Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Whenever the politicians boast about how bipartisan they are, hold on to your wallets and guard your children.

Here is the latest scam, direct from Scam Central:

REPS. MCCRERY AND POMEROY LAUNCH SSDI SOLUTIONS INITIATIVE

By: Committee for a Responsible Federal Budget (CRFB)Former Congressmen Jim McCrery (R-LA) and Earl Pomeroy (D-ND) today launched the McCrery-Pomeroy SSDI Solutions Initiative, a bipartisan effort to identify potential improvements to the Social Security Disability Insurance (SSDI) program.

There’s a Republican; there’s a Democrat; it’s a bipartisan effort; the purpose is to identify “improvements.”

What could possibly be wrong with that?

The goal of the SSDI Solutions Initiative will be to solicit practical, implementable, and thoughtful ideas to improve the SSDI program through a “call for papers,” a peer-review process, and an academic-style conference.

“Practical,” “implementable,” “thoughtful,” “improve,” “call for papers,” “peer-review,” “academic-style conference”: Most impressive, especially when you already know the answer: Pretend the government is running short of money, so take dollars from poor Peter to pay poor Paul, while adding nothing to the system.

Just a guess: Not one of those practical, implementable, thoughtful peer-reviewed papers will include any mention of Monetary Sovereignty.

As we’ve explained before, the SSDI trust fund is projected to run out of funds in just two years – after which current law calls for a 20 percent across-the-board benefit cut.

This could be avoided by borrowing or reallocating funds from the old-age system, but doing so would further strain the OASI trust fund, which also faces projected insolvency in the early 2030s.

In reality, the SSDI trust fund is an accounting fiction, which can run out of funds only if Congress wants it to.

For a Monetarily Sovereign nation, borrowing and reallocating funds is not necessary.

Our federal government (unlike state and local governments) easily can add funds to the mythical “trust fund,” at the touch of a computer key.

The CRFB’s raison d’etre is to pretend federal finances are like state and local government finances, so they can convince you there simply is not enough money for you and for the rich — so give it to the rich, who are needier than you.

More importantly, the SSDI Solutions Initiative argues, it represents a missed chance to begin making improvements to various aspects of the SSDI program.

In CRFB-speak, “improvements” means taking from the poor and middle, and giving to the rich.

They explain:

Instead of viewing the avoidance of trust fund exhaustion as a political liability, we believe policymakers should regard it as a policy opportunity.

If provided with thoughtful and practical ideas to improve the SSDI program, policymakers could not only avoid insolvency but begin to reform the SSDI program for the better.

This means identifying proposals well in advance of the deadline, rather than waiting for Congress to cobble together a last-minute, poorly conceived solution.

Translation: –“Trust fund exhaustion” means “phony accounting tricks.”

–“Policy opportunity” means “opportunity to widen the Gap between the rich and the rest.”

–“Avoid insolvency” means “more phony accounting tricks.”

–“Reform” (See “policy opportunity” above)

–“Identifying proposals” means “feeding you the same old BS you’ve been buying all these years.

–“Solution” (See “reform.”)

The SSDI Solutions Initiative will be lead by Pomeroy and McCrery, who will select proposals and synthesize their findings with assistance from an Advisory Council of experts, advocates, and practitioners from across the ideological spectrum.

Translation: –The “Advisory Council” will consist of people who either are ignorant of the differences between Monetary Sovereignty and monetary non-sovereignty, or are being paid by the rich to be ignorant — or both.

–“Across the ideological spectrum” means “people who think just like us.”

They both chaired the Social Security subcommittee of Ways & Means when in Congress.

That explains why these programs are “insolvent.”

In a press release, McCrery explained the goals of the initiative:

“The SSDI trust fund is going to run out of money in only two years, and policymakers have done little to prepare…”

Translation: “Amazingly, the federal government is about to run short of its own sovereign currency, the currency it invented and created from thin air more than 200 years ago, and still creates from thin air every day.

“So, don’t expect the government to create the dollars needed to support disabled people. We would rather create dollars for billionaire tax breaks and bank rescues.”

And then we hear from the always-reliable, right-wing Heritage Foundation:

Workers are healthier today, people are living longer, and jobs are less physically demanding.

So why has the percentage of the working-age population (ages 16 to 64) who receive SSDI benefits more than doubled from 2.3 percent in 1990 to 5.1 percent in 2014?

A good portion of the growth has to do with demographic factors, such as the aging of the baby boomers, women’s increased labor force participation (and SSDI eligibility), and the increase in Social Security’s standard retirement age.

Translation: Congress and the President, at the bidding of the rich, have punished the poor and middle-classes so ruthlessly, that two earners are needed to support their families.

That partly explains women’s increased labor force participation.

But the real coup was to raise the standard retirement age for Social Security, which has helped cause the need for more SSDI benefits — which the rich now decry.

Clever, huh?

And even though we acknowledge that the number of disabled people and elderly people needing help has risen, we politicians will not add dollars to the Social Security System.

Instead, we will shuffle dollars around, with pretend borrowing and fake trust funds, and then in a couple of years come back to you with more needs to cut your benefits.

Simply pumping more money into a broken system is the wrong approach.

Translation: Giving money to people who need it is the wrong approach. It would narrow the Gap between the rich and the rest, and the rich won’t like it.

Allowing the SSDI program to continue unchecked not only harms taxpayers who finance the program, it is also a disservice to truly disabled individuals who are often stigmatized as a result of fraud and abuse in SSDI that goes largely uncheced.

Translation: Yes, we know that federal taxpayers do not pay for federal spending, but you have been buying the Big Lie for all these years, so we continue telling it.

And to remove the stigma from receiving disability benefits, we’ll cut your benefits. Understand? Cutting benefits is the best way to reduce fraud. (Don’t ask “Why”? Just trust us.)

So here are our recommendations:

*Providing incentives and support to help disabled individuals return to work; (Force the disabled to work difficult and unpleasant jobs.)

*Establishing needs-based disability periods; (Cut benefits and change the definitions of “disabled,” to reduce the number of people who qualify.)

*Offering optional private disability insurance as part of the public program; (“Optional” means: You pay or you get nothing)

*Modernizing the disability definitions and qualifications; (Fewer people qualify)

*Implementing more effective and regular continuing disability reviews; (Kick ’em off the rolls)

*Applying a flat benefit structure; (You receive less)

*Improving the efficiency and integrity of the adjudication process. (Get more right-wing judges who will cut your benefits)

Bottom line: The non-existent “insolvency problem” will be solved by transferring dollars from one benefits program to another, always being careful not to touch any benefits to the rich.

We politicians might raise your taxes. We might delay your benefits, like we do almost every year, with Social Security. Or we might re-define “disability.” (We already have increased the definition of “old age.”)

Whatever we do, don’t expect to receive any additional dollars from OUR government. As we’ve told you for many years, we can’t afford it.

But you can. And you will.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

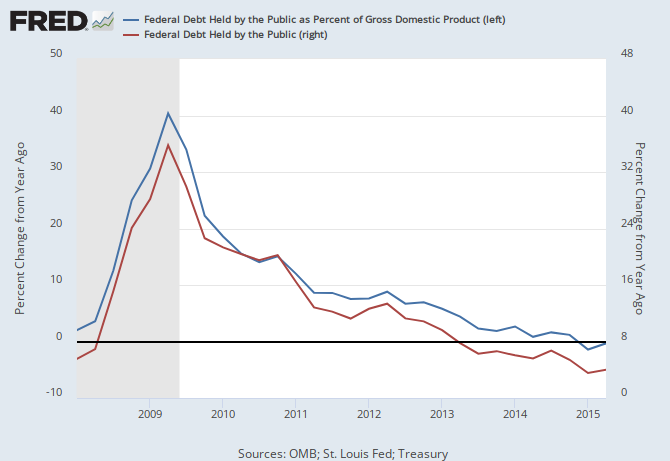

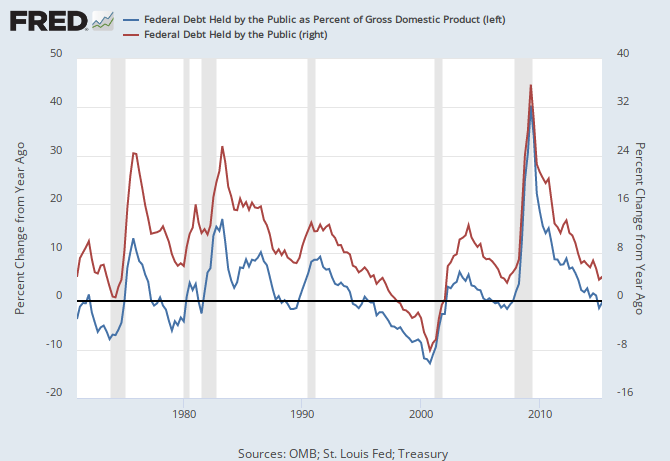

THE RECESSION CLOCK

Vertical gray bars mark recessions. Recessions come after the blue line drops below zero and when deficit growth declines.

As the federal deficit growth lines drop, we approach recessions, each of which has been cured only when the growth lines rose.

Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY