Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

Reader Ian Winograd alerted me to the fact that Stephanie Kelton has been chosen to be Chief Economist for Senate Budget Committee. This is great news.

As many of you know, Stephanie is Chair of the Economics Department at the University of Missouri, Kansas City. UMKC is the primary hub for Modern Monetary Theory, the sister of Monetary Sovereignty.

Presumably, Stephanie will have the opportunity to insert some reality into the government’s budgeting process, although she will be constrained by politics. To give you some idea, here are the people with whom she will deal.

This morning, I dropped Stephanie a note:

Hi Stephanie,

Wow! I don’t know how you made it happen, but I’m sure glad you did. Now, you’ll have a bigger, better chance to spread the truth.

Believe this 80-year-old man: It won’t be easy.

Many people go to Washington, filled with knowledge and faith, but then the political birds whisper in their ears — things like “To get along, go along,” and “The people can’t handle the truth,” and “It’s not politically possible,” and the not-so-subtle threat, “You can accomplish more on the inside than on the outside.”

And soon those well-meaning people sip the political drug, and gradually lose their principles, and themselves become part of the Big Lie.

I’m sure every Fed Chairman knows the truth. Some even have hinted at it. But the political birds convinced them to go along politically, and they gave credibility to the Big Lie.

I’m sure Eric Holder knew he should prosecute the banksters, but the political birds convinced him to go along. I’m sure George Bush knew torture is wrong, but the birds swayed him by political expediency. I’m sure at least some Senators know the facts of MMT and Monetary Sovereignty. But, the political birds convince them to stay silent.

There’s a funny thing about surrendering beliefs: It becomes easier every time you do it, and after a while, you barely can remember what your real beliefs are.

Anyway, you’ve fought long and hard to spread the truth. And now the opportunity has arisen and you’ll have a bigger megaphone.

I know you’ll do great things.

Much good luck to you. Let me know if I can be of assistance.

Rodger

Her response:

All good words. Thx, Rodger.

I suspect her job will resemble trying to reverse course on the world’s largest oil tanker, currently in full speed.

But . . . we can hope.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

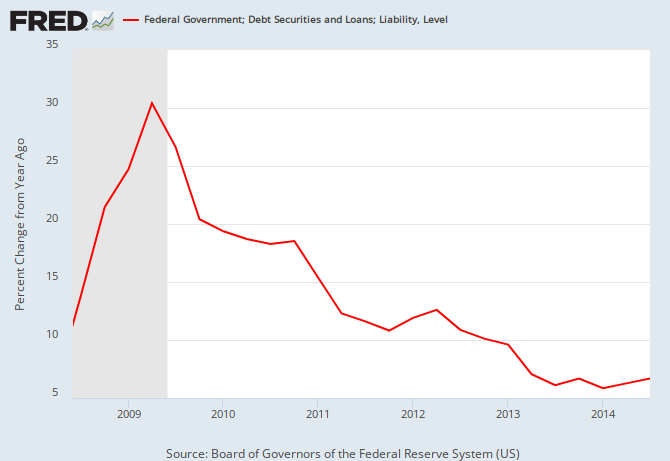

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY