mTwitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

…………………………………………………………………………………………………………………………………………………………………………..

It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders..

………………………………………………………………………………………………………………………………………………………………………………

The U.S. federal government is Monetarily Sovereign, which simply means it has the unlimited ability to create its own sovereign currency, the dollar.

The federal government never can run short of dollars, which it creates ad hoc, every time it pays a creditor. The federal government needs no income. Even if federal tax collections were $0, the federal government could continue spending, paying its bills, and creating dollars, forever.

Those are the fundamental truths of Monetary Sovereignty.

By contrast, your state, county, city, business, you and me all are monetarily non-sovereign. The dollar is not our sovereign currency. We can run short of dollars. We all need income to pay our bills.

I live in Illinois. It is insolvent. It is so broke it can’t even pay its Lotto winners their prize money. So it discontinued its Lotto, which makes it even more broke.

Illinois isn’t the only state with financial problems. Maine and New Jersey are in the news for similar situations. And not just Illinois, Maine, and New Jersey, but thousands of monetarily non-sovereign governments — villages, cities, counties, and states — are on the edge of insolvency, if not already insolvent.

And there is a reason.

To remain solvent, a monetarily non-sovereign entity must have more dollars flowing in than flow out.

Imagine the fictional town of Mini. The entire town consists of one house. The sole resident is one man, the Mayor of Mini.

The Mayor receives all his income from his Mini salary, and Mini receives all its income from the Mayor’s taxes. No dollars flow across Mini’s borders, either in or out. The same dollars just keep flowing back and forth.

Immediately you see the problem. The Mayor has no dollars left for food, clothing, etc. And Mini has no dollars left over for any town functions.

The only way Mini and the Mayor both can survive is if they both receive additional dollars from outside.

If for instance, a tourist comes by with dollars, and rents a room in the Mayor’s house, the influx of dollars allows the Mayor to survive financially, and even to increase his tax payments, which allows Mini to survive.

While a Monetarily Sovereign entity never can be unwillingly insolvent, a monetarily non-sovereign entity long-term must have more dollars coming in than going out.

Similarly, to financially survive long-term, not only you but your village, your county, and your state all must be net exporters of goods and services, i.e. net importers of dollars.

But, there is a problem. In a closed system, not everyone can be a net exporter or net importer of anything. For one entity to be a net importer, another must be a net exporter.

(The monetarily non-sovereign euro nations struggle because the Monetarily Sovereign European Union is too stingy with euros. The individual nations all must be net exporters of goods and services to survive — a practical impossibility.)

When that tourist to Mini showed up, the Mayor became a net importer of dollars (a net exporter of a service), and Mini also became a net importer of dollars (from the Mayor’s extra dollars).

But where did the tourist obtain his dollars?

For the tourist, and for villages, cities, counties, states, you and me all to survive financially long-term, every single one of us must run a long-term surplus of dollars, and some other entity must be able to run a long- term deficit without becoming insolvent.

Ultimately, that entity is the U.S. federal government. It uniquely has the unlimited ability to run deficits forever. That’s what makes it Monetarily Sovereign.

The implication is clear: When the federal government shifts any financial burden to a state, county, or village, it moves that entity toward insolvency.

Some politicians will tell you that the states, counties, and villages can do a “better job” serving the public, because of being “nearer” to the public, and for that reason, some of the costs should be transferred from the federal government to the states, counties, and villages.

Do you see what’s wrong with that idea?

- It’s wrong on the face of it, because the states are not “nearer” to anyone. Southern Illinois, for instance, is solid Republican, and Chicago is solid Democrat, with each suburb of Chicago varying between left and right. So, to whom, is Illinois “closer”?

- Illinois is broke. Forcing it to pay even more costs is ludicrous. The federal government never can be “broke.”

And then there are the politicians who tell you that the federal deficit is “too high” and “unsustainable.” But as we have seen, the deficit is necessary to fund all those monetarily non-sovereign entities, the states, counties, villages, businesses, you, and me.

Dollars have to come from somewhere, and ultimately that “somewhere” is the federal government that originally created them.

Now it’s true that new dollars also come from banks in the form of loans, but those new dollars must be paid back, and when they are paid back, the loans and the new dollars disappear.

The only dollars that never need to be paid back are the deficit dollars created by the Monetarily Sovereign federal government.

Return now to the title of this post, “You live on the edge of insolvency, but may not realize it.”

If not for the dollars you receive as income, you would be insolvent. In essence, you live on the edge of insolvency.

You cannot rely solely on other monetarily non-sovereign entities to supply you with dollars. They all have the same problem. They too need a continual inflow of dollars. They all need income.

Only the federal government doesn’t have that problem. It neither needs nor uses income. Tax dollars sent to the federal government cease to be a part of the money supply the instant they are received. In short, tax dollars are destroyed upon receipt.

Think of the federal government as the sun, and any individual state as a planet.

Every second, the sun runs a “deficit” of heat rays. It sends out more heat than it receives.

The planet is kept warm only if it receives more heat than it gives off.

An individual state is solvent only if it receives more dollars than it spends.

Think of what would happen if the “politicians” of the universe decided that the sun’s heat deficit was “unaffordable” and “unsustainable,” and the earth would have to do with less heat from the sun.

Think of what would happen if the “politicians” of the universe were to decide that the sun must run a balanced budget, meaning the heat it sends out must be balanced by the heat it receives from the rest of the solar system.

Everything in the solar system would become heat insolvent, and the entire solar system would turn to ice.

Today, our politicians tell us the federal government’s dollar deficits are “unaffordable” and “unsustainable.” So the states will be forced to do with fewer dollars, and the government will need to run a balanced budget.

If that happens, we all will be dollar insolvent and our economy will turn to ice.

And that is exactly what history reveals to us:

U.S. depressions tend to come on the heels of federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

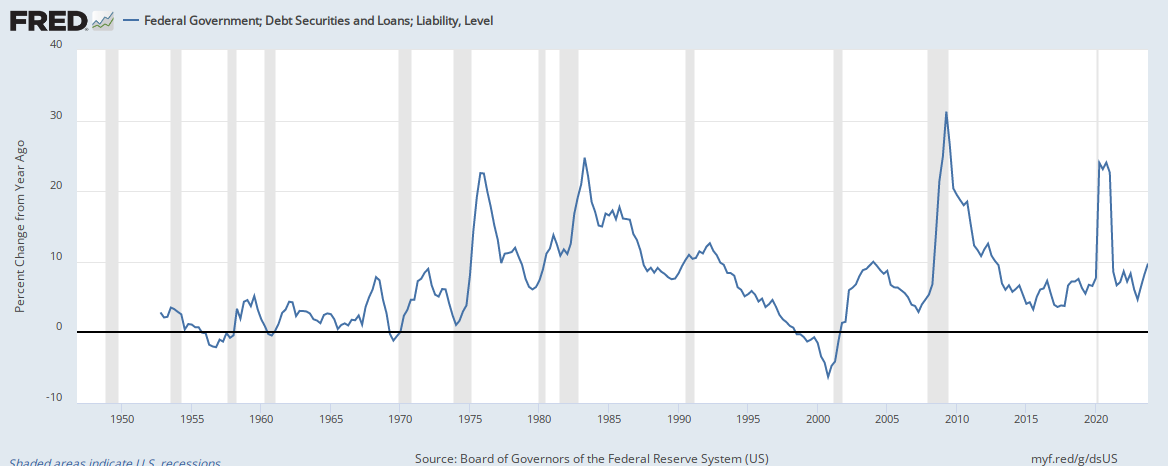

U.S. recessions tend to come on the heels of deficit growth reductions:

Federal deficit growth is necessary for economic growth.

All of us — the states, counties, villages, businesses, you, and me — we all live on the edge of insolvency. Only the Monetarily Sovereign federal government can save us.

Remember this the next time a politician or blogger tells you the federal government “can’t afford” something, and the deficit and debt are “unsustainable,” and the government should run a balanced budget.

At the behest of the rich, the politicians try to make you insolvent and turn your world into ice, so the rich can make you their desperate slave.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY