Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Back in 2012, we published, “The end of private banking: Why the federal government should own all banks.” The title says it all.

I was reminded of that article when I read this one:

The Secret Goldman Sachs Tapes

SEPT 26, 2014, By Michael Lewis(A) reporter, Jake Bernstein, has obtained 46 hours of tape recordings, made secretly by a Federal Reserve employee (Carmen Segarra), of conversations within the Fed, and between the Fed and Goldman Sachs.

First, a bit of background. After the 2008 financial crisis, the New York Fed commissioned a study of itself. This study, which the Fed also intended to keep to itself, set out to understand why the Fed hadn’t spotted the insane and destructive behavior inside the big banks, and stopped it before it got out of control.

(The results:) The Fed failed to regulate the banks because bank regulators were discouraged from (doing their jobs.

In early 2012, Carmen Segarra was assigned to regulate Goldman Sachs, and so was installed inside Goldman. (She found that) Fed employees would defer to the Goldman people; if one of the Goldman people said something revealing or even alarming, the other Fed employees in the meeting would either ignore or downplay it.

For instance, in one meeting a Goldman employee expressed the view that “once clients are wealthy enough certain consumer laws don’t apply to them.” After that meeting, Segarra turned to a fellow Fed regulator and said how surprised she was by that statement — to which the regulator replied, “You didn’t hear that.”

(Before you hear the tape recordings:)

1. You sort of knew that the regulators were more or less controlled by the banks. Now you know.

2. The only reason you know is that one woman, Carmen Segarra, has been brave enough to fight the system. She has paid a great price to inform us all of the obvious. She has lost her job, undermined her career, and will no doubt also endure a lifetime of lawsuits and slander.

So what are you going to do about it? At this moment the Fed is probably telling itself that, like the financial crisis, this, too, will blow over. It shouldn’t.

By now, you may be asking yourself why the Fed employees were so afraid to point out criminal wrongdoing by wealthy bankers, when that is exactly what they are paid to do.

Criminality often starts at the top — in this case, first with President Obama and then with U.S. Attorney General Eric Holder.

There are the two reasons why criminal banksters were not sent to jail, and not only still have their jobs, but received big bonuses. Here is the more benign of the two. We’ll call it the “Holder’s good intentions error”:

How Eric Holder Failed the Economy

In 2002 testing of Enron Corp. auditor Arthur Andersen LLP caused the company to fold, and thousands of innocent people lost their jobs.

Fearing a repeat of the Arthur Andersen debacle, prosecutors were careful to leave companies standing, even as they extracted tens of billions of dollars from banks for transgressions ranging from mortgage-related fraud to laundering money for drug cartels.

Under U.S. Attorney General Holder’s leadership, prosecutors lost sight of what mattered most: holding individuals, not companies, accountable for crimes. Of 21 separate actions against major financial companies from 2009 through May 2014, only eight were accompanied by charges against individuals, and none of them were high-level executives.

Failing to pursue individuals has sent executives the message that if they commit crimes, the worst that can happen is they’ll lose their jobs and shareholders will have to pay up.

Holder was so concerned about hurting innocent people, he didn’t go after the criminals.

Stupid? Yes. Criminal? Maybe. But give the man the benefit of the doubt, and call it “misguided.”

There is, however, a more sinister reason why no banker has gone to jail. Political contributions, aka “bribery.” For example:

Bank of America’s Political Contributions

Bank of America has spend $26.3 million on political contributions since 1989.

Despite tilting heavily toward Barack Obama in 2008, it reversed itself in 2012 on the heels of heightened regulatory scrutiny.

Translation: “We bought Obama but he didn’t stay as bought as he promised. He started to look at us, so we decided to buy the other guy. Too bad he didn’t get elected.”

And then there was:

The Goldman Sachs Group, Inc.

> Total contributions (2012-ongoing): $4,769,994

> Donations to Democratic Party: 29%; Donations to Republican Party: 71%

> Spending on lobbying (2012-ongoing): $1,380,000

Of course, these totals only represent corporate donations, not the millions in private donations from bank executives and other employees.

So the question is, how hard are you going to chase a criminal who gives millions to your political campaign?

And that amount of bribery is why the Obama administration has not prosecuted a single bankster. The money flow simply is too great.

Large, privately owned banks are a curse. Their size, their control over vast amounts of money, combined with their profit motive, makes them ungovernable and their criminality inevitable.

And that is why the federal government should own all banks, especially large banks..

Remove the profit motive and you remove the bribery.

Meanwhile, we wait with great anticipation, for the mainstream media (owned by the rich) to pick up on the Segarra tapes.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

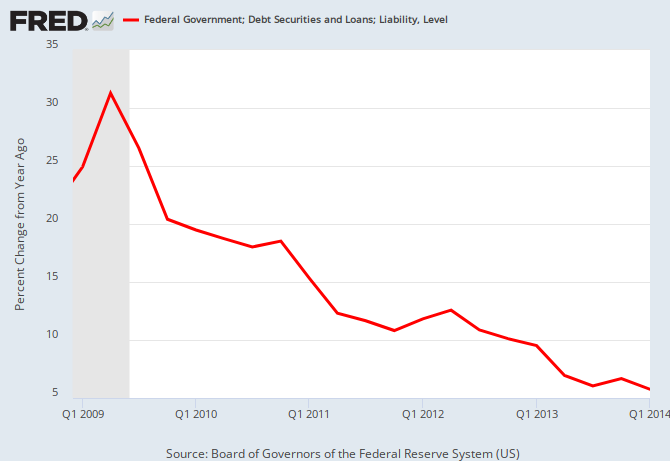

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY