Former Fed Chairman Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Former Fed Chairman Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Ben Bernanke when, as Fed chief, he was on 60 Minutes: Scott Pelley: Is that tax money that the Fed is spending? Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

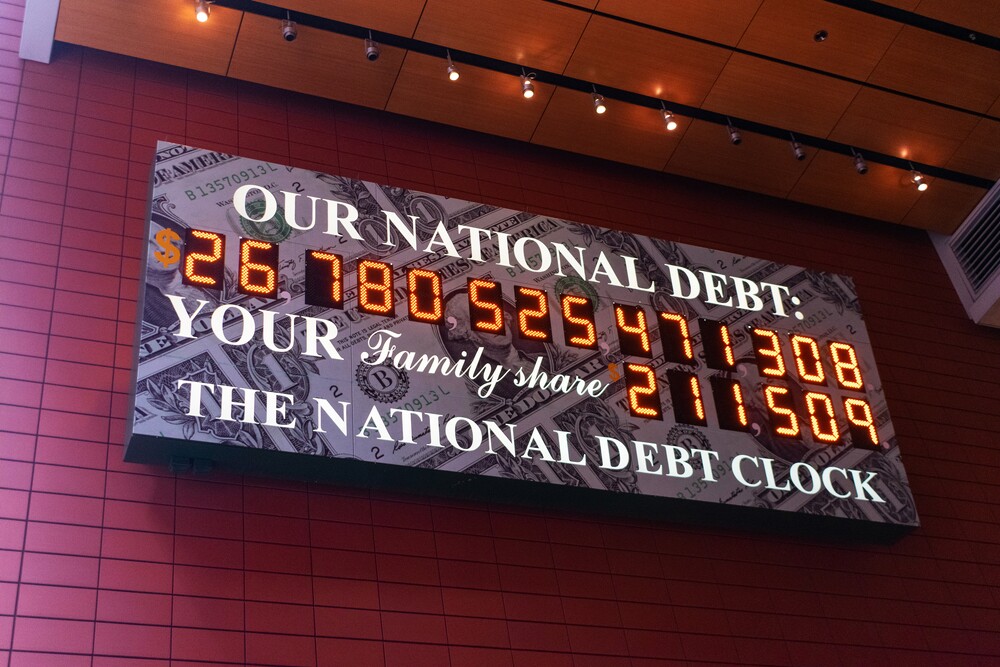

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Press Conference: Mario Draghi, President of the ECB, 9 January 2014 Question: I am wondering: can the ECB ever run out of money? Mario Draghi: Technically, no. We cannot run out of money.

[Why would any sane person take dollars from the economy and give them to a federal government that has the infinite ability to create dollars?]

————————————————————————————————————–

Step #4 of the Ten Steps to Prosperity (below) is: Free education for everyone That post begins with the following facts:- Educating our young people is important to the future of America.

- For that reason, free elementary education has been provided by every state and every town in America.

- Since WWII, America’s need for college-educated young people has grown, in a more sophisticated, more competitive world. College-educated students no longer are a luxury for America; they are a necessity.

- Many of America’s bright students are unable to afford a college education, especially not in better colleges.

- The U.S. federal government is Monetarily Sovereign, meaning it creates dollars at will. It never can run short of dollars. The federal government has the unlimited ability to pay for anything priced in dollars.

- The federal government’s responsibility is to advance the interests of the United States and its people.

- Putting America’s young people into debt, a debt so suffocating it cannot even be discharged in bankruptcy, does not advance the interests of the United States and its people.

Eliminating student debt would help narrow every income/wealth/power Gap in America. There is not a single benefit to our nation that emanates from charging American students to attend college. Given all you know, you might think student debt cancellation is an obvious solution to many problems facing all of America, not just those students who already are in debt. But America has two parties. The more aggressive and united GOP party is “The Party of the Rich.” It wants to widen, not narrow, the Gaps between the “haves” and the “have-nots.” It believes in harsh punishments for misdeeds by those below, and rewards only for those above. The wider the Gap, the richer are the rich, and that is what the GOP wants. The more timid and disunited Democratic party advocates narrowing the Gaps, with rewards for those below and punishments for those above, but it is riven with strife among partisans, whose blinders restrict each view to specific needs at the exclusion of all others. Not being able to present a united front, the Dems’ messages become muddled, so the general public rightfully views it and its programs as weak and ineffectual.Calls Mount to Cancel Student Debt as Biden Weighs Longer Payment Pause By Jessica Corbett. Originally published at Common Dreams

After a White House official confirmed this week that President Joe Biden is considering further extending a pandemic-related pause on student loan payments, lawmakers and activists renewed calls for debt cancellation.

“We have reached a student debt crisis of epic proportions.”

While payments are due to resume on May 1, White House Chief of Staff Ronald Klain suggested on a popular podcast that the president may extend the pause and is still sorting out whether he will take further action on the student debt crisis.

“This is a GOOD idea!” the group Bold Progressives tweeted with a video of Klain on “Pod Save America.”

Senate Majority Leader Chuck Schumer (D-N.Y.), a key advocate of student debt cancellation in Congress, agreed, also tweeting Klain’s comments.

In response to HuffPost‘s reporting on Klain’s remarks, Congresswoman Marie Newman (D-Ill.) said Saturday that “pausing student loan payments during Covid has allowed Americans to get by.”

“We need immediate student debt relief, and deferring payments again is a great step, but we need to do more,” she added.

Noting that “education is a pathway to greater opportunity and economic security, yet many Americans simply can’t afford it or become crushed by student loans,” Rep. Ilhan Omar (D-Minn.) told Biden on Saturday that “we must cancel student debt.”

Rep. Jesús “Chuy” García (D-Ill.) and Rep. Ayanna Pressley (D-Mass.) also pressured the president to take action on the issue Saturday:

Pressley and Sen. Elizabeth Warren (D-Mass.), who have been leading the fight in Congress with Schumer, participated in a Friday roundtable about how student loan debt impacts Black communities, particularly business owners, entrepreneurs, and other professionals.

Advocates of debt cancellation often argue that it is necessary to help address the racial wealth gap in the United States.

America does not need an “income-driven repayment plan.” America needs a no-repayment plan. More than that, America needs a no payment (i.e. no payment for college) plan. The U.S. government neither needs nor uses any dollars sent to it. In fact, every dollar sent to the U.S. federal government is destroyed upon receipt by the Treasury (When you pay taxes, for instance, those dollars in your checking account are part of the M1 money supply measure. When they hit the Treasury, they instantly disappear from any money supply measure. They effectively are destroyed. The federal government creates new dollars ad hoc each time it pays creditors.) And for those students who received dollars from private sources, the federal government has the unlimited ability to pay off those loans, and no cost to taxpayers.Also on Friday, the Debt Collective announced a nationally coordinated refusal to make payments if Biden refuses to step in before they resume in May.

“If President Biden resumes illegitimate student debt payments in May, we will facilitate as many student debtors as possible to safely pay $0 a month to the Department of Education,” declared Debt Collective co-founder Astra Taylor.

“Whether it’s filing a borrower defense or enrolling in an income-driven repayment plan, we are politicizing our refusal to pay as part of our escalation on President Biden,” Taylor said. “He has the authority to cancel all federal student debt with the flick of a pen. He can end this manufactured crisis today.”

Debt Collective spokesperson Braxton Brewington emphasized that “we want to be clear—a student debt strike is not intentionally defaulting on your loans but politicizing and collectivizing your refusal to pay by using the tools the Department of Education already provides to student borrowers.”

The federal government not only doesn’t need student debt payments, it doesn’t need any payments of any kind.“The federal government doesn’t need our student debt payments to function, and the last two years have proved that,” Brewington added, “but they do need our cooperation—and they certainly won’t have that.”

It’s only “long and hard,” because the “haves” don’t want it (Widening Gap makes the rich richer), and the “have-nots” don’t understand it (They erroneously believe, because they repeatedly have been told, federal deficits should be reduced.)Congresswoman Rashida Tlaib (D-Mich.) expressed support for the planned strike, noting that “the road to student debt cancellation is long and hard, and a key aspect is building solidarity amongst students and graduates with debt.”

Student debt cancellation may be popular with the public as a whole, but there may be some who find it less appetizing. The rich, of course, want to keep the rest of us down, because that makes them richer. Those who already have paid for college by scrimping, saving, and borrowing, may feel it’s “unfair” for others to have the benefits without the suffering. Those who don’t want college educations may feel it’s unfair or even unnecessary, for others to receive free college. Even those who recognize the massive benefits to America of universal, free college may object to student debt reduction or elimination. And there is another problem: Let us say that the Dems suddenly and miraculously acquire courage and cohesion, and they manage to pass a bill eliminating all student debt, what happens tomorrow? Who pays for tomorrow’s college? Do we begin the same process anew, with future students building future debt, and future arguments about paying it? How will colleges and teachers be supported? We already have a model for that. It is called “Medicare” and it answers the question, “How can hospitals and doctors be supported?” Just as America needs a Medicare available to everyone, (aka “Medicare for All,”) not just for the elderly, America needs a “Collecare” plan that funds grades 13+, not just grades K-12. The first 13 years of education in America are funded by local, monetarily non-sovereign governments, using taxpayer dollars. Why, in heaven’s name, are college years not funded by our Monetarily Sovereign government, that does not use taxpayer dollars, but instead can create infinite dollars from thin air? Just as Medicare does not treat patients — it merely funds private sector treatment — Collecare would not educate students — it merely would fund private sector education. And just as Medicare doesn’t pay the “better” hospitals more, Collecare would not pay the “better” universities more. Harvard would receive no more than would Podunk U. Today, Virtually all colleges and universities provide scholarships to students based on wealth, income, athleticism, skin color, religion, country of origin, and a long, often secret list of student attributes. With Collecare, that expense no longer would be necessary for any college. Your tuition payments no longer would be used to pay for other students’ educations. And, there yet is another problem: Those whose income is so low that even free college is unaffordable: They need their young people to work full time just to support themselves and their families. (For this latter group, we recommend (Ten Steps to Prosperity: Step 5: Salary for attending school, and Salary for attending school, III and Salary for attending school: 2nd paper.) Just as healthcare insurance should cover rehab costs, Collecare would be incomplete without a supplement that pays students’ living expenses. And then, there is one final problem. In general, the education in America’s K-12 schools is not worthy of this wealthy nation. We have good teachers in bad schools; we have bad teachers in good schools; and commonly, we have bad teachers in bad schools. Much of what is “bad” can be attributed to income. Low income begets crime, illness, and hopelessness, which beget bad K-12 schools, which in turn beget more crime, illness, and hopelessness. We cannot solve America’s income, education, and health problems separately without solving them together. America needs Medicare for All. America needs College for All. America needs Social Security for All. The U.S. government should do everything it can to support America’s people. That is the fundamental purpose of government — not to run people’s lives but to support people’s lives. The sainted President John Kennedy famously said, “Ask not what your country can do for you; ask what you can do for your country.” If by “your country” he had meant the federal government, it would have been among the most stupid, misleading statements of all time. I suspect however, that it was a general call to do right for everyone, not just yourself — a sort of golden rule appeal. It means, in part, when voting, vote for what is best for America, not just what is best for you. The rich hate federal funding for the have-nots. They will try to talk you out of it, with phony claims that inflation is caused by federal spending on your benefits. Quoting the voice of the rich, the Committee for a Responsible Federal Budget:“The Debt Collective’s Student Debt Strike is an important campaign to help build the mass movement we need to resist and abolish student debt, and there are so many ways to support it without putting yourself in financial jeopardy,” she said. “I stand with Student Debt Strikers and encourage everyone—whether you have debt or not—to join us.”

As Common Dreams reported last month, polling shows student debt cancellation is popular with the American public, even among people who don’t have higher education loans to repay.

Full debt cancellation would cost the federal government roughly $1.6 trillion, while improving household balance sheets by a similar amount.

Consistent with our prior analysis, we estimate this would translate to an $80 billion reduction in repayments in the first year, which would in turn increase household consumption by $70 to $95 billion once the effect of higher wealth is considered.

For the rich, “cost federal government” is bad only if the money goes to you, not to the rich. The rich hate “improving household balance sheets,” and “higher wealth” for you and me. Don’t listen to them. The government, being Monetarily Sovereign, can bring to bear unlimited funding, without taxpayer support. It should devote that funding to making our lives healthier, safer, and better. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell……………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

- Eliminate FICA

- Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

- Social Security for all

- Free education (including post-grad) for everyone

- Salary for attending school

- Eliminate federal taxes on business

- Increase the standard income tax deduction, annually.

- Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

- Federal ownership of all banks

- Increase federal spending on the myriad initiatives that benefit America’s 99.9%

MONETARY SOVEREIGNTY

Here are some of the facts.

Here are some of the facts.