- Inflations are caused by shortages of key goods and services.

- Inflations are not caused by federal deficit spending, which if applied toward reducing shortages, actually can cure inflations.

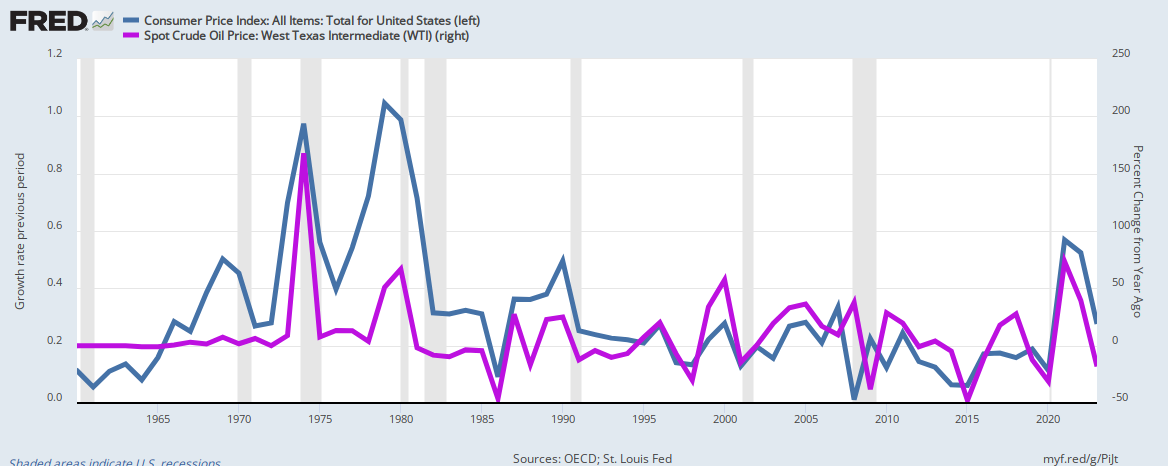

- Oil shortages cause the price of oil to rise. Oil prices affect the prices of most goods and services, which directly links shortages of oil to inflation.

- The federal government has many financial tools to prevent oil shortages, including tax and money benefits for production plus tax and money benefits for reduced usage.

- Federal deficit spending grows the economy by adding dollars to the economy. Reductions in deficit growth lead to recessions. Increases in deficit growth cure recessions.

- Increasing interest rates can have a modest ability to temper inflations by increasing the dollar’s value. But these increases also lead to recessions by making investments more expensive.

- The economy (i.e. the private sector) never should be “cooled,” in that “cooling” implies the recessionary slowing of economic growth.

How the Federal Reserve Controls Inflation The Fed has several tools it traditionally uses to tame inflation. Open Market Operations (OMO) The Fed buys or sells securities, typically Treasury notes, from its member banks. It buys securities when it wants them to have more money to lend. It sells these securities, which the banks are forced to buy.Selling securities (which the Fed is doing now) reduces the private sector’s liquidity, which is recessive in that it effectively reduces the economy’s spending-money supply.

Fed Funds Rate (FFR) The FFR is the interest rate banks charge for overnight loans they make to each other. Discount Rate The Fed also changes the discount rate. That’s the interest rate the Fed charges to allow banks to borrow funds from the Fed’s discount window.Interest rate increases supposedly mitigate against inflation by increasing the demand for (and price of) U.S. dollars (with which to purchase dollar-denominated bonds). But that effect, if it exists, is quite small, as inflation does not seem to respond as the Fed predicts.

Managing Public Expectations Former Chairman Ben Bernanke noted that public expectations of inflation are an important influencer of the inflation rate. Once people anticipate future price increases, they create a self-fulfilling prophecy. They plan for future price increases by buying more now, thus driving up inflation even more.Tellingly, none of the Fed’s tools addresses the fundamental cause of inflation: Shortages of key goods and services. Today’s inflation is due to shortages of food, lumber, computer chips, labor, supply chains, etc., and particularly of energy. None of these shortages will be ameliorated by the Fed’s actions. In short, the Fed has been told to battle inflation and has been given, no weapons for the fight.

It wasn’t the “stop-go” policy. The Fed failed, and still fails, to recognize that inflation is not caused by the oft-quoted but mythical, “Too much money chasing too few goods.” Inflation, very simply, is caused by shortages — i.e. the “too few goods” part of the quote. In effect, the Fed has tried to cure a sprained ankle by an amputation.The Fed’s history of responding to inflation gives you an insight into what may work and what doesn’t.

Bernanke said the mistake the Fed made in controlling inflation in the 1970s was its go-stop monetary policy. It raised rates to combat inflation, then lowered them to avoid recession.

That volatility convinced businesses to keep their prices high.

Supply Chain Woes: There is a shortage of shipping containers because so many are full or stuck on vessels waiting to unload. Big rig trucks are sitting idle and unable to move goods to alleviate the backlog because mechanics are waiting on parts for repairs which are at the port waiting to be trucked. Equipment such as water pumps, NOX sensors, and rebuild kits are delayed for the want of a truck to deliver the parts. And manufacturers of new trucks are running into the same problem as car manufacturers — a chip shortage — creating a reported backlog of 260,000 truck orders.Nothing the Fed has the power to do will alleviate the supply chain woes. Congress, however, does have the tools at its disposal. It can pay for the import and/or production of shipping containers. It can pay for more truck imports or production. It can pay for more truck drivers. It can pay for more chips to be imported or manufactured. Congress and the President uniquely have the power to fix what is wrong with the U.S. economy, including inflation, but to do so, they must recognize that the problem is scarcity, not “heat.”

The problem doesn’t seem to be getting better. It’s beginning to look like the supply chain crisis will persist through all of 2022. The most pressing problem in the supply chain is the shortage of semiconductor chipswhich has damaged many sectors, and is expected to last beyond 2022. This is the most critical shortage impacting manufacturing. If a product has any sort of electronics, it’s got a chip. Suppliers are planning on upping production, but the new facilities won’t be online to alleviate the shortfall until 2023 or 2024. Other experts are more optimistic. Intel is back in the chip game and plans to open two facilities in Arizona at a cost of $20 billion. TSMC is also building a plant in the state as well at a cost of $12 billion. Malaysia’s Unisem, a major chip assembler and tester, will close it’s Ipoh plants until September 15 to stop the spread of COVID-19 after three employees died. Rohm, who supplies chips to Toyota and Ford, expects the shortage to continue through 2022.The Fed can do nothing to correct the chip problem. Congress can aid financially, in the purchase and production of chips.

New Automobiles, Used Vehicles and Parts “…the auto industry faces a volume drop of up to 36 million units over the next three years…”— AlixPartners Due to a worldwide shortage of semiconductor chips, car manufacturers have cut back or stopped production on some new vehicles. An estimated 7.7 million vehicles will not be produced this year. This is driving up prices and demand for used vehicles, which is exacerbating ongoing delays for parts. Demand for used vehicles has been climbing, mostly due to the downturn in new car production and COVID. Auto manufacturers are reporting shortages of wiring harnesses, plastics and glass, in addition to the chip problem. This is impacting auto parts supplies. Also, it looks as if there may be a tire shortagein the future, according to Car and Driver. Arabica Coffee Beans:Coffee is one of the biggest imports. after petroleum for many nations. The price is the highest since 2014 and Arabica beans have risen 40%. Colombia and Brazil account for two-thirds of the world’s Arabica production and both nations’ output has been slashed. Lumber, Paper Pulp, Toilet Paper, Cardboard, Books. “Soaring lumber prices that have tripled over the past 12 months has caused the price of an average new single-family home to increase by $35,872.” — National Association of Home Builders Labor shortages, and greater demand for boxes from online merchants is currently impacting many industries that rely on paper products. Wood pulp, a byproduct of wood used as a raw material for paper products, has increased 50.2% over the past year. The toilet paper shortage is currently as bad as it was at the beginning of the pandemic. Only 60% of orders to retailers are being shipped. Costco is reinstating purchasing limits across the nation.Labor shortages have two fundamental causes, both of which can be addressed by the federal government: Insufficient mechanization and insufficient net pay to workers. The federal government could help fund labor-saving mechanization via tax breaks and/or via direct subsidy. The federal government could encourage more hiring by eliminating the useless, regressive FICA tax, which penalizes businesses for hiring and workers for working. Additionally, offering free Medicare for All would eliminate another hiring cost from those companies that now fund healthcare insurance for workers. Increasing Social Security benefits would eliminate the need for company-sponsored retirement plans.

Shortages of wheat, barley, beans, peas:Probably no shortage is more disconcerting than food, especially a staple product like wheat. You can blame a drought in Southwest, West, and Northern Great Plains states, affecting 98% of the spring wheat production.The federal government should fund farmers for growing rather than paying them for not growing. This includes paying for labor and allowing more immigrant labor, in addition to funding farming education, equipment, and research into more productive crop species — things that will increase food production.

Shortages of HVAC equipment, parts, refrigerant: a decline of 40% of its annual production Contractors are reporting difficulty sourcing parts and refrigerant due to the supply chain disruption and chip shortage. The labor shortage has also visited the industry. Raw materials that go into these systems such as steel, aluminum, copper and plastics are in short supply. Also scarce are electrical components, such as motors and compressors, along with evaporator coils, resins for pans, and control boards. Shortages of Silicone rubber: Silicone rubber prices have increased up to 25% and further hikes are predicted. This shortfall in supply appears to be driven by scarcity due to the supply chain, increased demand, and labor shortage. Shortage of Appliances: COVID messed up both the supply and demand side of major appliances like refrigerators, freezers, dishwashers, dryers, dehumidifiers, and microwaves. Manufacturers are grappling with a shortage of stainless steel and a 20% increase in the cost of raw materials. Expect higher prices and delays of up to 8 months. Shortage of Chicken Wings: Climate change, along with rising demand has created a shortage of chicken wings. The price of wings is up a reported 87%. Shortage of Pool Liners, Chemicals, Chlorine Tabs: Shortages of PVC pipe, valves, tile, heaters, and concrete used in other industries is causing construction delays. The ongoing national labor shortage is negatively impacting pool and spa businesses. Chlorine tablets are in short supply after a fire at the BioLab facility, and of course, COVID-19. Shortage of Drywall: Thanks to the Texas spring blizzard, a facility producing latex was severely damaged. This, along with a shortage of synthetic gypsum, led to the a decline in inventory. Shortage of Printers and Ink: One of the unforeseen consequences of millions of people working at home was the increased demand for printers and ink. There is a backlog of billions of dollars of consumer goods waiting at the nation’s ports — in addition to all the supplies to keep the economy moving. The backlog at ports is stalling the moving of goods through the supply chain and now is threatening economic collapse on a global scale.IN SUMMARY The fundamental causes of all inflations are shortages. The fundamental effect of inflations is they reduce the people’s ability to buy. Congress and the President have the tools to combat both the causes and effects of inflation. To combat the causes, the government can use its infinite financial power to reduce shortages. To combat the effects of inflation, the government can use its infinite financial power to provide the populace with net, take-home money. The Fed cannot address the shortages that cause inflations, nor can it cure the effects of inflations. It doesn’t have the tools. Raising interest rates and selling Treasuries to cure inflation is like using a sponge to cure a flood. Congress and the President have the spending and tools to control all aspects of the economy, including inflation, deflation, recession, depression, and growth. They should use them. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

MONETARY SOVEREIGNTY