Read that last sentence carefully, for it is the heart of this discussion. It consists of three truths:A federal trust fund is an accounting mechanism the federal government uses to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures.

The largest and best-known trust funds finance Social Security, portions of Medicare, highways and mass transit, and pensions for government employees.

Federal trust funds bear little resemblance to private-sector counterparts; therefore, the name can be misleading.

A “trust fund” implies a secure source of funding. However, a federal trust fund is simply an accounting mechanism that tracks inflows and outflows for specific programs.

In private-sector trust funds, receipts are deposited, and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Instead, the receipts are recorded as accounting credits in the trust funds and combined with other receipts that the Treasury collects and spends.

Further, the federal government owns the accounts and can, by changing the law, unilaterally alter their purposes and raise or lower collections and expenditures.

- The federal government owns the accounts

- The government can change the law and unilaterally change the purposes of the accounts.

- The government unilaterally can raise or lower collections and expenditures.

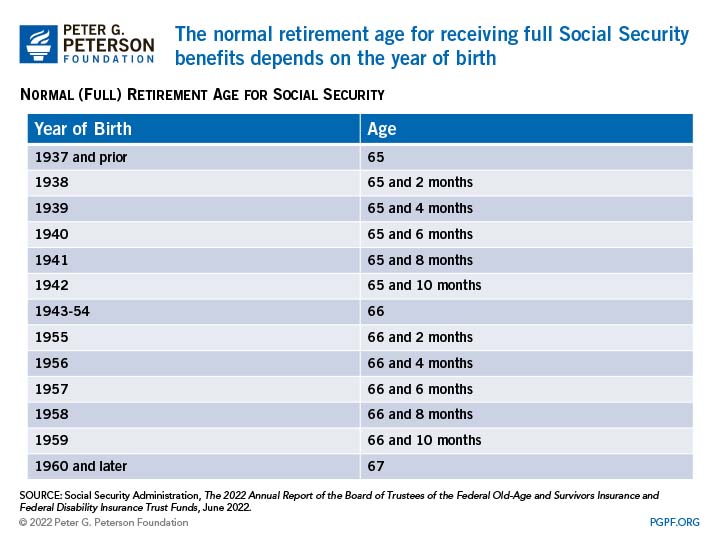

Translation: The primary “trust fund” will spend more than it collects –according to current law, which Congress and the President can change at will, but the only law changes being considered are:SOCIAL SECURITY REFORM: SHOULD WE RAISE THE RETIREMENT AGE? In their 2022 Annual Report, the Social Security trustees estimate that the program’s primary trust fund — Old Age and Survivors Insurance (OASI) — will spend more on payments to beneficiaries than it collects yearly until it is depleted in 2034.

At that time, an estimated 70 million beneficiaries would see a substantial reduction in their benefits. OASI would only be able to distribute as much in benefits as it collects in annual revenues.

Driving that impending depletion are the dual demographic trends of retiring baby boomers and lengthening life expectancies, which together have placed considerable strain on Social Security’s finances.

Many options exist to shore up OASI’s solvency, including increasing revenues dedicated to the program, raising the full retirement age, and decreasing the program’s benefits.

A balanced approach that combined components from each option would likely provide the fairest, most lasting, and least painful adjustment for the future.

- Higher taxes

- Raising the retirement age, and

- Reduced dollar benefits

The U.S. federal government is Monetarily Sovereign. It cannot run short of its own sovereign currency.

To pay for your Social Security benefits, the federal government sends instructions (in the form of a wire or check) to your bank or you, instructing your bank to increase the dollar balance in your checking account.

When your bank does as instructed, the balance in your account increases, creating new dollars and adding them to the M2 money supply measure, growing the economy.

Sending instructions to banks is the primary way the federal government creates dollars. The federal government, being Monetarily Sovereign, has the infinite ability to send and clear instructions, thus, the endless ability to create dollars.

(By contrast, everyone who writes a check or sends a wire can send instructions but not clear them. Checks that don’t clear are said to “bounce.”)

Your bank then clears the transaction through the Federal Reserve, another federal agency. Thus, the federal government clears its own money-creation transactions, giving it the infinite power to create dollars.

The U.S. federal government is Monetarily Sovereign. It cannot run short of its own sovereign currency.

To pay for your Social Security benefits, the federal government sends instructions (in the form of a wire or check) to your bank or you, instructing your bank to increase the dollar balance in your checking account.

When your bank does as instructed, the balance in your account increases, creating new dollars and adding them to the M2 money supply measure, growing the economy.

Sending instructions to banks is the primary way the federal government creates dollars. The federal government, being Monetarily Sovereign, has the infinite ability to send and clear instructions, thus, the endless ability to create dollars.

(By contrast, everyone who writes a check or sends a wire can send instructions but not clear them. Checks that don’t clear are said to “bounce.”)

Your bank then clears the transaction through the Federal Reserve, another federal agency. Thus, the federal government clears its own money-creation transactions, giving it the infinite power to create dollars. The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

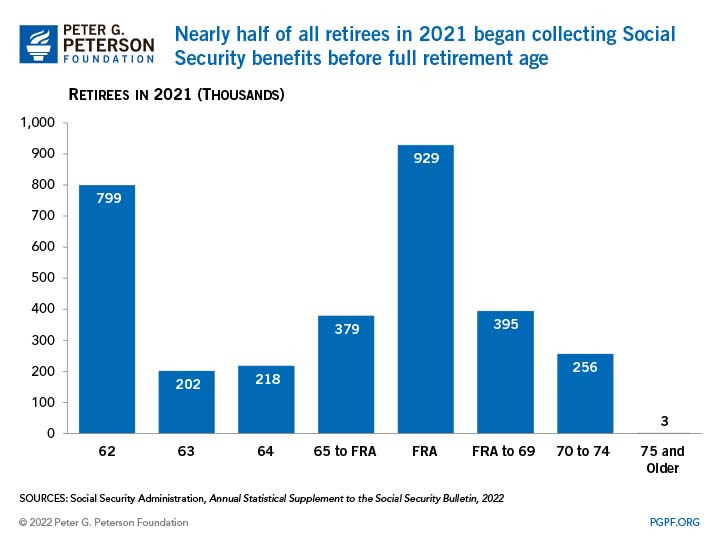

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.

The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.

The above two paragraphs indicate ignorance of the difference between Monetary Sovereignty and monetary non-sovereignty. If Social Security were private insurance (i.e., monetarily non-sovereign), pegging benefits to life expectancy would be appropriate, even necessary. However, there are zero reasons for the federal government to do this. There is no fiscal reason why the federal government should try to extract $90 billion from the private sector. If one wishes to grow the U.S. economy, it is the worst possible course of action. This is what happens when the federal government “closes the mismatch between revenues and spending“(i.e., runs a surplus). Federal surpluses extract dollars from the economy, causing depression or recessions:WHAT EFFECT COULD RAISING THE FULL RETIREMENT AGE HAVE ON SOCIAL SECURITY’S LONG-TERM SOLVENCY? Given that more retirees are beginning to collect Social Security benefits earlier in their retirement and that overall life expectancy continues to increase, many policymakers have called for a modification to the program, wherein the full retirement age is gradually raised and ultimately pegged to average life expectancy.

According to an analysis from the Committee for a Responsible Federal Budget (CRFB), gradually increasing the full retirement age by two months per year until it reaches 69 and then indexing it for changes in overall life expectancy would save $90 billion over 10 years, but much more in future decades; CRFB estimates that the change would close over half of the structural mismatch between Social Security’s revenues and spending in the long run.

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807. 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Even without surpluses, just reducing federal deficits leads to recessions:

- Control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward and

- Assure demand for the U.S. dollar by requiring taxes to be paid in dollars.

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

The fact that the government can afford anything tells me the whole system is a defensive setup for the rich and powerful. Why monetary sovereignty doesn’t catch on is a mystery. But as you keep saying, ‘everyone is afraid to step out of line’, similar to those who fearfully support Trump. This all comes down to having the guts to admit the truth or we pay the consequences, like that 1950s quiz show.

LikeLike

The motive: To reduce benefits for the not-rich, thereby widening the Gap between the rich and the rest. This makes the rich richer.

LikeLike

Also, to do “favors” for the rich, thereby ensuring continuing campaign contributions for reelection. If they enabled money for the plebes, their contributions would dry up and they might even be “primaried.” The rich are different from us: they don’t take “no” for an answer.

LikeLike

Have any of your MMT friends got draft legislation posted somewhere showing precisely what couple of words have to be added or deleted from the law here and there so the “trust funds” can all have negative balances some day?

Positive balance or negative balance they are just accounting ledger entries.

As an example of the draft legislation the text of the submitted unchanged every term since 2010 End Government Shutdowns Act is all of one page: Text – S.104 – 116th Congress (2019-2020): End Government Shutdowns Act | Congress.gov | Library of Congress

LikeLike

Or simply eliminate FICA and the trust funds, and fund Social Security and Medicare the same way the White House, the Senate, the House, the military, etc. are funded. The FICA nonsense gives the pols the opporturnity to say. “It’s not our fault. There just wasn’t enough coming in from FICA taxes to pay for all those old people.

LikeLike

Re: “Or simply eliminate FICA and the trust funds, and fund Social Security and Medicare the same way the White House, the Senate, the House, the military, etc. are funded.”

Must be someone Mosler can hire with his carried interest dollars to show how swiftly that could be done with one piece of legislation once and for all. 1100 E Woodfield Rd, Suite 350 Schaumburg, Illinois 60173 the administrative office of the American Institute of Parliamentarians might be a good place a few technicians skilled in the requisite arcana and minutiae. American Institute of Parliamentarians – Wikipedia

Though surely Komissar Wray believes that he alone possesses all the requisite skills to be able to be the one to draft such needed legislation. To which I would wonder: Why haven’t him and his job guarantee fraternity brother Bill Mitchell done that yet? Put up or shut up as they say on the streets of the School of Hard Knocks.

LikeLike

S.1190 – End the Threat of Default Act118th Congress (2023-2024) Text – S.1190 – 118th Congress (2023-2024): End the Threat of Default Act | Congress.gov | Library of Congress So brief. So succinct. Should get a vote.

LikeLike

They still call it “Debt.”

1. If they are referring to the net total of deficits, there is no debt. They already have been paid for.

2. It they are referring to the total of T-securities, there is no debt. There are DEPOSITS into accounts that are wholly owned by the depositors. Since the government never takes those dollars out of the accounts, the government doesn’t owe the dollars.

Does anyone really think China would put dollars into accounts that the federal government used for spending?

LikeLike

RE: They still call it “Debt.”

So where has your penpal Kelton got draft legislation posted that removes every reference to the “debt”? Those bozos in Congress rarely ever draft bills themselves anymore. Some interest group has to do it for them.

LikeLike

The MMTs are mostly in favor of ‘Overt Monetary Financing’ [the central bank is permitted to purchase government bonds directly from the fiscal authority] which doesn’t actually remove all references to “borrowing” or “the debt” leaving the door open to playing political games.

“the net impact on balance sheets of the various approaches to government spending – (A) overt monetary financing, (B) sale of bonds to the private sector and (C) interest on reserves – is the same. There is a direct and immediate increase in net financial assets held by non-government as well as a creation of income.

Both effects are equal in size to the amount of government spending. But in the case of method B, these effects are achieved in an inefficient and convoluted way that obscures the origin of government money, which in reality is created through the act of government spending or lending rather than being “borrowed” from the private sector.

Even so, the practice of auctioning bonds to the private sector has often been rationalized on the supposed grounds that methods A and C are more expansionary in their demand effects than method B, and so are claimed to carry a greater inflation risk. In truth, there is no significant difference between the three methods when it comes to the expansionary impact or inflation risk of government spending. If anything, method B might carry marginally more, not less, inflation risk to the extent that bonds attract higher interest payments than reserves (inducing slightly more consumption), but any such difference will be minimal.

If, in comparing effects, it is assumed that the same interest rate applies under each method, then the choice of method will affect the composition of net financial assets but make no difference to the expansionary effects of the government spending.” https://heteconomist.com/overt-monetary-financing-poses-no-special-inflation-risk/

Government could do away with the fiction of government “borrowing” altogether and simply conduct the following single-step operation in which the policy rate is paid on reserve balances:

In this approach, the Treasury or the central bank, or a merged government agency, would spend simply by adding reserves to the banking system and instructing banks to credit the accounts of spending recipients.

This would do away with the fiction of the government needing to “borrow” and also make clear that it is the act of government spending itself that creates government money in the form of reserves. (Once again, the real assets acquired by government and the extra net worth for non-government are left out to make clear the increase in non-government net financial assets.)

LikeLike

It could be helicopter money for all I care.

LikeLike