Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

=========================================================================================================================================================================================================================

Would it be too much to speculate that 99% of the literate world is completely clueless about the differences between Monetary Sovereignty and monetary non-sovereignty? Or is 99% an underestimate?

Surely, only a small percentage of the people, even those living the nightmare of the euro, understand what has happened to them. All they seem to understand is they are poor when pre-euro, they were not poor.

And not only don’t they understand that they have surrendered the single most valuable asset they have — their Monetary Sovereignty — but they don’t know why this was done, and who engineered it.

(Hint: The rich, of course.) Virtually everything that happens in economics is engineered by the rich.

And now we look at our brethren in Kansas, a monetarily non-sovereign entity, just like Greece, Italy, France and the other euro nations.

What’s The Matter With Kansas And Its Tax Cuts? It Can’t Do Math

Forbes: Business, JUL 15, 2014 @ 1:31 PM

Howard Gleckman, CONTRIBUTORThe tax cuts in Kansas have been breathtaking. In 2012, at (Governor Sam) Brownback’s urging, the legislature cut individual tax rates by 25 percent and repealed the tax on sole proprietorships and other “pass-through” businesses.

In 2013, the legislature cut taxes again. It passed a measure to gradually lower rates even more over five years. By 2018, the top rate, which was 6.45 percent in 2012, will fall to 3.9 percent.

Kansas is a Republican state. Although the Democrats love the rich, they do save a bit of affection for the poor. The Republicans, by contrast, worship the rich, to the total exclusion of anyone having fewer than a hundred million in assets.

So when the Republicans cut taxes, they cut the taxes that mostly affect the rich: income taxes. And when they increase taxes, they increase the taxes that mostly affect the not-rich: sales taxes.

Brownback To Sign Historic Sales Tax Hike After Bruising Budget Battle

Kansas Gov. Sam Brownback’s signature personal income tax cuts emerged mostly intact from a grueling legislative fight to close a budget deficit that arose after revenue failed to match the conservative governor’s predictions of an economic boom.

Brownback and his GOP allies managed to avoid backtracking on past reductions on income tax rates.

Instead, they raised the state’s sales tax to one of the highest rates in the nation and smokers will be paying 50 cents more for each pack of cigarettes.

Get it? The rich-owned Republicans cut those pesky income taxes on the rich, and then replaced them with sales taxes that mostly impact the middle and low income people. It’s a direct transfer of dollars from poor to rich.

Two bills approved by Kansas legislators in the waning hours of their session will raise $384 million during the fiscal year beginning July 1, to avert a deficit prohibited by the state constitution.

The sales tax will rise to 6.5 percent from 6.15 percent and the cigarette tax will jump to $1.29.

Republicans who pushed the plan said its tax increases have to be seen in the context of the income tax cuts in 2012 and 2013, which the Legislature’s top tax analyst said could be worth $900 million annually.

Isn’t it beautiful?

The rich saved hundreds of millions of dollars a year, and the poor and middle classes will pay for it — and they have no idea what has been done to them.

So long as it’s positioned as anti-Obama and/or anti-liberal, that’s sufficient for them.

Ah, the bliss of ignorance.

We close this post with a sample of economic ignorance as expressed in the above-referenced Forbes article by Howard Glickman:

One cannot credibly argue that tax cuts increase revenue or even pay for themselves. They didn’t for Ronald Reagan. They don’t for Sam Brownback.

They won’t for the next politician who tries — whether he (or she) is in Washington, D.C. or in some state capital.

As has become the norm, Mr. Glickman and Forbes equate the Monetarily Sovereign federal government (which neither needs nor uses tax dollars) and the monetarily non-sovereign state governments (which both need and used tax dollars).

The rich-owned media help perpetuate that myth of equivalence, because it allows them to fool the public, and to transfer dollars from the 99.9% to the .1%, as requested by the .1%.

What do conservatives conserve? They conserve the riches of the rich.

Now that’s engineering.

Rodger Malcolm Mitchell

Monetary Sovereignty

==========================================================================================================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded free Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (the “.1%”) more, with higher, progressive tax rates on all their forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.-

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

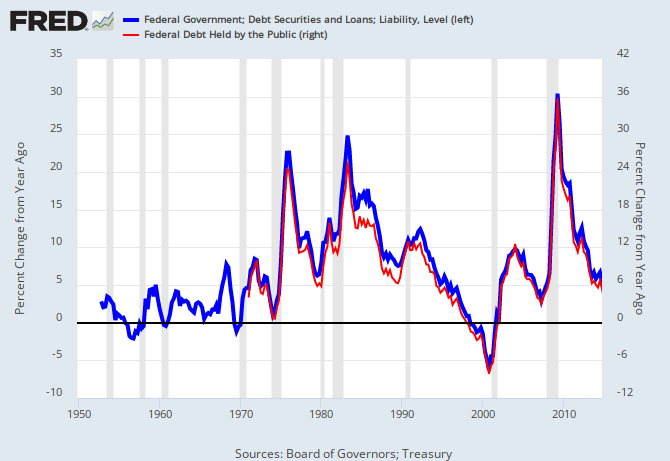

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY