Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

=====================================================================

After each of the following articles, we ask you a question. Can you achieve a perfect Texas score?

CPSC Sues Star Networks USA Over Hazardous, High-Powered Magnetic Balls and Cubes

Magnets that attract through the walls of intestines result in progressive tissue injury. Such conditions can lead to infection, sepsis, and death.

There are regulations against selling these dangerous balls. But, the regulations failed to prevent their sale and serious resultant human damage. Shall we eliminate these burdensome regulations?

Salmonella Outbreak Linked to Las Vegas Restaurant

The outbreak was linked to Firefly, a tapas restaurant. Health officials say the restaurant will remain closed until the investigation is complete. The restaurant was also cited for more than 40 health violations.

Health regulations failed to prevent the spread of salmonella. Shall we eliminate such burdensome regulations?

Compounding pharmacy death toll continues to rise

Now at 51 dead across the country, the latest fatality related to the New England Compounding Center occurred in Florida in the past week.

Although senators soon began studying changes to federal law, fierce opposition from the compounding industry killed those reform attempts.

Current regulations failed. Shall we soften the burdensome regulations already in place?

How Wells Fargo Cheated Its Customers

In a harshly worded decision issued late Tuesday afternoon, a federal judge in California ruled that Wells Fargo deliberately manipulated customer transactions in order to trigger overdraft fees. The bank was ordered to pay $230 million in restitution.

Regulation failed to prevent rampant bank cheating. Are banks too heavily regulated?

Stampede at packed Chicago nightclub leaves 21 dead

At least 21 people were killed and 57 injured in the stampede early Monday at the crowded E2 nightclub. As many as 500 people were crammed into the second-floor club when someone sprayed Mace or pepper spray to quell a fight about 2 a.m.

A judge had ordered the owners to close their second-floor club last July because of safety violations, including failure to provide enough exits.

Regulations failed to prevent nightclub deaths and injuries. Should those burdensome regulations be eliminated?

Whalen Furniture to Pay $725,000 Civil Penalty for Failing to Report Defective Children’s Beds

Toddler Died When Lid of Bed’s Toy Chest Fell on Him

Regulation failed. Is this a case of over-regulation?

Parents of Kids Killed in Pool Drain Accidents Outraged By Federal Rethink of Safety Law

The mother of a six-year-old who died in 2007, sent an angry letter to the Consumer Product Safety Commission (CPSC) after that agency recently voted to interpret the 2007 Pool Safety Act to no longer require back-up anti-entrapment systems in as many as 150,000 public and hotel pools and hot tubs.

In one horrific instance, four adult men were unable to pull a young girl from the grasp of a deadly drain. Swimmers can die from drowning or evisceration.

Should swimming pools be deregulated?

All of the above describe illegal acts by businesses, cutting corners to make an extra buck. All of the above describe failures of regulation, that resulted in deaths and serious illness. Is the solution to eliminate regulations? Does corporate profit trump the lives and health of ordinary people?

If you live in Texas, your answer is, “Yes.”

After Plant Explosion, Texas Remains Wary of Regulation

Asked about the disaster, Governor Rick. Perry responded that more government intervention and increased spending on safety inspections would not have prevented what has become one of the nation’s worst industrial accidents in decades.

Last month’s devastating blast did little to shake local skepticism of government regulations. Tommy Muska, the mayor, echoed Governor Perry in the view that tougher zoning or fire safety rules would not have saved his town. “Monday morning quarterbacking,” he said.

“Monday morning quarterbacking” also known as “learning from your mistakes,” is a process apparently alien in Texas.

Texas is the only state that does not require companies to contribute to workers’ compensation coverage. It boasts the largest city in the country, Houston, with no zoning laws. It does not have a state fire code, and it prohibits smaller counties from having such codes.

But Texas has also had the nation’s highest number of workplace fatalities — more than 400 annually — for much of the past decade. Fires and explosions at Texas’ more than 1,300 chemical and industrial plants have cost as much in property damage as those in all the other states combined for the five years ending in May 2012.

Compared with Illinois, which has the nation’s second-largest number of high-risk sites, more than 950, but tighter fire and safety rules, Texas had more than three times the number of accidents, four times the number of injuries and deaths, and 300 times the property damage costs.

In order to appease business, Texas is willing to sacrifice workers’ lives. The rich have been able to convince voters that “real” Texans shouldn’t ask for help from the government (unless it’s tax breaks for the wealthy).

In Texas, it’s a matter of pride to be ground under by the upper .1% income group.

“The Wild West approach to protecting public health and safety is what you get when you give companies too much economic freedom and not enough responsibility and accountability,” said Thomas O. McGarity, a professor at the University of Texas at Austin School of Law and an expert on regulation.

Since the accident, some state lawmakers began calling for increased workplace safety inspections to be paid for by businesses. Fire officials are pressing for stricter zoning rules to keep residences farther away from dangerous industrial sites. But those efforts face strong resistance.

Chuck DeVore, the vice president of policy at the Texas Public Policy Foundation, a conservative study group, said that the wrong response to the explosion would be for the state to hire more “battalions of government regulators who are deployed into industry and presume to know more about running the factory than the people who own the factory and work there every day.”

See, it’s like this. Factory owners know more than regulators, so regulations should be eliminated. We can trust those factory owners to protect workers and customers. Right?

Texas is dotted by more than 700 fertilizer depots. A fire code would have required frequent inspections by fire marshals who might have prohibited the plant’s owner from storing the fertilizer just hundreds of feet from a school, a hospital, a railroad and other public buildings.

A fire code also would probably have mandated sprinklers and forbidden the storage of ammonium nitrate near combustible materials. (Investigators say the fertilizer was stored in a largely wooden building near piles of seed, one possible factor in the fire.)

Ah, who cares about schools, hospitals, railroads and the public. There’s money to be made, and regulations just get in the way.

From the freewheeling days of independent oilmen known as wildcatters to the 2012 presidential race, in which President Obama lost Texas by nearly 1.3 million votes, the state’s pro-business, limited-government mantra has been a vital part of its identity.

That is particularly true in the countryside. “In rural Texas,” said Stephen T. Hendrick, the engineer for McLennan County, where the explosion occurred, “no one votes for regulations.”

The upper .1% income group has brainwashed the lower 99.9% into believing benefits like Social Security, Medicare et al should be reduced. But the Texas rich take it even further. Here, the upper .1% has brainwashed the population into believing the Texas myth of self-sufficiency.

Enriching business owners at the cost of ordinary people’s lives and health – that is a sign of Texas manhood. Regulations are for sissies, not for real cowboys. Money and bullets is all the regulation they need.

In America, and especially in Texas, the unnecessary deaths, sicknesses and misery of ordinary people are no burden. Government is the real burden. Cut Social Security. Cut Medicare. Cut aid to the poor and the middle classes. Cut regulations that protect ordinary people.

Ask any rich businessman.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

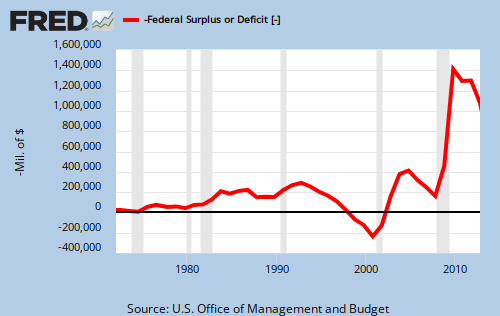

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY