Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes. Austerity = poverty and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

This is an update of a post that ran in 2009.

Kermit the frog famously said, “It isn’t easy being green.” It also isn’t easy convincing people that traditional economics not only is hypothetically wrong, not only is factually wrong, but is wrong to such a degree it is extremely harmful to our economy.

The more extreme debt hawks believe the U.S. federal government should run a balanced budget or even have no debt at all. The more moderate debt hawks feel some debt may be necessary at times, but to them, federal debt is like bitter medicine you take only when absolutely necessary.

All debt hawks, whether extreme or moderate, are long on twisted “facts” but short on evidence.

Their “facts” inevitably include federal deficit and debt measures, projections for the future, debt/GDP ratios, and spending on Medicare and Social Security.

However, when they interpret the facts, they provide no evidence that their interpretations reflect reality.

By contrast, here are facts and a few opinions, which you may interpret for yourself.

1. Fact: Money is the way modern economies are measured. By definition, a large economy has a larger money supply than does a small economy. Therefore, a growing economy requires a growing supply of money. QED

The graph below shows the essentially parallel paths of GDP vs. perhaps the most comprehensive measure of the money supply, Domestic Non-Financial Debt:

One could argue that money begets production or that production begets money, and both would be correct. The point is that money supply (i.e. debt) and GDP go hand-in-hand. Reduced debt growth results in reduced economic growth.

Gross Domestic Product = Federal Spending + NonFederal Spending + Net Exports.

Thus, by formula, a cut in federal spending cuts GDP.

2. Fact: All money is debt and all financial debt is money. In addition to being state-sponsored, legal tender, there are four criteria for modern money:

–Monetarily Sovereign money must be defined in a standard unit of currency.

–MS money has no, or limited, intrinsic value.

–The demand for money is determined by its risk (danger of default or devaluation, i.e., inflation) and its reward (interest rates).

–To have value, money must be owned by an entity other than the entity that created it.

The above criteria describe many forms of money, including currency, bank accounts, T-securities, corporate bonds, and money markets. All forms of money are debt, and a growing economy requires a growing supply of debt/money.

2.a. Fact: Federal “deficit” is a statement of the net amount of money the federal government has created in one year.

Opinion: The word “deficit” is pejorative. A more neutral description would be money “created” or “added,” as in, “The government has created $1 trillion,” or “The government has added $1 trillion to the economy.”

Compare the psychological meaning of those statements with the current phrasing, “The government has run a $1 trillion deficit.”

3. Fact: U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

4. Fact: Recessions tend to follow reductions in federal debt/money growth (See graph below), while debt/money growth has increased when recessions are resolving.

Taxes reduce debt/money growth. No government can tax itself into prosperity, but many governments tax themselves into recession.

Recessions repeatedly come on the heels of deficit growth reductions, and are cured with deficit growth increases.

5. Fact: On August 15, 1971, the federal government gave itself the unlimited ability to create debt/money by completely abandoning the gold standard. This ability is called Monetary Sovereignty.

Because the federal government now has the unlimited ability to create dollars, it neither taxes or borrows in order to obtain dollars. It simply creates them ad hoc. Tax dollars are destroyed upon receipt.

When you pay your taxes, you take dollars from your checking account. These dollars were part of the M2 money supply measure.

When they reach the Treasury, they cease to be part of any money supply measure. They effectively are destroyed. To pay its bills, the federal government creates new dollars, ad hoc.

6. Fact: Federal “debt” is the total of outstanding Treasury Securities. Here is how Treasury Securities, incorrectly termed “borrowing” come into existence.

–You tell the government to debit your checking account and credit your Treasury security account by the same amount. The process is similar to transferring money from your checking account to your bank savings account.

To “pay off” the Treasury Security, the government simply debits your T-security account and credits your checking account.

Thus, the government could pay off all its so-called “debt” tomorrow simply by debiting all T-security accounts and crediting the T-Security owners’ checking accounts.

The entire process neither adds nor subtracts money from the economy (but for interest paid).

Our Monetarily Sovereign government does not borrow the money it has already created but rather exchanges one form of U.S. money (T-securities) for another (dollars). The entire “borrowing” process is nothing more than an asset exchange.

Do T-securities have any benefit? Yes, federal interest payments add to the money supply, an economically stimulative event. Federal interest payments help the government control interest rates and the dollar’s value. (The higher the interest, the greater the value of the dollar, and the more the economy receives in growth dollars.)

The most important purpose of T-securities is to provide a safe place to store unused dollars. This stabilizes the dollar while increasing its value.

T-securities (debt) are not functionally related to the difference between taxes and spending (deficits). They are related only by laws requiring the Treasury to create T-securities in the amount of the deficit.

The Treasury can create T-securities (debt) without a deficit, and the government can run a deficit without creating T-securities. Federal debt is not functionally the total of federal deficits.

The federal government could pay off the entire so-called “debt” today, merely by returning the dollars to the T-security depositors.

7. Fact: Federal taxes, as a money-raising tool, are unnecessary, harmful and futile:

— unnecessary because since 1971 (when the U.S. government became fully Monetarily Sovereign), the government has had the unlimited ability to create money without taxes,

— harmful because taxes reduce the money supply, which reduction leads to recessions and depressions, and

–futile because tax money sent to the government is destroyed upon receipt by the U.S. Treasury.

When you send taxes to the government, you are sending M2 dollars, but when they reach the Treasury, they cease to be part of any money supply measure. They effectively are destroyed.

Our Monetarily Sovereign government does not store dollars for future use. It can create unlimited dollars ad hoc by paying bills.

The so-called “debt” merely accounts for the total outstanding T-securities created out of thin air by the federal government.

The government decides to create T-securities equal to the deficit, but this requirement became obsolete in 1971 when we went off the gold standard and became Monetarily Sovereign.

Today, the federal government creates money by spending, i.e. it credits checking accounts to pay its bills. This crediting of checking accounts adds dollars to the economy.

The federal “deficit” is the net money created in one year and the federal “surplus” is the net money destroyed in one year. In short, deficit spending creates money and taxing destroys money. If taxes fell to $0 or rose to $100 trillion, this would not affect by even one dollar, the federal government’s ability to spend.

Further, (opinion)all tax (money-destroying) systems are unfair. See: http://rodgermitchell.com/FairTaxes.html. For a country with the unlimited power to create money, spending is not related in any way to taxing.

8. Fact: Contrary to popular myth, there is no post-gold standard relationship between federal debt and inflation. (See graph, below)

Also, contrary to popular myth, inflation is not caused by “excessive federal spending.” Inflation is caused by shortages of crucial goods and services, most often oil and/or food. (See the graph, below)

A brief discussion of oil prices and inflation is at https://rodgermmitchell.wordpress.com/2009/09/24/is-inflation-too-much-money-chasing-too-few-goods/

In this regard, hyperinflations are not caused by “money-printing,” but rather by shortages. So-called “money printing” (ala Zimabwe and Germany), were the governments’ response to hyperinflation, not the cause.

The Zimbabwe inflation was caused by food shortages. (The government stole land from farmers and gave it to non-farmers.) Money “printing” was the faulty response to inflation, not the cause.

The most recent inflation was caused by COVID-related shortages of oil, food, shipping, computer chips, metal, housing, lumber, and labor, among other things. As the shortages have been reduced, so has the inflation.

-

WWII Context: During World War II, many consumer goods were in short supply because production was focused on the war effort. When the war ended, the supply of goods resumed, and the previously unmet demand was suddenly able to be fulfilled.

-

Oil Crises: Similarly, during the oil crises of the 1970s, the reduced supply of oil caused prices to spike, not because of a sudden increase in demand, but because the existing demand couldn’t be met.

-

COVID-19 Pandemic: Supply chain disruptions and production bottlenecks during the pandemic created shortages in various goods, leading to price increases once supply constraints eased and the pent-up demand was met.

While the underlying demand might have been consistent, the ability to fulfill that demand was constrained by supply issues. When supply bottlenecks were removed, the previously suppressed demand could finally be expressed, leading to price increases.

-

Latent Demand: The concept of latent demand suggests that consumers’ desire for goods remains constant, but it is the availability of those goods that fluctuates.

-

Supply Constraints: Supply-side constraints create temporary mismatches between demand and supply, leading to inflationary pressures once those constraints are lifted.

-

Observing changes over time can reveal the true causes of economic phenomena. By examining what happens just before and during an inflationary period, we often find that supply-side disruptions are the primary drivers.

-

Gradual Demand Changes: Demand usually changes slowly, giving the economy time to adjust. This gradual change rarely leads to significant price fluctuations on its own.

-

Sudden Supply Changes: Supply-side shocks, such as natural disasters, geopolitical events, or production bottlenecks, can occur rapidly and unpredictably. The economy struggles to adjust quickly to these disruptions, leading to price increases as a balancing mechanism.

9. Fact: There is no post-gold standard relationship between federal debt and your taxes.

Unlike state/local governments, which are monetarily non-sovereign, the federal government does not use tax dollars to pay its bills. It creates new dollars, from thin air, every time it pays a creditor.

The sole purposes of federal taxes are:

–To control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward.

–To assure demand for the U.S. dollar by requiring all federal taxes to be paid in dollars.

Taxes do not pay for federal spending. Federal spending creates dollars.

9.a. Fact: Federal deficit spending does not use “taxpayers’ money.” Federal spending creates money ad hoc.

When the government spends it credits bank accounts. No taxes involved. By definition, deficit spending means taxes do not equal this year’s spending let alone previous year’s spending. Only surpluses use taxpayers’ money, by causing recessions.

For the above reasons, our children and grandchildren will not pay for today’s money creation. Still, they will benefit from today’s deficit spending — better infrastructure, army, education, R&D, safety, security, health, and retirement.

Any time you hear or read about the federal government spending “taxpayers’ money,” know that the person is ignorant about Monetary Sovereignty. The federal government doesn’t spend taxpayers’ money. Period.

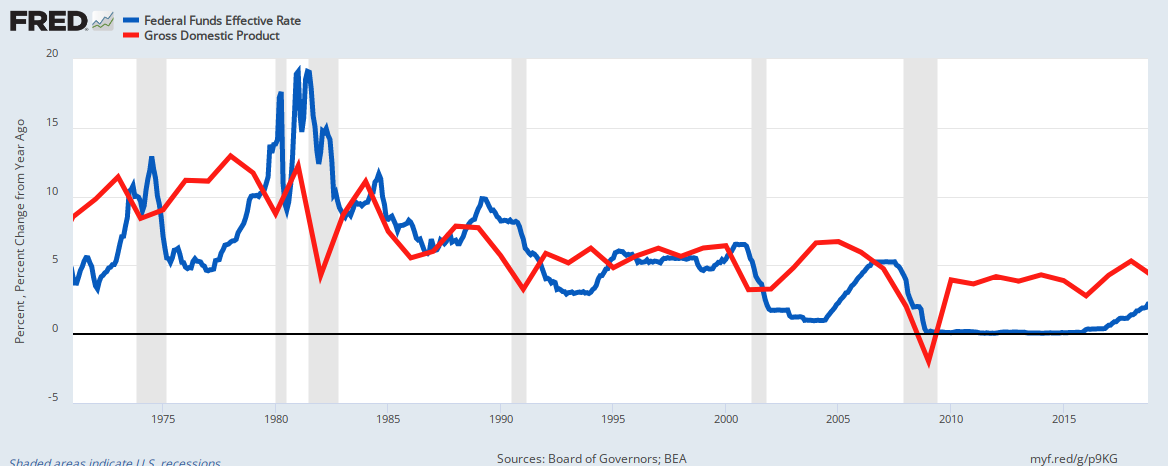

10. Fact: There is no post-gold standard relationship between low interest rates and high GDP growth.

Opinion: The opposite seems true:

Why do high interest rates stimulate?

Opinion: High rates force the federal government to pay more interest, pumping more money into the economy.

The Fed increases interest rates to fight inflation. But increasing interest rates increases the prices of goods and services, i.e. causes inflation.

The Fed, in a sense, is using leeches to fight anemia.

11. Fact: The Federal debt/GDP ratio is a meaningless fraction, because it measures two, mathematically incompatible pieces of data. It’s an apples/oranges comparison. GDP is a one-year measure of output; federal debt is the net outstanding T-securities created since the nation’s birth.

The T-securities created years ago affect this year’s debt in the debt/GDP ratio, while even last year’s GDP does not affect this ratio. See: Debt/GDP

Because federal debt is the total of T-securities, and the federal government has the functional ability to stop creating T-securities at any time, the Debt/GDP ratio easily could fall to 0, depending on federal law.

11.a. Fact: The debt/GDP ratio does not measure the federal government’s ability to pay its bills. The government does not pay bills with GDP; it creates the money ad hoc to pay its bills.

Were GDP to be $0, the government still could pay bills of any size, simply by crediting the bank accounts of its creditors.

12. Facts: In 1979, gross federal debt was $800 billion. In 2009 it reached $12 trillion, a 1400% increase in 30 years. During that period, GPD rose 440% (annual rate of 5.5%>) with acceptable inflation. The same 1400% increase would put the debt at $180 trillion in 2039, a mean annual deficit of $5+ trillion.

This calculates to a 9.5% annual debt increase for the past 30 years. Repeating that growth rate would put the 2010 deficit at about $1.14 trillion, and the 2011 deficit at about $1.25 trillion. The deficit for year 2039 would be about $15.8 trillion.

Opinion: I know of no reason why the results would not be the same as they have been in the past 30 years. However, increasing the debt growth rate above 9.5% might show even better results:

In the 10 year period, 1980 – 1989, federal debt grew 210%, from $900 billion to $2.8 trillion (a 12% annual debt increase), while GDP grew .96% from $2.8 trillion to $5.5 trillion (a 7% annual increase). During that same period, inflation fell from 14.5% in 1980 to 5.2% in 1989. See graph, below.

Facts: In summary, large deficits have coincided with real (inflation adjusted) GDP growth

12. Facts: Any health insurance proposal that covers more people will cost more money. Extracting that money from doctors, hospitals, pharmaceutical companies, by necessity, would reduce the availability of health care.

Increasing taxes on any individuals (even the wealthy) or on businesses, will depress the economy by removing money from the economy. Only the federal government can supply additional money while stimulating the economy.

13. Fact: Social Security is supported neither by FICA nor by a trust fund. Were FICA eliminated, and benefits doubled, Social Security still would not go bankrupt unless Congress decided to make this happen.

In June, 2001, Paul O’Neill, Secretary of the Treasury said, “I come to you as a managing trustee of Social Security. Today we have no assets in the trust fund. We have promises of the good faith and credit of the United States government that benefits will flow.“

Yet, SS continues to pay benefits. Your Social Security check comes from a mythical trust fund that contains no money and receives no money.

Social Security (and Medicare) benefits are paid ad hoc by the U.S. government, not from a trust fund, and are not dependent on FICA taxes. which (opinion:) can and should be eliminated. See: FICA

14. Fact: The finances of the federal government are different from yours and mine and businesses’ and state, county and city government finances.

Unlike the federal government, which is Monetarily Sovereign, we cannot create unlimited amounts of money to pay our bills. We first need to acquire money, either by borrowing or by saving, to spend.

The federal government does not acquire money. It creates money by spending. As an accounting principle, the tax money you send to the government is destroyed upon receipt. Then the federal government creates new money to pay its bills. The government has no fund from which it pays bills.

Fact: Were taxes to decrease to zero, this would not change by even one penny, the federal government’s ability to spend.

Opinion: The failure to recognize the difference between the Monetarily Sovereign federal government and all other entities, which are monetarily non-sovereign, is the primary reason for recessions and depressions.

15. Fact: The federal government has the unlimited ability to create the dollars to pay any bill of any size. It never can run short of dollars; it never can go broke.

Opinion: The federal government should distribute dollars to each monetarily non-sovereign state, on a per capita basis.

The states would determine how they distribute the dollars (to counties, cities and/or taxpayers). I suggest a distribution of $5,000 per person or a total of $1.5 trillion.

16. To understand economics you must understand Monetary Sovereignty.

Fact: In 1971, the U.S. went off the gold standard, thereby becoming a Monetarily Sovereign nation, and at that moment, all economics textbooks became obsolete. Sadly, mainstream economists, the politicians and the media have not yet caught up.

============================================================

Summary: So there you have a list of facts, plus a few opinions, which I have noted. Read the facts and draw your own inferences.

You can find a great number of debt-hawk sites (i.e. Concord Coalition, Committee for a Responsible Federal Budget), which in essence are privately funded think tanks, paid to influence popular belief, with propaganda masquerading as data.

There, you will see data showing the size of the federal debt. These data are presented in a way designed to imply that the debt (money created) is too large.

But you will find no proof of these ideas. You will see no historical graphs equating debt with any negative economic outcome, simply because such graphs do not exist. Debt hawks believe federal deficits are so obviously bad, no proof is needed.

Yet, despite lacking proof, debt-hawks have foisted their opinions on the media, the politicians, weak-minded economists, and the public, much to the detriment of our economy.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

#MONETARY SOVEREIGNTY

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/

The prevention and cure for a loss of democracy is an informed and energized electorate.

With Donald Trump ripping the government and the economy apart, here is what you should know during the two years before casting your vote in the next Congressional elections.

the federal government created out of thin air.

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/