Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

The police are our defense against the people who would hurt us. Every day, they face mortal danger to protect us. So why do we see this story in the Washington Times?

Police officer deaths in the line of duty double as morale sinks to new low

Law enforcement morale is at an all-time low as uniformed officers endure increased pushback from the communities and politicians they’re risking their lives to protect, and a new report released Monday shows on-duty law enforcement deaths in 2014 occurring at nearly twice the previous year’s rate.

The answer is complex, but I believe it boils down to one word: Control.

The number of law enforcement officers who were feloniously killed in the line of duty in 2014 increased 89 percent as compared to the year prior — with most dying after being shot by gun-carrying criminals, according to a preliminary report issued by the FBI on Monday.

The virtual disappearance of gun control in America means that anyone can have a gun and carry a gun. And humans being humans, a bit of anger, the need for revenge, the desire for larceny — all lead to shootings, planned or spontaneous, by someone carrying a gun.

Some percentage of the people, subject to a traffic stop, will be angry at the police officer. And since more people legally carry guns, there is an increased likelihood they will shoot the officer. It’s a matter of mathematics: More guns in the hands of angry or vengeful or larcenous people = more gun usage.

A “gun carrying criminal” is any person, carrying a gun, who commits a criminal act — like shooting someone. There is no sign on his forehead saying, “I am a criminal.” He is not recognizable on the street. He could be the guy sitting next to you on the bus. He could be your neighbor. He could be you.

You have a gun. You are angry about something. Maybe some jerk cuts you off on the road. Maybe your neighbor’s kid has a loud 2:00AM party. Maybe you were fired, today. And now a rude cop pulls you over.

Bam!

So that is the first Control problem. Controlling guns themselves.

The gun and ammo manufacturers have created a perfect business plan:

1. Bribe politicians to misinterpret and ignore the “militia” clause of the Constitution, to allow almost everyone to carry virtually every kind of gun.

2. Tell the populace that because almost everyone is carrying a gun, “you need to carry one, too.”

3. Fund an organization (NRA, et al.) to take the public heat and to spread the propaganda.

4. Convince the populace that any gun control is a government plan to take away their guns.

5. Return to point #1 and repeat.

So that is the second Control problem: Controlling the information about guns.

Police unions are “very much concerned” over the increased number of attacks on officers, which seem to be planned ambushes and unprovoked attacks.

Police unions are a bad idea on their face. A strike for better wages or working conditions, would cause great harm to the entire community and the resultant animosity. So instead, the unions justify their dues by defending every officer from every charge, no matter how guilty the officer may be.

Officers who, within the department, are well known to be dishonest or racist or just plain mean bullies, are protected from punishment, which means they keep doing the very things that cause mistrust and anger among the populace — things leading to “unprovoked” attacks on police..

Additionally, there is the “blue wall of silence,” where police officers refuse to report fellow police for serious breaches of rules. They are caught in a system, where silence about evil is called “loyalty,” and reporting evil is punished.

We see repeated stories about an officer being shown on tape abusing a citizen, only to “discover” later that this was not his first transgression that previously had been covered up.

Is it any wonder that many in the public hate the very people who defend them?

So that is the third Control problem: Controlling the police.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

There are solutions to the three Control problems: Gun Control, Information Control and Police Control.

Gun Control

With a right wing Supreme Court, any type of sensible gun control seems impossible (except ironically, when it comes to the Supreme Court itself, where for the Justices own protection, guns are not allowed).

But there are two proposed laws that would avoid the misinterpretation of the 2nd Amendment, but still provide some gun Controls.

Click on the link to see the rationale for each proposed law.

Information Control

Those who favor gun control should cease anti-gun ownership efforts (that battle is lost), and instead invest their time and money to support the creation of a pro-gun organization. Call it the U.S. Gun Rights Organization (USGRO).

USGRO would support the rights of Americans to own guns, but also support laws (See the above link) that, while not limiting the rights of citizens to own guns, still fight illegal gun violence.

Harshly prosecute the “bad guys,” the illegal users of guns and their suppliers, rather than the “good guys,” the innocent gun owners.

Police Control

Some organizations should not be unionized. The army, the fire department, the police, Congress are examples. They never should be allowed to go on strike, and they never should be allowed to negotiate for work rules or to interfere with management.

Police unions, whose primary function seems to be to cover up for bad police officers, actually do great harm to the police. By helping miscreants to go unpunished, they create strong resentment among the populace, and it is this resentment and the lack of respect it breeds, that leads to police killings.

The rule in every police department should be: Any officer who becomes aware of a rule infraction by a fellow officer, must report that infraction immediately to his superior, or be equally guilty of the infraction.

This rule should apply not just to beat patrolmen, but all the way up to the chief himself.

In summary: The public has grown angry with the people hired to protect them. The police have grown angry with the public for not appreciating the effort and the danger involved.

Both public and police are victims of lack of Gun Control, Information Control and Police Control. Control can be exerted, not by laws restricting gun sales and ownership, but by forcing gun and ammo manufacturers, gun sellers, gun users, gun owners and the police to accept full responsibility for what they do.

The idea is not to fight gun owners, the vast majority of whom are good, honest people. That fight is being fostered by the gun and ammo manufacturers, who have worked hard to create a psychological civil war, where the populace is encouraged by fear, to buy their products.

We have fallen into their trap of believing we need more, bigger, more deadly guns, for our own safety. But, guns do not make us safe. We all should join together to achieve safety, by creating the rules, laws and an environments conducive to safety.

It begins with control.

“If I want the gun, I accept the responsibility.”

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

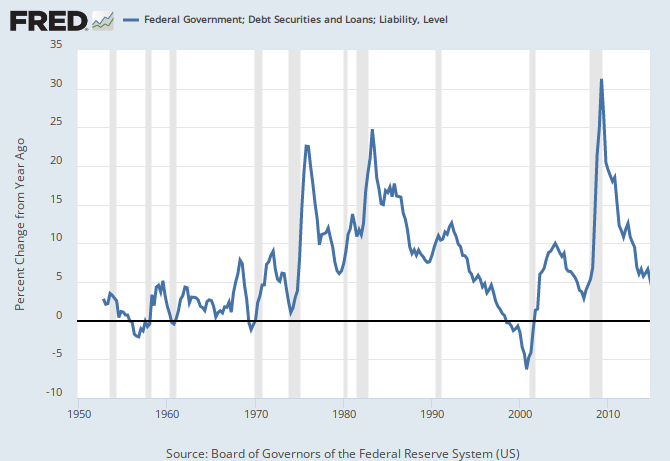

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY