Mitchell’s laws: The more budgets are cut and taxes inceased, the weaker an economy becomes. To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity = poverty and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

Kermit the frog famously said, “It isn’t easy being green.” It also isn’t easy convincing people that traditional economics not only is hypothetically wrong, not only is factually wrong, but is wrong to such a degree it is extremely harmful to our economy.

The more extreme debt hawks believe the U.S. federal government should run a balanced budget or even have no debt at all. The more moderate debt hawks feel some debt may be necessary at times, but to them, federal debt is like bitter medicine you take only when absolutely necessary.

All debt hawks, whether extreme or moderate, are long on twisted “facts” but short on evidence.

Their “facts” inevitably include federal deficit and debt measures, projections for the future, debt/GDP ratios, and spending on Medicare and Social Security.

However, when they interpret the facts, they provide no evidence that their interpretations reflect reality.

By contrast, here are facts and a few opinions, which you may interpret for yourself.

1. Fact: Money is the way modern economies are measured. By definition, a large economy has a larger money supply than does a small economy. Therefore, a growing economy requires a growing supply of money. QED

The graph below shows the essentially parallel paths of GDP vs. perhaps the most comprehensive measure of the money supply, Domestic Non-Financial Debt:

One could argue that money begets production or that production begets money, and both would be correct. The point is that money supply (i.e. debt) and GDP go hand-in-hand. Reduced debt growth results in reduced economic growth.

Gross Domestic Product = Federal Spending + NonFederal Spending + Net Exports.

Thus, by formula, a cut in federal spending cuts GDP.

2. Fact: All money is debt and all financial debt is money. In addition to being state-sponsored, legal tender, there are four criteria for modern money:

–Monetarily Sovereign money must be defined in a standard unit of currency.

–MS money has no, or limited, intrinsic value.

–The demand for money is determined by its risk (danger of default or devaluation, i.e., inflation) and its reward (interest rates).

–To have value, money must be owned by an entity other than the entity that created it.

The above criteria describe many forms of money, including currency, bank accounts, T-securities, corporate bonds, and money markets. All forms of money are debt, and a growing economy requires a growing supply of debt/money.

2.a. Fact: Federal “deficit” is a statement of the net amount of money the federal government has created in one year.

Opinion: The word “deficit” is pejorative. A more neutral description would be money “created” or “added,” as in, “The government has created $1 trillion,” or “The government has added $1 trillion to the economy.”

Compare the psychological meaning of those statements with the current phrasing, “The government has run a $1 trillion deficit.”

3. Fact: U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

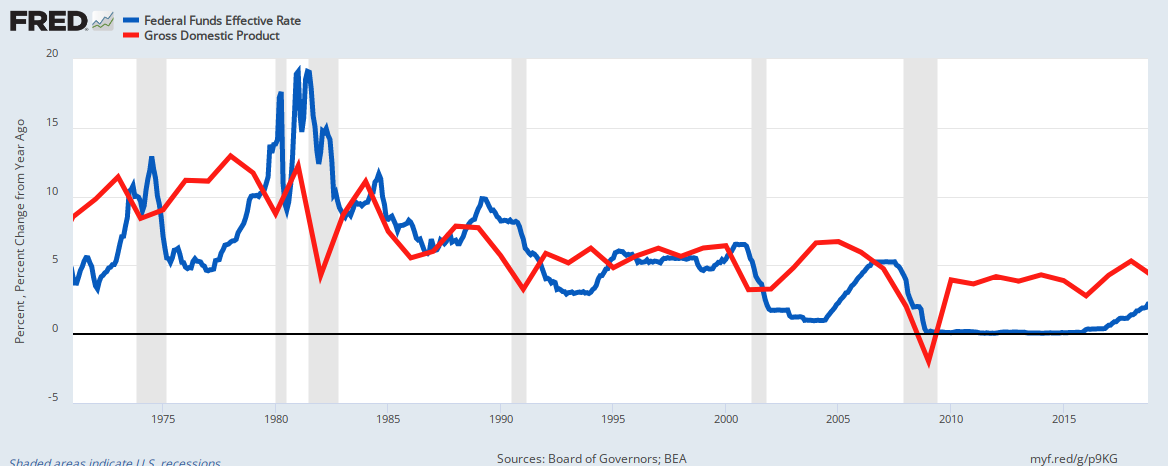

4. Fact: Recessions tend to follow reductions in federal debt/money growth (See graph below), while debt/money growth has increased when recessions are resolving.

Taxes reduce debt/money growth. No government can tax itself into prosperity, but many governments tax themselves into recession.

Recessions repeatedly come on the heels of deficit growth reductions, and are cured with deficit growth increases.

5. Fact: On August 15, 1971, the federal government gave itself the unlimited ability to create debt/money by completely abandoning the gold standard. This ability is called Monetary Sovereignty.

Because the federal government now has the unlimited ability to create dollars, it neither taxes or borrows in order to obtain dollars. It simply creates them ad hoc. Tax dollars are destroyed upon receipt.

When you pay your taxes, you take dollars from your checking account. These dollars were part of the M2 money supply measure.

When they reach the Treasury, they cease to be part of any money supply measure. They effectively are destroyed. To pay its bills, the federal government creates new dollars, ad hoc.

6. Fact: Federal “debt” is the total of outstanding Treasury Securities. Here is how Treasury Securities, incorrectly termed “borrowing” come into existence.

–You tell the government to debit your checking account and credit your Treasury security account by the same amount. The process is similar to transferring money from your checking account to your bank savings account.

To “pay off” the Treasury Security, the government simply debits your T-security account and credits your checking account.

Thus, the government could pay off all its so-called “debt” tomorrow simply by debiting all T-security accounts and crediting the T-Security owners’ checking accounts.

The entire process neither adds nor subtracts money from the economy (but for interest paid).

Our Monetarily Sovereign government does not borrow the money it has already created but rather exchanges one form of U.S. money (T-securities) for another (dollars). The entire “borrowing” process is nothing more than an asset exchange.

Do T-securities have any benefit? Yes, federal interest payments add to the money supply, an economically stimulative event. Federal interest payments help the government control interest rates and the dollar’s value. (The higher the interest, the greater the value of the dollar, and the more the economy receives in growth dollars.)

The most important purpose of T-securities is to provide a safe place to store unused dollars. This stabilizes the dollar while increasing its value.

T-securities (debt) are not functionally related to the difference between taxes and spending (deficits). They are related only by laws requiring the Treasury to create T-securities in the amount of the deficit.

The Treasury can create T-securities (debt) without a deficit, and the government can run a deficit without creating T-securities. Federal debt is not functionally the total of federal deficits.

The federal government could pay off the entire so-called “debt” today, merely by returning the dollars to the T-security depositors.

7. Fact: Federal taxes, as a money-raising tool, are unnecessary, harmful and futile:

— unnecessary because since 1971 (when the U.S. government became fully Monetarily Sovereign), the government has had the unlimited ability to create money without taxes,

— harmful because taxes reduce the money supply, which reduction leads to recessions and depressions, and

–futile because tax money sent to the government is destroyed upon receipt by the U.S. Treasury.

When you send taxes to the government, you are sending M2 dollars, but when they reach the Treasury, they cease to be part of any money supply measure. They effectively are destroyed.

Our Monetarily Sovereign government does not store dollars for future use. It can create unlimited dollars ad hoc by paying bills.

The so-called “debt” merely accounts for the total outstanding T-securities created out of thin air by the federal government.

The government decides to create T-securities equal to the deficit, but this requirement became obsolete in 1971 when we went off the gold standard and became Monetarily Sovereign.

Today, the federal government creates money by spending, i.e. it credits checking accounts to pay its bills. This crediting of checking accounts adds dollars to the economy.

The federal “deficit” is the net money created in one year and the federal “surplus” is the net money destroyed in one year. In short, deficit spending creates money and taxing destroys money. If taxes fell to $0 or rose to $100 trillion, this would not affect by even one dollar, the federal government’s ability to spend.

Further, (opinion)all tax (money-destroying) systems are unfair. See: http://rodgermitchell.com/FairTaxes.html. For a country with the unlimited power to create money, spending is not related in any way to taxing.

8. Fact: Contrary to popular myth, there is no post-gold standard relationship between federal debt and inflation. (See graph, below)

Also, contrary to popular myth, inflation is not caused by “excessive federal spending.” Inflation is caused by shortages of crucial goods and services, most often oil and/or food. (See the graph, below)

A brief discussion of oil prices and inflation is at https://rodgermmitchell.wordpress.com/2009/09/24/is-inflation-too-much-money-chasing-too-few-goods/

In this regard, hyperinflations are not caused by “money-printing,” but rather by shortages. So-called “money printing” (ala Zimabwe and Germany), were the governments’ response to hyperinflation, not the cause.

The Zimbabwe inflation was caused by food shortages. (The government stole land from farmers and gave it to non-farmers.) Money “printing” was the faulty response to inflation, not the cause.

The most recent inflation was caused by COVID-related shortages of oil, food, shipping, computer chips, metal, housing, lumber, and labor, among other things. As the shortages have been reduced, so has the inflation.

-

WWII Context: During World War II, many consumer goods were in short supply because production was focused on the war effort. When the war ended, the supply of goods resumed, and the previously unmet demand was suddenly able to be fulfilled.

-

Oil Crises: Similarly, during the oil crises of the 1970s, the reduced supply of oil caused prices to spike, not because of a sudden increase in demand, but because the existing demand couldn’t be met.

-

COVID-19 Pandemic: Supply chain disruptions and production bottlenecks during the pandemic created shortages in various goods, leading to price increases once supply constraints eased and the pent-up demand was met.

While the underlying demand might have been consistent, the ability to fulfill that demand was constrained by supply issues. When supply bottlenecks were removed, the previously suppressed demand could finally be expressed, leading to price increases.

-

Latent Demand: The concept of latent demand suggests that consumers’ desire for goods remains constant, but it is the availability of those goods that fluctuates.

-

Supply Constraints: Supply-side constraints create temporary mismatches between demand and supply, leading to inflationary pressures once those constraints are lifted.

-

Observing changes over time can reveal the true causes of economic phenomena. By examining what happens just before and during an inflationary period, we often find that supply-side disruptions are the primary drivers.

-

Gradual Demand Changes: Demand usually changes slowly, giving the economy time to adjust. This gradual change rarely leads to significant price fluctuations on its own.

-

Sudden Supply Changes: Supply-side shocks, such as natural disasters, geopolitical events, or production bottlenecks, can occur rapidly and unpredictably. The economy struggles to adjust quickly to these disruptions, leading to price increases as a balancing mechanism.

9. Fact: There is no post-gold standard relationship between federal debt and your taxes.

Unlike state/local governments, which are monetarily non-sovereign, the federal government does not use tax dollars to pay its bills. It creates new dollars, from thin air, every time it pays a creditor.

The sole purposes of federal taxes are:

–To control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward.

–To assure demand for the U.S. dollar by requiring all federal taxes to be paid in dollars.

Taxes do not pay for federal spending. Federal spending creates dollars.

9.a. Fact: Federal deficit spending does not use “taxpayers’ money.” Federal spending creates money ad hoc.

When the government spends it credits bank accounts. No taxes involved. By definition, deficit spending means taxes do not equal this year’s spending let alone previous year’s spending. Only surpluses use taxpayers’ money, by causing recessions.

For the above reasons, our children and grandchildren will not pay for today’s money creation. Still, they will benefit from today’s deficit spending — better infrastructure, army, education, R&D, safety, security, health, and retirement.

Any time you hear or read about the federal government spending “taxpayers’ money,” know that the person is ignorant about Monetary Sovereignty. The federal government doesn’t spend taxpayers’ money. Period.

10. Fact: There is no post-gold standard relationship between low interest rates and high GDP growth.

Opinion: The opposite seems true:

Why do high interest rates stimulate?

Opinion: High rates force the federal government to pay more interest, pumping more money into the economy.

The Fed increases interest rates to fight inflation. But increasing interest rates increases the prices of goods and services, i.e. causes inflation.

The Fed, in a sense, is using leeches to fight anemia.

11. Fact: The Federal debt/GDP ratio is a meaningless fraction, because it measures two, mathematically incompatible pieces of data. It’s an apples/oranges comparison. GDP is a one-year measure of output; federal debt is the net outstanding T-securities created since the nation’s birth.

The T-securities created years ago affect this year’s debt in the debt/GDP ratio, while even last year’s GDP does not affect this ratio. See: Debt/GDP

Because federal debt is the total of T-securities, and the federal government has the functional ability to stop creating T-securities at any time, the Debt/GDP ratio easily could fall to 0, depending on federal law.

11.a. Fact: The debt/GDP ratio does not measure the federal government’s ability to pay its bills. The government does not pay bills with GDP; it creates the money ad hoc to pay its bills.

Were GDP to be $0, the government still could pay bills of any size, simply by crediting the bank accounts of its creditors.

12. Facts: In 1979, gross federal debt was $800 billion. In 2009 it reached $12 trillion, a 1400% increase in 30 years. During that period, GPD rose 440% (annual rate of 5.5%>) with acceptable inflation. The same 1400% increase would put the debt at $180 trillion in 2039, a mean annual deficit of $5+ trillion.

This calculates to a 9.5% annual debt increase for the past 30 years. Repeating that growth rate would put the 2010 deficit at about $1.14 trillion, and the 2011 deficit at about $1.25 trillion. The deficit for year 2039 would be about $15.8 trillion.

Opinion: I know of no reason why the results would not be the same as they have been in the past 30 years. However, increasing the debt growth rate above 9.5% might show even better results:

In the 10 year period, 1980 – 1989, federal debt grew 210%, from $900 billion to $2.8 trillion (a 12% annual debt increase), while GDP grew .96% from $2.8 trillion to $5.5 trillion (a 7% annual increase). During that same period, inflation fell from 14.5% in 1980 to 5.2% in 1989. See graph, below.

Facts: In summary, large deficits have coincided with real (inflation adjusted) GDP growth

12. Facts: Any health insurance proposal that covers more people will cost more money. Extracting that money from doctors, hospitals, pharmaceutical companies, by necessity, would reduce the availability of health care.

Increasing taxes on any individuals (even the wealthy) or on businesses, will depress the economy by removing money from the economy. Only the federal government can supply additional money while stimulating the economy.

13. Fact: Social Security is supported neither by FICA nor by a trust fund. Were FICA eliminated, and benefits doubled, Social Security still would not go bankrupt unless Congress decided to make this happen.

In June, 2001, Paul O’Neill, Secretary of the Treasury said, “I come to you as a managing trustee of Social Security. Today we have no assets in the trust fund. We have promises of the good faith and credit of the United States government that benefits will flow.“

Yet, SS continues to pay benefits. Your Social Security check comes from a mythical trust fund that contains no money and receives no money.

Social Security (and Medicare) benefits are paid ad hoc by the U.S. government, not from a trust fund, and are not dependent on FICA taxes. which (opinion:) can and should be eliminated. See: FICA

14. Fact: The finances of the federal government are different from yours and mine and businesses’ and state, county and city government finances.

Unlike the federal government, which is Monetarily Sovereign, we cannot create unlimited amounts of money to pay our bills. We first need to acquire money, either by borrowing or by saving, to spend.

The federal government does not acquire money. It creates money by spending. As an accounting principle, the tax money you send to the government is destroyed upon receipt. Then the federal government creates new money to pay its bills. The government has no fund from which it pays bills.

Fact: Were taxes to decrease to zero, this would not change by even one penny, the federal government’s ability to spend.

Opinion: The failure to recognize the difference between the Monetarily Sovereign federal government and all other entities, which are monetarily non-sovereign, is the primary reason for recessions and depressions.

15. Fact: The federal government has the unlimited ability to create the dollars to pay any bill of any size. It never can run short of dollars; it never can go broke.

Opinion: The federal government should distribute dollars to each monetarily non-sovereign state, on a per capita basis.

The states would determine how they distribute the dollars (to counties, cities and/or taxpayers). I suggest a distribution of $5,000 per person or a total of $1.5 trillion.

16. To understand economics you must understand Monetary Sovereignty.

Fact: In 1971, the U.S. went off the gold standard, thereby becoming a Monetarily Sovereign nation, and at that moment, all economics textbooks became obsolete. Sadly, mainstream economists, the politicians and the media have not yet caught up.

============================================================

Summary: So there you have a list of facts, plus a few opinions, which I have noted. Read the facts and draw your own inferences.

You can find a great number of debt-hawk sites (i.e. Concord Coalition, Committee for a Responsible Federal Budget), which in essence are privately funded think tanks, paid to influence popular belief, with propaganda masquerading as data.

There, you will see data showing the size of the federal debt. These data are presented in a way designed to imply that the debt (money created) is too large.

But you will find no proof of these ideas. You will see no historical graphs equating debt with any negative economic outcome, simply because such graphs do not exist. Debt hawks believe federal deficits are so obviously bad, no proof is needed.

Yet, despite lacking proof, debt-hawks have foisted their opinions on the media, the politicians, weak-minded economists, and the public, much to the detriment of our economy.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

#MONETARY SOVEREIGNTY

Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/

that’s the question, inflation or deflation, right? I vote deflation. We’ve just seen the biggest inflation of our lifetimes, and the correction is consuming our phantom money supply for years to come. We should ask a Japanese suburban apartment owner who bought around ’90 to chime in and tell us the score, but, of course, we wouldn’t listen, because, this time, it’s different.

LikeLiked by 1 person

Actually, the biggest inflation of your lifetime probably occurred in 1979/80, which was caused by increased oil prices, not by deficit spending (See point 8.) It was cured during the massive Reagan deficits.

Deflation generally is felt to be worse than inflation, because it theoretically delays spending (“Why buy now when I can buy later for less?”) I question this theory, since it has not happened in electronics. I may write about this soon.

Rodger Malcolm Mitchell

LikeLike

Wow, what a blog, Rodger, on the most important public subject there is in my view!!!

I’ve studied the subject from the UK perspective, as a mathematician and system analyst. Hence I make a big difference between WHO issues a debt. A publicly elected government differs from a privately owned Federal Reserve.

Therefore I think you need to consider the difference between the CASH that the government prints and mints and the CREDIT that the Fed issues as T-securities and other forms of paper. The difference is INTEREST.

But I do love your fundamental point about taxes! And therefore my fear is that the IMF will catapult itself into the THE global central bank and use nation states just to give citizens a hard time via ‘law enforcement’.

Anyway, you’ll find more food for thought on http://publicdebts.wordpress.com

With best wishes for more and more power to your blogging elbows,

Sabine

Organiser, Forum for Stable Currencies

http://forumforstablecurrencies.info

LikeLiked by 1 person

Thank you, Sabine. I noted your reference to a “Robin Hood” tax, and the explanation that, “This tax on banks – not on you or I . . . ”

Banks are companies, and companies do not pay taxes. Every company is a financial intermediary that passes all its tax liabilities on to its owners, customers and employees. Taxing banks = taxing people.

Several other posts on this site show why sovereign nations neither need nor spend tax money. Taxes do not support national spending. Even were taxes to fall to 0 pounds, this would not affect the English government’s ability to spend by even 1p.

By the way, you were wise not to convert to the euro, a doomed currency.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

LikeLike

Hi Rodger,

Perhaps you can shed some light on this. I have spent the last few hours debating a friend who believes that in the near future (perhaps even this year), some corporate bonds will yield less than equivalent duration and coupon US Treasury bonds (or flipped be worth more).

My take on this is that it is impossible since the govt has the ability to “print” up both coupon and principal payments, an advantage which no corporation has, no matter how sound.

He has brought up cases like Argentina, Greece, California and Latvia where that has been true but I’ve replied that either those countries/states have pegged currencies (which is akin to debts denominated in foreign currency) or in Greece and California’s case they cannot print Euros or dollars.

Finally he has reminded me that bonds are priced by the market, not some formula, which I understand of course, but it doesn’t alter the reality here.

Am I missing anything? Can you envision any circumstance in which fixed payment dollar-denominated corporates could be worth more than the same US govt paper?

LikeLiked by 1 person

In the “near” future? If he is so sure, tell him to specify when the “near” future ends; then you can bet him he’s wrong. Trust me; he won’t bet.

Your 2nd paragraph is correct. All corporations have the ability to go bankrupt. Who would have believed, five years ago, GM would default? The U.S. government cannot go bankrupt. Therefore, the risk in owning T-bonds always is less than the risk in owning any corporate bond. Interest rates are based on risk.

Your answer regarding Greece et al also is correct. When a nation’s currency is pegged to an asset, over which they have no control, that nation’s bankruptcy risk rises dramatically. That is the fundamental flaw of the gold standard and the euro (which properly should be called the “euro standard.”) I will post a short essay on this, today.

Your last paragraph is a totally different question, because you used the word “worth.” Many people might think corporate bonds are “worth” more than Treasuries, which is why they buy corporate bonds, rather than buying Treasuries.

Perhaps it’s barely possible a wild rumor of some sort could, trigger a temporary selloff of Treasuries, lasting a day or two. For example, long term debt generally is considered riskier than short term debt, but there are times when short term debt pays more. This is known as “upside down” debt. The market can be strange, sometimes. But even with a strange market, I don’t recall Treasuries paying higher interest than comparable corporates, nor can I imagine the circumstances that would make it possible.

Rodger Malcolm Mitchell

LikeLiked by 1 person

Roger,

I believe you are technically incorrect on this one in regards to the US gov’t going bankrupt. It is actually bankrupt and has been since 1863. See:

BOUVIER’S LAW DICTIONARY 1914.

Comptroller in Bankruptcy. An officer . . . whose duty it is to receive from the trustee in each bankruptcy his accounts and periodical statements showing the proceedings in the bankruptcy, and also to call the trustee to account for any misfeasance, neglect, or omission in the discharge of his duties.

So if the government is bankrupt, who is the trustee? This is answered for us by Congressional Record March 17, 1993. P.H1303. The following is from that record:

Mr. TRAFFICANT asked and was given permission to revise and expand his remarks.

Mr. TRAFFICANT. Mr. Speaker, we are here now in chapter 11. Members of Congress are official trustees presiding over the greatest reorganization of any bankrupt entity in world history, the U.S. government.

The United States government is in bankruptcy and Congress are the trustees. It is a legal maxim that a bankrupt is ‘civilly dead’. That means that Congress cannot legally make positive law in bankruptcy, because they have no legal standing. The federal government has been in Chapter 11 bankruptcy from 1863 to today, and sits at the pleasure of the Commander in Chief, waiting to do his bidding.

Now, ain’t that a kick in the butt.

Regards,

Mike

LikeLike

Bankruptcy is a legally declared inability or impairment of ability of an individual or organization to pay its creditors.

When the U.S. federal government is unable to pay its creditors, and legally declared bankrupt, it will be bankrupt — in short, never.

A federal debt does not a bankrupt make.

Rodger Malcolm Mitchell

LikeLiked by 1 person

Good work there. I must appreciate author as well.

LikeLiked by 1 person

Thanks for your quick reply earlier. I read your post. In #15 you say “The federal government does not acquire money. It creates money.” Although they do create (print) money, they do acquire money from people who buy T-Bills. We have acquired a bit of money from the Chinese, haven’t we?

LikeLiked by 1 person

Mr. Wizard,

I should have been more specific. Yes, you’re right, the government does acquire money, tax money for instance. I should have said the government neither needs nor even uses the money it acquires. That money is destroyed as a credit in a balance sheet, never to be spent.

Instead, the government creates all the money it spends. In fact, federal spending is what creates federal money.

Rodger Malcolm Mitchell

LikeLiked by 1 person

What about exporting inflation? Are the increasing wages in foreign countries a sign that as we move manufacturing and customer service jobs to far away lands that the costs are reduced here which makes our inflation (rise in prices) less severe?

LikeLiked by 1 person

China’s low cost production and exporting has helped moderate our inflation. Many things affect inflation, but my point was, oil pricing seems to be the most powerful cause.

Rodger Malcolm Mitchell

LikeLiked by 1 person

When US “Currency System” is depended on OPEC nations oil supply how can it be sovereign?

LikeLiked by 1 person

“All money is debt and all financial debt is money.”

Is all nominal money debt? Your statement implies that all money used in transactions is thus a debt based transaction. Sure, the physical money or even the number in the computer may have started out as a debt, but at the time I use that money, it doesn’t mean I’ve entered a debt based transaction.

Thus, I’d say all money begins as debt, but not all transactions are debt based transactions. I think you say this in your book, but there are those (I once thought this) that think there never is enough money created to pay back debts since it is thought that every transaction uses debt money.

LikeLiked by 1 person

All money is debt. Period. If you don’t believe it, tell me a form of money that is not debt.

“Nominal” money merely is inflation-adjusted money, i.e inflation adjusted debt.

I don’t know what your definition is of a “debt-based transaction,” but whenever you go to the store to buy a banana, you exchange some debt for a banana.

Rodger Malcolm Mitchell

LikeLiked by 1 person

“Nominal” money merely is inflation-adjusted money, i.e inflation adjusted debt.

What I’m referring to with nominal money is the total amount of money used in the economy. Money like you say is debt. But when it is used, it isn’t always “used as” debt.

The total GDP is estimated as $14 trillion annually. That doesn’t mean that $14 trillion of debt was created and used each year. Rather, the total nominal amount of money used in the economy annually is that GDP number. (At least that’s what I would assume if I understand nominal money.) The amount of total nominal money is dependent on velocity. Or rather, money created and money exchanged add up to nominal money.

LikeLiked by 1 person

I rushed and made a typo. Nominal money is non-inflation adjusted money. “Real” money is inflation adjusted. Nominal has no dependence on velocity. GDP can be expressed in real money or in nominal money.

If inflation made a formerly $.80 banana now cost $1, you pay $1 in nominal money or $.80 in real money.

I’m unsure of the point you are trying to make, but money is debt. When money is used, debt is used. Whatever you say about money, you are saying about debt. When people complain the government has created $12 billion in debt, they mean the government has created $12 billion in money. The words are synonyms. Exactly alike. Indistinguishable. Identical. No difference. The same.

Until you accept that, you cannot understand economics.

Rodger Malcolm Mitchell

LikeLiked by 1 person

> tell me a form of money that is not debt.

Use of food grains as money – it is absolute money does not need one more exchange or redemption to realize value…..

Food grain money system was working successfully in Indian villages from ancient times till 1970, when government abolished the system by implementing food grain levy – which forced farmers to pay farm wages in paper currency. The result is obvious today, thousands of farmer suicides in India every year.

LikeLiked by 1 person

Fantastic post, thank you!

I think that everything you say makes perfect sense.

I am simply amazed that you could discover what eluded people trained in the field, but is certaily seems to be the case. I hope they will name federal buildings after you some day 🙂

Most “hidden truths” tend to paint a bleaker picture of reality than commonly believed, so I love that we don’t have to fret about “staggering public debt of X gazillion”, LOL! Thank you!

LikeLiked by 1 person

Thank you. This was one of those odd cases where I thought and thought, and then wrote a book, only later to discover that other people (the Chartalists) thought similarly. While I have a few areas of disagreement with the Chartalists (mostly regarding inflation), they and I agree on most things.

You might want to check my friend Warren Mosler’s 7 Deadly Innocent Frauds

Rodger Malcolm Mitchell

LikeLiked by 1 person

Thank you. I know of Warren Mosler, and I follow the billyblog, I am trying to understand this.

I noticed that recently Yves Smith gives exposure to chartalism on her blog nakedcapitalism, I think she is widely read, so it would make sense if you could have her link to your blog entires. I am saying this, because we need as much understanding as quicky as possible in these perilous times, when the debate is totally controlled by deficit crazies. I think these ideas have not yet registered in the public domain.

Best regards, please keep up the great work.

LikeLiked by 1 person

I just found your blog. It’s very interesting. However, isn’t there a danger of bubbles forming, like the housing bubble, if the money supply is too high? I agree that the risks for that, or inflation, are near zero. I wonder what the psychological impact of a change in terminology might have on our citizens? Would you create a moral hazzard? Economists rarely seem to talk publicly about the psychological factors that go into public policy discussions about the economy.(at least on TV) Would this cause people to lose faith in the money as having value itself?

LikeLiked by 1 person

Patrick,

Bubbles have many causes, but are not caused by a high money supply. The housing bubble grew for 60 years, during high money growth and low money growth. There is no relationship between money supply and the irrational bid-up of a single commodity’s price.

The psychological effect of changing from misleading, wrong and harmful terminology (federal “debt”) to correct terminology, would be positive, especially as that would support economic growth.

Americans never have lost faith in the dollar. Though booms and depressions and recessions and inflations and stagflations, Americans continue to use dollars. They have to. Dollars are needed to pay taxes and are legal tender.

The fundamental problem in America is the belief in the myth that we have a federal “deficit” problem. The only problem with the so-called federal “deficit” is that it is too low.

If you know anyone who would like an easy $1,000, tell them to go to REWARD

Rodger Malcolm Mitchell

LikeLiked by 1 person

Maybe I’m not grapsing exactly what you are saying-are you saying that this crisis has been brewing for 60 years. A 60 year bubble? I was under the impression that the bubble started around 99′ when housing prices came unlgued from inflation. Up until that point, growth in housing prices largely tracked inflation. It then accelerated all the way up to the crash.

Also, wouldn’t increasing the money supply-increase purchasing-which in turn increases inflationary pressure on the macroeconomy-which in turn could cause a bubble to form. The more money that is floating around should result in more purchases of property.

I guess you could argue our huge trade deficit might act like a vent-and reduce the likelyhood of a bubble. But it still seems that if you are pumping money into the economy at a high rate like you are suggesting, you are going to get a bubble somewhere-probably in an area that can’t be impacted heavily by international trade-like housing or healthcare.

LikeLiked by 1 person

I think low interest rates (and zero lending standards) were the two major causes of the housing bubble. Housing prices are somewhat similar to the price of bonds as both go up in value as interest rates go down. Obviously this is not a perfect correlation as interest rates are even lower now than they were in 2006, but once any bubble pops it tends to deflate completely.

LikeLiked by 1 person

Jason,

If housing prices go up as interest rates go down, housing prices should be high today. I agree with the standard theme that housing prices collapsed when too many people, who could not afford housing, bought housing.

Here is a graph of interest rates. GRAPH. As you can see, they were rising when the bubble burst.

Rodger Malcolm Mitchell

LikeLiked by 1 person

Hi Rodger,

I just came across your website and this thread. I am not a deficit hawk by any means and agree with a lot of what you say but I do disagree with a lot of what you say but I do need to further at your sight … In any case I am not following your logic about the housing bubble.

It seems fairly straight forward to me..please explain where I am going wrong…

In 2000/2001 interest rates were reduced, (I think we both can agree on that). They were reduced by the feds creating credit. That credit in the form of reduced interest rates allowed people like you, me along with speculators and large home builders etc to purchase/build more homes then they otherwise could afford (again I think we would agree on this point…people bought houses they could not afford..) So for example if someone could afford 100,000 loan at 8%, at 4% they could afford a larger loan (without doing the actual math) maybe up to 200,000.

Would this not have the effect of bidding up prices?? I believe if you look at any graph housing prices increased more rapidly after 2001 then it did in the post war period leading up to 2001 or the 60 yr period you mentioned at an earlier point.

This would have created the bubble would it not…along with the leveraging of the mortgages the banks did and all the other shenanigans that went along with it??

When the feds pulled back on their credit creation in 2006-2007 by increasing interest rates this would have popped the bubble would it not??

It would have done so if people had adjustable mortgage rates and their payments all of a sudden increased more then they could afford, or as projects became more expensive then originally planned and had to be abandoned ie..Vegas and Nevada in general are good examples of this.

This would have burst the bubble, would it not?? So would it not make sense that as interest rates increased it would have burst the bubble??

If not please explain why not??

LikeLiked by 1 person

“When the feds pulled back on their credit creation in 2006-2007 by increasing interest rates this would have popped the bubble would it not??

As you noted, housing prices had risen for more than 60 years, during which time interest rates have risen and fallen many times. See: http://research.stlouisfed.org/fredgraph.png?g=10i

There was no “bubble” burst all those years. The burst came with the confluence of two situations:

1. Banks were lending to unqualified borrowers, under the belief housing prices would rise enough to allow the borrower to remortgage or sell, thereby paying down the first mortgage,

and

2. The rate of federal deficit spending declined, which led to slower economic growth.

Rodger Malcolm Mitchell

LikeLiked by 1 person

Sorry, still not really following you..I actually noted that housing prices grew faster after 2001 than in the previous 60 years, although they have grown since after ww2. If memory serves there were several bubbles/bursts in housing over the last 60 yrs, I believe the early 1980’s was one period.

But again the point is that after 2001 when interest rates were lowered housing prices did grow faster then the previous 60 yrs creating a bubble. If I have time I will see if I can locate the chart that shows this.

The decline in “Federal deficit spending” as you call it (which I need to familiarize myself more with) would have declined when rates were raised and would have lead to the bursting of the “bubble” and slower growth which makes sense so I think we agree somewhat there.

LikeLiked by 1 person

Yes, rising interest rates affected certain of the adjustable rate mortgages (a distinct minority of mortgages), and would have been an added, though not decisive, factor. The key factors were the combination #1 and #2.

Zero-down mortgages + slowed economic growth = default.

Interest rates have gone up and down many times with no significant bubble: http://research.stlouisfed.org/fredgraph.png?g=10l

and

http://www.jparsons.net/housingbubble/

Rodger Malcolm Mitchell

LikeLiked by 1 person

I guess we are not seeing the same things.. when I look at both of these charts I see a pretty big housing bubble occurring around the same time as interest rates were declining..that to me is a bubble.

Also this is an interesting chart I came across showing real interest rates and inflation, the increase in inflation was not that great but it does seem to show a correlation….http://www.matissecapitalmanagement.com/.a/6a00d83452bb8769e2010535d5bd1d970c-pi.

LikeLiked by 1 person

Patrick,

Jason felt low interest rates caused the real estate price increases. I showed him this was not the case. No one knows when the “bubble” began, because there is no specific definition of bubble. Housing prices have gone up since WWII.

If you check points #4 and #5 of this post, you’ll see there is no relationship between federal deficit spending (aka “money creation”) and inflation, which is caused by energy prices.

Rodger Malcolm Mitchell

LikeLike

I am trying to understand hyperinflation and MMT and have attempted an explanation of hyperinflation using MMT terms. If you could provide any feedback on any of this I would appreciate it.

http://pair.offshore.ai/38yearcycle/#hyperinflation

http://pair.offshore.ai/38yearcycle/#chartalism

http://pair.offshore.ai/38yearcycle/#mmthyperinflation

LikeLiked by 1 person

Vincent,

You should know that I am not MMT. Though I do agree with most of its basics, I disagree with its positions on inflation.

MMT suggests that inflation can be controlled by taxes. While taxes do control money supply, which may affect inflation, taxes are too slow, too political and too imprecise to be an effective tool.

The Fed’s target rate of inflation is around 3%. What would the nation do if inflation rose to 5%? Passing new tax laws takes months of controversy, and no one could say how much tax rates should be changed to effect the desired inflation. It would be like using a chain saw to clip your nails.

By contrast, interest rates, which determine the value of money, can be calibrated quickly and precisely. That is why I suggest interest rates for inflation control.

If you want to understand MMT, contact Randall Wray and tell him I suggested it. Randy believes raising interest rates actually causes inflation, by raising producer prices, but there is no historical evidence of this. In America, inflation has been caused by energy prices.

Historically, hyperinflation is not “inflation on steroids.” It is a different phenomenon, caused by political problems unique to each country.

Germany’s pre-war hyperinflation was caused by the onerous terms the Allies put on them, following WWI. Zimbabwe’s hyperinflation was caused by Robert Mugabe’s mishandling of its economy.

Hyperinflation results when a government attempts to address inflation, not by increasing the value of its money, but rather by increasing its supply. In that sense, hyperinflation causes money printing, rather than the other way around.

Rodger Malcolm Mitchell

LikeLike

Do you think taxes are needed to provide a core demand for the currency? Or do you think a fiat currency would be sustainable with no taxes at all?

If we say oil/energy prices correlate with inflation, what causes oil prices to go up? To me it looks like the value of the dollar on the international markets sets the price of oil. So if they print too much money the value of the dollar goes down relative to other currencies and the price of oil in dollars goes up. So the first sign that inflation is coming will be when the dollar goes down relative to other currencies and oil goes up. But I think it is the weakening of the dollar by printing too many that is causing the dollar to go down and oil up, not that oil just goes up for no reason.

I agree that hyperinflation is very different from normal inflation. It seems some MMT people do not agree with this though. It is not just “too much money” is is a breakdown in confidence in the money, where people don’t want to hold it for any length of time.

LikeLike

Warren Mosler, Randy Wray and I have discussed this at length. MMT says taxes provide a core demand for money. I agree.

However, as I have pointed out to Warren and Randy, federal taxes are not necessary. There are plenty of state and local taxes for this purpose. They agree with me on this.

You said, “To me it looks like the value of the dollar on the international markets sets the price of oil.” Not exactly. Oil is priced in dollars, but what causes a barrel of oil to require more or fewer dollars? I believe it is a function of supply and demand for oil.

Since oil is priced in dollars, it is difficult for me to see how the price of a dollar vs, for instance, a British pound, could influence the number of dollars needed for each barrel of oil. If the exchange rate, dollars vs pounds changed from 1/1 to 2/1, this merely would mean the British could buy oil cheaper. Americans still would pay the same number of dollars per barrel.

Rodger Malcolm Mitchell

LikeLike

I see on the taxes.

How about thinking of the price of oil in dollars as a function of the supply and demand for oil as well as the supply and demand for dollars? It is like there are 2 currencies (oil and dollars) and there is an exchange rate between the two. The value of each is a function of the supply and demand of each. You can see that if you doubled the supply of oil the price would go down, so how about if they double the supply of dollars, will that make the price go up?

LikeLike

You are correct that the price of oil is based on the supply and demand for oil vs. the supply and demand for dollars.

When it comes to dollars, however, don’t focus too much on supply, because that does not seem to be the determining factor in money value. Rather the demand, which is a function of risk and reward (interest rates) seems to be the key.

If the supply and demand for oil remained constant, and U.S. interest rates went up, I suspect the price of oil would go down. I’ve not done any research on this however, and there are many factors affecting oil prices. You might want to check into it.

Rodger Malcolm Mitchell

LikeLike

Vincent, you might find this link interesting: Oil vs. interest

It seems to indicate that when the Fed Funds rate goes up, oil prices tend to drop shortly thereafter, and vice versa. There looks to be about a zero to one-year lag. But again, many factors affect oil prices.

Rodger Malcolm Mitchell

LikeLike

Vince Cate said,

“The problem is that your $1,000 will be worthless if there is hyperinflation and my $40 is real money. 🙂 Are you willing to do my 2 oz of pure silver against your 50 oz of pure silver?. Can we define hyperinflation as at least 3% inflation per month by end of 2011. Deal?”

Deal. Please Email me to confirm at rmmadvertising@yahoo.com.

Rodger Malcolm Mitchell

LikeLiked by 1 person

It also isn’t easy convincing people that traditional economics not only is hypothetically wrong, not only is factually wrong, but is wrong to such a degree it is extremely harmful to our economy.

It is also why I have just signed up to recieve your blog.

Stephen A. Boyko

Author of “We’re All Screwed: How Toxic Regulation Will Crush the Free Market System” and a series of articles on capital market governance.

http://www.traderspress.com/detail.php?PKey=671

LikeLike

Hello Roger

What do you think of the theory that the FED is controlled by the Rothschild family and prevents the US government from exercising its right to create money?

What do you think of Ron Pauls plan to abolish the FED?

LikeLike

Graham,

The first one sounds like an idiotic, anti-semitic rant, that only utter fool would consider much less repeat.

I disagree with the second one.

Rodger Malcolm Mitchell

LikeLike

Roger,

I just started reading your blog and really think that MMT and your theory are both gret theories and are much easier to understand than the false education I received in ECON101. Now I have to decide what I think controls inflation, interest rates or taxes, or should I say which is a better controller of inflation….

I think one thing we need to figure out who is how to get the general voting public to see it this way as well, so we could actually help our country. I would love for our left and right debates to be between MMT and your theory one day.

JP

LikeLike

Mr. Hochbaum.

A discussion of inflation control is at I’m not MMT.

The general voting public relies on the media and the politicians to tell them what to think. So, to help our country, I suggest you contact your local media and politicians, and urge them to read: Monetary Sovereignty.

If enough people contact the media and the politicians, they finally will find the energy to read the facts. Our responsibility, as citizens, is to push the media and the politicians in the right direction.

Rodger Malcolm Mitchell

LikeLike

Rodger,

First off sorry for initially misspelling your name. Second I just picked up a book today about how ideas spread and how they spread like epidemics. I think you may like it, “The Tipping Point” by Malcolm Gladwell. Funny how life has interesting connections, finding this blog and then finding a book about spreading ideas.

Cheers!

LikeLike

JP,

There is a tipping point in nature called “quorum sensing.” My hope is that eventually we reach a tipping point in recognition of Monetary Sovereignty. It requires enough people contacting their politicians. I hope you will.

Rodger Malcolm Mitchell

LikeLike

before free trade our country made what we consumed and exported huge quantities to other countries. our import taxation discouraged slavery, prevented dumping and supported domestic jobs, america produced more jobs than people. the small business family owned community structure prevailed. we were a wealthy middle class country.

now we have descended into 25 % unemployment, and the wealth is mostly in the hands of a few dozen billionaires. these men empowered by bribery through legal maneuvers, and criminality in government, patent laws, hidden assets , laundering, creative accounting, lobbyst writing laws, paying off lawyers/judges/pliticians to enact and/or ignore the laws,

unless we abandon free trade, restore import taxation, creating economic justification of rebuilding our once massive manufacturing infrastructure, and family owned small business community model, our downward spiral in the quality of life will continue, along with the exponential hoards of homelessness.

lawyers are not economists, neither do they serve our country, they are self serving criminality, fueled by lust and greed, selling their votes to lobbyst paid to empower the world class mafia, seeking a one world power

we their victims

LikeLike

Jackie I didn’t know Warren Buffett, Bill Gates, Sergey Brin, Jeff Bezos, Larry Ellison, Mark Zuckerberg. Steve Jobs etc were criminal, money laundering thieves. Thank you for clearing that up.

LikeLike

You want to abandon free trade, and to tax imports, but you also want to export huge quantities? That’s been tried. It was called the Hawley-Smoot Tariff. One thing we learned: When we tax other people’s exports, they tax our exports, world trade disappears along with economic growth.

Not sure how import duties discourage slavery.

By the way, “lust and greed” is what the other guys have. You and I have “frugal ambition.”

Rodger Malcolm Mitchell

Rodger Malcolm Mitchell

LikeLike

And if I am not mistaken our manufacturing output is still 50% higher than number 2 in the manufacturing race.

LikeLike

Good article above. Just a few points where I disagree.

Fact 1. Apart from the fact that growing economies need an expanding money supply, there is inflation to take into account. I.e. if inflation is say 2%, the national debt and monetary base will contract at 2% a year unless topped up. Assuming a constant monetary base and national debt to GDP ratio, this “topping up” process involves even more deficit (over and above the “growing economy” point).

Fact 6. I don’t agree that it’s a good idea for central banks to control interest rates or the value of their currency on forex markets. GDP will be maximised when the price of borrowed money and currencies (just like the price of most other things) is determined by market forces, rather than central banks. In fact Abba Lerner claimed that the only tool needed to influence demand is government net spending. I agree. Altering that spending will doubtless influence interest rates, but that’s incidental.

Fact 10. I don’t agree that high interest rates are stimulatory because they “force the federal government to pay more interest, pumping more money into the economy.” I know Warren Mosler is sympathetic to this view and I’ve debated this point with him. My reasons are as follows.

Whether the money for interest is, 1, “new central bank money” or, 2, money effectively taken from taxpayers depends entirely on the rules or customs governing the relevant central bank. Warren claims that “1” operates in the US. But for all I know there are countries where “2” operates.

To have “1” as the institutional arrangement strikes me as silly because it negates the intended purpose of interest rate changes.

I think the solution to this conundrum is to make the “other things being equal” assumption when considering interest rate changes – in particular it should be assumed that government / central bank net spending is constant. This assumption is normally made when considering the effect of ANYTHING.

LikeLike

Ralph,

I agree with your comment that federal deficits must be large enough to include inflation — also, population growth and GDP growth.

I’ve seen no evidence that “GDP will be maximised when the price of borrowed money and currencies is determined by market forces.”

Re. 10, the fact seems to be that high rates coincide with GDP growth. I’ve speculated this is because it forces then government to pay more interest.

Rodger Malcolm Mitchell

LikeLike

Hi Roger,

I was hoping you could answer some questions for me.

If taxes are simply destroyed once they are received, why do govt’s keep charging people taxes? Wouldn’t this be a conspiracy, or that the government is lying (imagine that?)

I read that our income taxes are sent to the IMF for debts owed over the decades (WW2 etc for us aussies), and it’s the rest of the taxes that supposedly pay for the roads etc. But your theory would suggest this is not what taxes are for, they seem to have no purpose…I’m wondering why they keep doing it?

I also find it alarming at the number of immigrants we are accepting into our country, and it’s the amount of money they are given that angers Australians. Of course, I always assumed that the reason our government pays them so much in welfare etc is because they see them as a long term investment, i.e. from tax receipts over their life time….but if taxes are not used for anything, then this blows my assumption out of the water…can you shed any light on this?

Cheers

LikeLike

Taxes are necessary for monetarily non-sovereign governments, (cities, counties, states, Greece, Ireland et al), because they do not have an unlimited ability to pay bills. So taxpayers in those governments do pay for government spending.

Taxes were necessary for the U.S. until 1971, when we went off the gold standard and became Monetarily Sovereign. Today, taxes do not support U.S. spending. If taxes were $0 or $100 trillion, neither event would affect by even one dollar the federal government’s ability to spend.

Those who subscribe to MMT, (Modern Monetary Theory) believe taxes are necessary to create demand for money, but in the U.S. there are sufficient state and local taxes for that purpose.

So today, federal taxes have no purpose other than restraining inflation and economic growth. Today, the big problem is growth, not inflation.

Rodger Malcolm Mitchell

LikeLike

Thanks Roger

LikeLike

Rodger,

Enlightening stuff. I’m currently reading G. Edward Griffin’s The Creature from Jekyll Island about the creation of The Federal Reserve. It paints a rather dubious picture of its motives. Do you have any thoughts on those theories- assuming you might be familiar with it?

Also curious if you think the deficit/debt hawks are just ignorant or if they may have something to gain by convincing everyone that we need to gain “fiscal responsibilty” by slashing spending?

LikeLike

Pete, the problem with most accounts of the Fed is there always seems to be an agenda. It’s difficult to separate the facts from the almost facts and the sort of, kind of facts.

Perhaps the biggest myth about the Fed has to do with its independence. It is not independent. It is an arm of the President and Congress. Fed leaders serve at the whim of both. So all the crap about the Fed being able to create money that the government can’t is just that: crap.

I suspect the vast majority of debt-hawks are average, everyday people, who do not understand the difference between Monetary Sovereignty and monetary non-sovereignty.

Then there are those who do know, but won’t say, for political purposes. Old-line professors may know, but no way will they admit it now. Politicians may know, but are afraid to anger the voters. Some in the media may know, but won’t upset their readers.

Rodger Malcolm Mitchell

LikeLike

Rodger,

Interesting. Since the bail out/looting, most of my investigation has lead me to believe that the banking cartel (via the Fed) is at the top of the power structure. That the arms of the Govt. do the police work at the behest of the financial elite, not the converse. The bail out and “TBTF” itself seems to be evidence of this. Sorry for the sidebar here on the thread, but do you have any suggested readings that support the idea that The Fed is the Jr. Partner in the relationship, not the Sr.?

I found this video series about the power structure by Damon Vrabel to be quite fascinating. http://csper.org/intro-video.html

He suggests that the Govt. is outside the pyramid. It sure seems like our mutant, out of control campaign finance system and the fraternity of bankers who revolve in and out of the high financial chairs of the land provide pretty telling evidence to support this case. If the Fed were indeed independent, and used debt as a control instrument, I reckon that would technically mean we are not monetarily sovereign. It sure doesn’t seem like our politicians, whether it be the POTUS or any of the losers in congress, have the brain power to be really calling the shots.

LikeLike

Rodger,

Have you ever read Warren Mosler’s “Seven Deadly Innocent Frauds Of Economic Policy”?

Click to access 7DIF.pdf

That author points out many of the same things you do, and explains them in a manner that is so “logical” that no “rational” person can disagree!

LikeLike

Yes, his book is excellent. He and I have been in correspondence for years. I gave him my thoughts when he blog-posted previews of his book.

His scoreboard analogy is one of the great examples in economics (A Monetarily Sovereign government is like a scoreboard. It creates money the way a scoreboard creates points, and does not need to obtain dollars from any source.)

He has a good blog, too. I have huge respect for Warren. We disagree in just one area: The prevention/cure for inflation. That is why he is MMT and I am Monetary Sovereignty.

Rodger Malcolm Mitchell

LikeLike

The Fed has quite a bit of independence, not to mention secrecy. 14 year terms for the appointees on the board. Sure, they meet with Congress a couple of times a year to put the dog and pony show on, and Congress and/or the President could change the laws (if they were so inclined), but Congress does not challenge the monetary policies set by the FOMC. I’m not debating whether this amount of power & independence is good or bad- I have my own thoughts. But it begs the question… does the fuzzy relationship between our Government and this private corporation comprised of highly concentrated industry and with the power to issue money & interest rates raise questions as to the “sovereignty” of our money? If it’s contracted out, is it sovereign?

I’m not challenging the fundamentals of what you say about Monetary Sovereignty and I don’t want to split hairs, but I think it’s worth consideration as to the definition.

From the Naked Capitalism blog: http://www.nakedcapitalism.com/2011/03/matt-stoller-the-federal-reserves-wheezy-independence-takes-another-hit.html

LikeLike

Pete,

Actually, it may be splitting hairs. I think of it as something like the relationship between a two-year-old and his parents. The parents allow him to play for hours, any sort of game he wishes, until he does something dangerous or otherwise not according the the parents’ liking.

Then the parents rein him in.

Is the child independent? So long as he keeps playing “nice” games he is — until the parent says, No!”

Rodger Malcolm Mitchell.

LikeLike

Are there any recent examples of “being reined in”? It would appear to me, especially considering the massive industry consolidation over recent decades, that the family relationship takes on a different appearance.

Possibly that of the parents being the people, the Govt. being son #1, and the Fed being son #2. The parents now suffer from Alzheimers or some kind of Dimentia. The young brothers have convinced the parents to hand them the debit card and free reign over the family account with no real accountability. The brothers at the end of the day, sit down and decide how to use the debit card in such a way that keeps both their pockets stuffed (along with their friends outside the family). The fuzzy, yet dependent relationship between the two brothers allows for neither of them to accept responsibility. Mom and Dad are told “don’t worry, it’s best for you…” as they are thrown the occasional scrap and moved into a minimum security, low budget, assisted living home.

LikeLike

It’s ongoing and done in private. Each of the stimuli, from the first $500 checks to the QEs, were discussed with the President. The Chairman is appointed by the President and serves at his pleasure.

Anyone who thinks the Fed just goes off and does things the President rejects, doesn’t understand Washington.

LikeLike

I guess we’ll have to agree to disagree on that point. The Govt. has been captured. You can’t get elected without a seal of approval and large investment from the banking community. They write (better yet strip) the legislation through their army of lobbyists & wholy owned subsidiaries in Congress, they own the prominent, influential “academics”, their fraternity revolve in and out of the doors of the high offices of Govt.- including the laugh out loud “regulatory” agencies. Sumners, Geitner, Paulson, Rubin and the list goes on….

Sorry, I’m betting there was a time not too long ago when it was different (as you say), but it’s just too difficult a pill to swallow that the banksters are not in charge after watching old Hank Paulson tell us how the bailout was gonna go down and that there was nothing we could do about it.

Curious what you thought of the documentary Inside Job?

I’m betting you’re familiar with Ellen Brown’s blog and/or books? She advocates for state owned banks such as in North Dakota (state monetary sovereignty?). Anyway, thanks for the exhange and humoring me by answering a bunch of questions you probably don’t have the time or inclination to respond to all day. I appreciate your time. Here’ a link to one Ellen’s good articles…

http://www.webofdebt.com/articles/nobailout_mainstreet.php

LikeLike