Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

How stupid do they think we are? For those of us who are not super-rich, the (the politicians) must think we are very stupid, because they keep telling us the same Big Lie, and we keep falling for it.

Even if you learn nothing more about economics for the rest of your life, learn this seven word secret, and you will know more than 99% of Americans:

Federal taxes do not fund federal spending.

That’s right. Your city taxes fund your city’s spending. Your county taxes fund your county’s spending. Your state taxes fund your state’s spending, but:

Federal taxes do not fund federal spending.

Even were all federal tax collections to drop to $0, the federal government could continue paying all its bills, forever.

The federal government is unique in that it alone is Monetarily Sovereign. It is sovereign over the dollar. It originally created the dollar from thin air, and continues to create dollars from thin air.

Cities, counties, states, businesses, you and I all can run short of dollars. We are monetarily non-sovereign. The federal government never can run short of dollars, if it doesn’t want to.

In fact, it creates dollars, ad hoc, simply by paying its bills.

You now know more than 99% of Americans, and much more than the politicians want you to know.

Why do politicians want to keep this secret? They are bribed by the super-rich, via campaign contributions and promises of lucrative employment later.

And why don’t the super-rich want you to know this secret? Because so long as you believe federal taxes pay for federal spending, the rich can convince you there isn’t enough money to pay for your Social Security, Medicare, Medicaid and all other benefits the middle- and lower income groups receive.

The super-rich want to widen the Gap between them and you, so they can retain and increase their power over you.

Here is an example of the Big Lie by the bought-and-paid-for politicians.

Christie calls for raising ages for Social Security, Medicare

In major policy speech, Christie calls for ‘honest conversation’ on entitlements

Apr 14, 2015The New Jersey governor, in a speech at the New Hampshire Institute of Politics at Saint Anselm College, called for means testing Social Security, raising the retirement age for Social Security to 69 and gradually raising the eligibility age for Medicare to 67 by the year 2040.

Means testing and raising the retirement and eligibility ages reduce benefits to upper middle, middle and lower-income people, all of whom rely on these benefits.

As for the rich: They don’t care. These benefits mean nothing to them. While, for instance, Social Security benefits might account for 25% of a middle-income person’s livelihood, such benefits may not even account for 1% of a super rich person’s income.

Thus, every single one of Chris Christie’s proposals widens the Gap between the rich and the rest. But, he believes we’re not smart enough to understand this. He expects us to think federal financing is like personal financing, which is what makes us believe the Big Lie.

The Republican likely future presidential candidate said another key part of the sweeping proposal would change the Medicaid system to “per capita” allotments to each state.

Overall, he said, the plan would save the federal government $1 trillion over 10 years.

Christie doesn’t explain two things:

1. The federal government neither needs nor uses “savings.” Being Monetarily Sovereign, it creates all the dollars it needs.

2. Federal deficit spending adds dollars to the economy, and federal surpluses subtract dollars from the economy. When the federal government spends less (i.e. “saves”), the economy receives less — and that leads to recessions. (See “The Recession Clock at the bottom of this page).

Christie said, “Our leaders in Washington are not telling people the truth,” he said. “Washington is still not dealing with the problem. Washington is afraid to have an honest conversation about Social Security, Medicare and Medicaid with the people of our country. I am not.”

Tom Rath, a veteran Concord Republican strategist who is uncommitted in the GOP primary, said that while other candidates have been making political announcements in recent days and weeks, Christie’s focus on a specific issue with a specific plan “stands out.”

The Concord Coalition is one of the many mouthpieces for the rich. They are paid by the rich to make the false claim that in some unknown way, the federal government can run short of the dollars it creates as needed. The purpose: To cut your Social Security, Medicare, Medicaid and other benefits.

“When it’s 71 percent of the federal budget, you’d better have some ideas and some answers about it and you can’t be timid about it,” he said. “If this stuff wasn’t true, why would I say it?”

Well, for one thing, you’ve been bribed to say it, Governor Christie, and it’s not like you don’t have a record of lying to the public.

“There’s no political upside to wading into Social Security and Medicare. But you have to do it because if you don’t you’re not going to have the money to spend on national defense. You’re not going to have the money to invest in research and development and you’re not going to have the money to bring tax relief to the American people.

The upside is, the more you lie, the more the rich will pay you. And note the bold-faced lie that the federal government can run short of dollars if it pays Social Security and Medicare benefits.

Christie, who is in a legal battle in his home state over his attempts to cut state funding to public worker pension and health benefits to help balance his state’s budget, touched on that controversy, too. He said his reforms in his home state will “reduce the burden on taxpayers by over $120 billion over 30 years.”

Right. His state, New Jersey, is monetarily non-sovereign. Like all states, it can and has, run short of dollars. Christie wants you to believe the Big Lie that state finances are like federal finances.

The speech on entitlement reform, however, was billed as the centerpiece of his visit.

“In the short term,” he said, the massive cost of entitlements “is growing the deficit and slowly but surely taking over all of government. In the long term, it will steal our children’s future and bankrupt our nation. “

No, what will steal our children’s future is the loss of Social Security, Medicare, Medicaid and other benefits from the federal government. Christie doesn’t want your children and grandchildren collecting benefits.

Christie proposed a “modest means test that only affects those with non-Social Security income of over $80,000 per year, and phases out Social Security payments entirely for those that have $200,000-a-year of other income.”

Translation: He wants to cut Social Security benefits to the people who will need it. The super-rich don’t care. They don’t need Social Security.

In addition to raising the retirement age to 69, he would raise eligibility for early retirement benefits to 64.

It’s bad enough that, uniquely among insurance policies, Social Security benefits are taxed. Now, he wants to raise the retirement age so as to punish even the lowest income groups.

Christie also proposed expanding existing premium means testing for Medicare to ensure, he said, that only those who cannot afford to pay for their own health benefits will receive it.

Christie noted that under current Medicare means testing, there is a sliding scale of costs paid by seniors for part B and part D, from 25 percent for those with incomes above $85,000 to 80 percent for those with incomes of more than $214,000.

He would change the scale to have seniors at the $85,000 level pay 40 percent of premium costs and those with incomes of at least $196,000 pay 90 percent.

Cut, cut, cut. Make life harder for the middle and the aged, so the Gap can be widened.

He also called for raising the eligibility age for Medicare “at a manageable pace” of one month per year, so that by 2040, it would be 67 years old, and by 2064, it would be 69 years old.

This is the “make the middle-class work until they drop” philosophy of the super-rich. Make people poorer and so desperate they will beg the rich for any low-paying job. This is the way the rich re-install slavery in America.

But he would also eliminate the payroll tax for seniors who stay in the workforce over the age of 62.

Each state would receive a “set amount of funds per individual enrollee.”

Translation: He would like to transfer some of the Social Security costs from the federal government — which being Monetarily Sovereign, can afford anything — to the states which are broke.

Christie also addressed the Social Security disability trust fund, which, he said, will run out of money next year without action by congress.

Since the “trust fund” is an accounting fiction, all Congress needs to do is vote to support Social Security disability in perpetuity.

“I believe we should use this moment to reform the system and incentivize getting back to work,” he said.

Ah, there is the cruel myth,“The poor don’t like to work. They are lazy. We need to punish them if they don’t work into old age.”

He said the reforms will allow the federal government to invest in other areas, including defense.

Again, the Big Lie that the federal government is like you and me, and can run short of dollars. It can’t.

Christie’s plan was sharply criticized by the National Committee to Preserve Social Security and Medicare, a leading advocacy group for the programs, as another in a “long line of conservative politicians” who want to dismantle the programs.

“The Governor’s plan to means-test Social Security, cutting off some Americans and transitioning the program from an earned benefit to welfare has long been the goal of those who oppose social insurance programs,” the group said in a statement. “It seems the governor acknowledges that his flagging presidential campaign needed a jolt because today’s speech was far more about burnishing Governor Christie’s conservative credentials than offering new proposals that could help America’s workers and retirees.”

Conservatives despise the poor and middle-income groups as being lazy “takers.” What conservatives seldom realize: By punishing the poor and middle, eventually their own children and grandchildren and the nation as a whole, will be punished.

Christie said he will soon unveil a plan to replace the Affordable Care Act, which, he said, “does not and cannot work for America.”

“Does not work and cannot work,” except for the additional millions who now have medical insurance.

The right wing has established its lower- and middle-hating credentials. (Remember Bush’s attempt to privatize Social Security?) But lest you believe the right-wing is alone in telling the Big Lie, here is a note recently received from Democrat Sen. Dick Durbin.

The Social Security system is currently generating a surplus in tax revenues and interest income, and is expected to maintain this surplus through 2020.

However, Social Security’s costs will continue to grow in the coming years as millions of baby boomers enter retirement. Expenditures eventually will exceed revenues and interest income.

The long-term funding shortfall is attributed primarily to demographic factors, such as increasing life expectancy, as well as program design features, like annual COLAs and a wage-indexed benefit formula.

While reforms are necessary to ensure the survivial of Social Security, we must pursue sensible changes instead of a risky overhaul of the program.

There is no “long-term funding shortfall.” The federal government cannot have a “shortfall” of dollars.

In summary:

1. The federal government does not use tax dollars to pay for its spending. Even if federal taxes were $0, the government could continue spending, forever. (Tax collections are a relic of gold-standard days, when the government’s dollar-creation was limited.)

2. The super-rich pay the politicians to lie about the need to cut benefits. The purpose is to widen the Gap between the rich and the rest.

Now that you know then facts, contact your Senator and Representative and ask him/her, “How stupid do you think I am?”

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

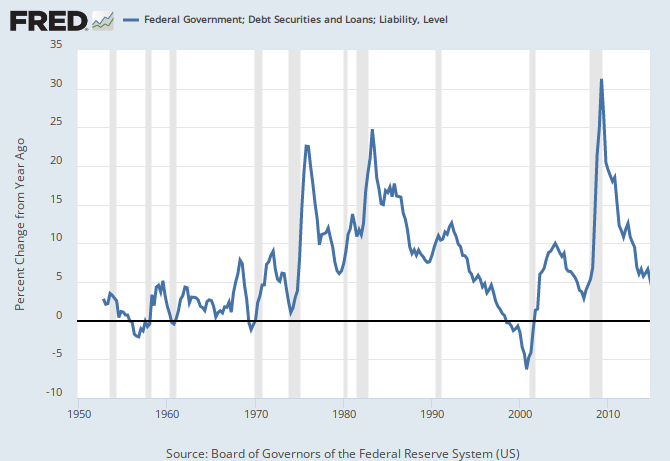

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY