘Don’t stick me with the needle.'”

Lilly had a form of the disease generally under the umbrella “monogenic diabetes,” that was cured by a drug called sulfonylurea — a drug already in use to help manage Type 2 diabetes.

Consider all the R&D that preceded this discovery: All the gene research, all the chemical testing. All the millions of hours of expensive education that has led us this far — the more millions that will be needed to go further.

Then think of those who never became researchers, and never made discoveries, because they couldn’t afford school. So those discoveries never were made and lives weren’t saved.

US has been cutting medical research funding since 2004

Meanwhile, the rest of the world is investing more

The US’s investment in medical research between 2004 and 2012 declined significantly. The same can’t be said for the rest of the world, as global investment in biomedical research actually increased during that same period, according to a study published today in the Journal of the American Medical Association.

Between 2004 and 2012, the amount of (US) money for research decreased by 0.8 percent a year — as the US’s global contribution to biomedical research dollars dropped to 44 percent in 2012, from 57 percent in 2004.

And while the US was cutting its medical research investments, Asian countries increased their global investment by 7 percent.

This means that some discoveries never get to move ahead, because there’s no money to make it happen.

And here is where the problem lies:

The reasons for the decline in medical research aren’t straightforward. Part of it has to do with a change in the investment landscape, where industry has taken to funding projects that yield results over short periods of time.

But a bigger part of the reason lies in economic downturns that occurred in the early 2000s. “When the US federal government runs deficits, biomedical research is de-emphasized.”

For all those who accept the Tea Party / libertarian thesis that the federal government is too big, and that the private sector always does things better, the fact is: The private sector is ruled by the profit motive.

So unless the R&D looks like it will pay off (which is very difficult to determine), and pay off in a big hurry, the CEOs of major corporations and institutions will not approve the millions or billions of dollars a research project might require — and lead nowhere.

The investor worldwide has become impatient. As a result, the markets have rewarded short-term performance, and that means that a marketing dollar goes further than a science dollar.

The federal government is under no such limitations. Federal spending is constrained only by Congress and the President, not by any lack of dollars or potential profits.

Federal spending, federal deficits and federal debts never are “unsustainable,” the word used by those who either are ignorant of, or uncaring about, Monetary Sovereignty.

When you see it or hear it, you know you are being treated to the Big Lie.

If the US wants to ensure that the health of its citizens is taken care of in the future, or that research in the country won’t be hindered by non-US patents, the US needs to increase spending in biomedical research, and investment in health services research.

Every day, Research & Development saves the lives of the Lilly Jaffes of the world. And every day, the lack of R&D costs the lives of millions.

Years ago, Senator William Proxmire, mockingly issued the “Golden Fleece award 168 times for what he deemed wasteful spending.

No one knows how many people died unnecessarily, as a result of this exercise in ignorance.

In his book, Creativity Inc, Pixar President Ed Catmull spoke of the “chilling effect on research” The Golden Fleece Award exerts.

He argues that if you fund thousands of research projects, some will have measurable, positive impacts and that others will not.

It is not possible to know in advance what the results of every research project would be or whether the results would have value.

He further argues that failure in research is essential and that fear of failure would distort the way researchers choose projects, which would ultimately impede society’s progress.

Today, the Tea/Republicans, with aid from the libertarians and even compliant Democrats, proudly proclaim that federal deficit spending will decrease to where the government actually runs a surplus.

In other words, not only will federal cash infusions to the economy decrease, but the federal government soon will be taking money from the economy.

Does the federal government need this money? No, it has the unlimited ability to create dollars.

Does the private sector need this money. Absolutely.

The lack of funding will continue to impact R&D, not only medical, but ALL research.

For lack of R&D funding, you and those you know and love, will lead less fulfilling lives, suffer too much and die too soon. That is beyond question.

And you never will know why.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

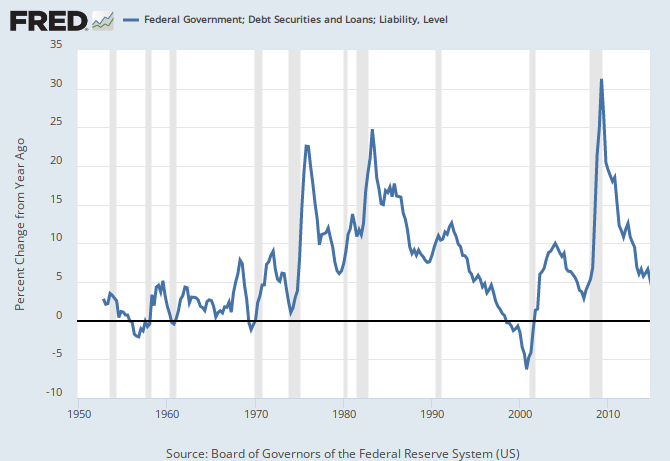

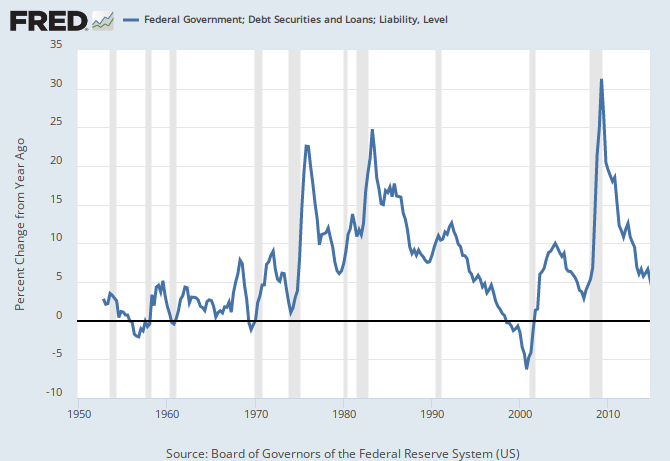

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY