Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Donald Trump, Ted Cruz and other Republicans want to build a gigantic wall — the world’s 2nd longest wall — between Mexico and the U.S.

No, wait. Donald doesn’t want to build the wall. He’s not an engineer or an architect, and being born rich, he probably has not lifted a brick in his life, nor does he intend to.

Hard work is not for the wealthy. Only poor “takers” work hard.

Donald, Ted et al, want the U.S. to force Mexico to build the wall.

No, wait. Donald, Ted et al don’t want Mexico to build the wall. That would require thousands of Mexicans to come onto American soil.

Donald, Ted et al want to force Mexico to pay many thousands of American workers to build the wall.

But, there is a small problem:

Changes in US immigration are creating a construction cost nightmare

With so much discussion today about the lack of construction labor, despite low levels of construction, and rising construction costs, I want to share some research from our Chief Demographer Chris Porter who projects household formations for us.

Chris notes that there has been a 67% decline in immigration from Mexico, and there are 570,000 fewer Mexico-born construction workers than in 2007.

Oh, darn it. Just when the right-wing has a nice bit of fake xenophobic outrage going, someone discovers that those evil Mexican rapists and murderers are not really swarming across our Rio Grande River.

Inconvenient.

We believe many of those 570,000 workers have likely returned to Mexico and will not return to the US construction industry because of:

–Significantly higher border patrol investments

–Acceleration in court-ordered deportations over the last 7 years

–Implementation of E-Verify technology by employers

—Arizona’s SB 1070 bill passing in 2010

–Economic opportunity in Mexico

What!? Does this mean that our hard-fought effort to exclude Mexican rapists and murderers, has left us short of carpenters, framers, masons, painters, electricians, plumbers and roofers?

SO WHO IS GOING TO BUILD OUR WALL?

And who is going to build our houses, offices, bridges, roads, dams and Donald’s 92 story skyscrapers, not to mention pick our vegetables, mow our lawns, watch our children, clean our homes and do all the other chores we don’t want to do ourselves?

Perhaps a help-wanted ad: “Desperately need thousands of workers to build the world’s 2nd longest wall. No browns, blacks, yellows, reds, Muslims and other non-Christians, non-citizens, legal citizens born here to non-citizens, non-English speakers, gays, union members or women need apply.”

Will Donald, Ted et al have to pick up bricks after all?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

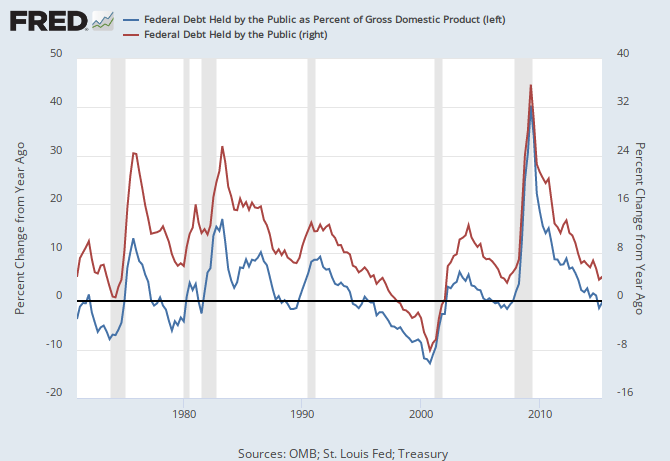

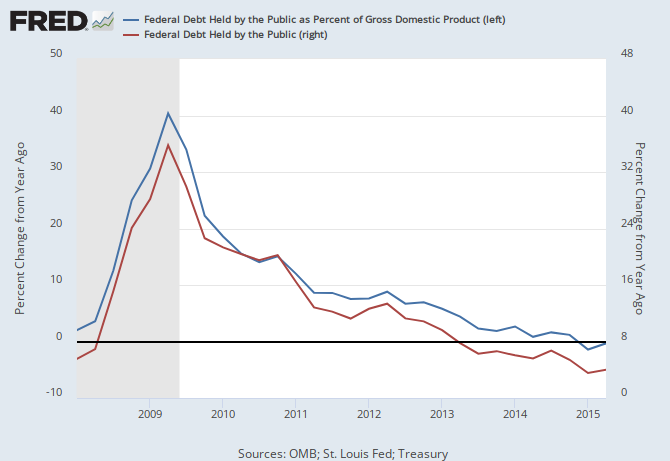

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY