Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Politicians of a certain political stripe tend to brand any federal spending as “socialism” and “redistribution.”

Social Security, Medicare, Medicaid and Food stamps all are “Socialism and redistribution.” Any other aid to the poor and middle classes is Socialism and redistribution.

Those two words, “socialism” and “redistribution” have become the epithets du jour.

As to socialism, there are many kinds, but those who use the word seldom know any of them. For all kinds of socialism, the word does not simply mean government spending.

If it did, every government in history could be called “socialist,” since all spend money.

Rather “socialism” means government ownership and management of production. So the next time someone tells you a certain government project is socialism, ask him for the definition of “socialism,” then watch him stumble.

So called “socialized medicine” is not socialized medicine. Truly “socialized” medicine would be a system in which the government owned all the hospitals and employed all the doctors, nurses and other health-care providers.

I doubt many in America advocate socialized medicine.

The term ignorantly is used to describe “single payer” programs. Medicare is an example. Medicare is not socialized medicine any more than the Supreme Court is “socialized” law, though the government pays the justice’s salaries. Nor is Congress “socialized” legislation. Nor have we had a “socialized” military, or a “socialized” White House.

Government spending is not socialism. (It also is not communism, fascism or any other “ism.” It simply is spending.)

Now, having stepped on the obtuseness of the “socialism” epithet, let’s examine “redistribution”.

Every time you, your city, county or state spends a dollar, there is some measure of “redistribution.” You had a dollar; you spend it; now the store has your dollar. That dollar has been redistributed.

State, county and local taxes are redistributed via state, county and local spending.

Ironically, when the federal government spends a dollar, no redistribution occurs. The federal government creates new dollars by spending. So although federal spending causes “distribution,” it is not an example of RE-distribution.

(Some may object that federal taxing AND spending together comprise redistribution, but that would not strictly be correct. There is no relationship between federal taxing and federal spending. Federal taxing destroys dollars; federal spending creates new dollars. Different dollars.)

Semantic arguments aside, the right-wing objects to any program from which the gap between the rich and the rest is narrowed. They sneer at narrowing of the gap as “redistribution.”

To prevent the poor and middle class from coming closer to the rich, right-wingers define redistribution as a process whereby indolent slobs, who rather than becoming educated or working for a living, prefer to commit crimes in a drug-induced stupor, while collecting easy money from the government.

Never mind that the vast majority of Americans are poor or middle class, and by portraying these folks in negative terms, the right wing essentially portrays America in those same terms.

Such is right-wing patriotism.

New York Times

WHITE HOUSE MEMO

Don’t Dare Call the Health Law ‘Redistribution’

By John Harwood

Published: November 23, 2013Rebecca M. Blank was a top candidate in 2011 to lead President Obama’s Council of Economic Advisers, but then the White House turned up something politically dangerous.

“A commitment to economic justice necessarily implies a commitment to the redistribution of economic resources, so that the poor and the dispossessed are more fully included in the economic system,” Ms. Blank, a noted poverty researcher, wrote in 1992. With advisers wary of airing those views in a nomination fight, Mr. Obama passed over Ms. Blank.

“Redistribution is a loaded word that conjures up all sorts of unfairness in people’s minds,” said William M. Daley, who was Mr. Obama’s chief of staff at the time. Republicans wield it “as a hammer” against Democrats, he said, adding, “It’s a word that, in the political world, you just don’t use.”

Despite the fact that, compared with the rich, the average poor and middle class labor harder and longer, and lead more difficult, less healthy lives, and have less bright futures, this is not thought to be “unfair.”

To the right wing, “unfairness” means closing that income/wealth gap. Even the poor and middle class have been brainwashed to believe such nonsense.

These days the word (“redistribution”) has been hidden away to make the Affordable Care Act more palatable to the public and less a target for Republicans, who have long accused Democrats of seeking “socialized medicine.”

The right wing, by controlling the media, the politicians and the mainstream economists, has been so effective in using “redistribution” as a pejorative, one cannot even utter the word without adverse consequences.

But the redistribution of wealth has always been a central feature of the law and lies at the heart of the insurance market disruptions driving political attacks this fall.

“Americans want a fair and fixed insurance market,” said Jonathan Gruber, a health economist at the Massachusetts Institute of Technology who advised Mr. Obama’s team as it designed the law. “You cannot have that without some redistribution away from a small number of people.”

And therein lies the problem, for even Mr. Gruber buys into the Big Lie, the belief that taxes pay for federal spending, which if true, would mean that the rich are paying for the poor. But in a Monetarily Sovereign government, taxes do not pay for spending.

Mr. Obama’s advisers set out to pass the law in 2009 fully aware that fears among middle-class voters sank President Bill Clinton’s health initiative 16 years earlier. So they designed the legislation to minimize the number of people likely to be hurt.

That was a perfect example of the brainwashing. To “minimize the number of people likely to be hurt,” the federal government should institute a fully paid, comprehensive Medicare for every man, woman and child in America.

Instead of a sweeping change to a government-run “single-payer” system favored by Democratic liberals, members of the administration sought to preserve the existing system of employer-provided health insurance while covering the uninsured through the expansion of Medicaid and changes to the individual insurance market.

Sadly, there seem to be no “Democratic liberals.” Obama is a right winger, who may seem liberal only by comparison with the extreme right wingers of the Republican party.

When Mr. Obama ran for president in 2008, Republicans tried to wound him by accusing him of waging “class warfare” to achieve wealth redistribution. That fall, the Republican presidential nominee, Senator John McCain, derided Mr. Obama as the “redistributor in chief.”

“Class warfare” and “redistributor in chief” meant Obama wished to reduce the GINI ratio, which unfortunately, he seems not to.

Mr. Obama survived that episode and other instances when Republicans deployed old recordings of him using the word “redistribution” as evidence that he was a closet socialist.

Again, misuse and stigmatizing of the word “socialist.”

The president promised stability: “If you like your current insurance, you will keep your current insurance.”

Hiding in plain sight behind that pledge — visible to health policy experts but not the general public — was the redistribution required to extend health coverage to those who had been either locked out or priced out of the market.”

Again, fundamental misunderstanding on two levels:

1. Since taxes do not pay for federal spending, there should be no redistribution in the ACA.

2. Redistribution, if it occurred, would narrow the GINI ratio, and therefore benefit America.

The law, for example, banned rate discrimination against women, which insurance companies called “gender rating” to account for their higher health costs. But that raised the relative burden borne by men. The law also limited how much more insurers can charge older Americans, who use more health care over all. But that raised the relative burden on younger people.

And the law required insurers to offer coverage to Americans with pre-existing conditions, which eased costs for less healthy people but raised prices for others who had been charged lower rates because of their good health.

The “redistribution” is not between rich and poor, but rather among select demographic groups — which would be unnecessary in a “Medicare for All” program. The government simply would pay for health care, regardless of age of prior condition.

Ironically, that private insurance redistribution is made necessary by the right-wing’s focus on the reduction of deficit spending, making fully funded Medicare for All impossible.

David Axelrod, the president’s longtime strategist said, “we’ve created a sense that everyone can expect to win — nobody has to sacrifice.”

Which would be true in a federally funded, “Medicare for All” scenario.

Mr. Axelrod argued that widening income inequality has, to some Americans at least, changed the meaning of redistribution. “The whole redistribution argument has shifted in the country because there’s a sense that a lot of redistribution has been to the top and not the bottom.”

Bingo! That is exactly what has happened. The rich, who argue most against redistribution, have been, in fact the beneficiaries of tax laws and a bribed Congress and President, who have legislated the huge increase in income/wealth redistribution to the top.

“Understand this is not a redistribution argument,” the president told his audience [18 months ago]. “This is not about taking from rich people to give to poor people. This is about us together making investments in our country so everybody’s got a fair shot.”

Rather than “redistribution,” our Monetarily Sovereign government can make it “fair distribution,” where nothing is taken from the rich, but more is given to the middle and the poor.

Closing the gap is the course of action, fairest and most beneficial to America — but that would be mis-termed, “socialism” and “redistribution.”

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

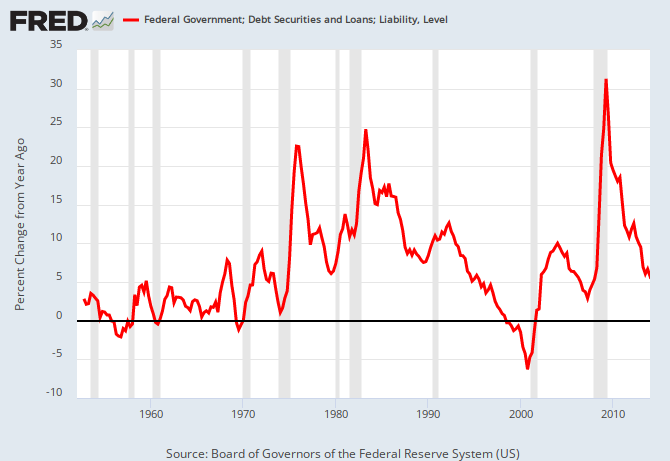

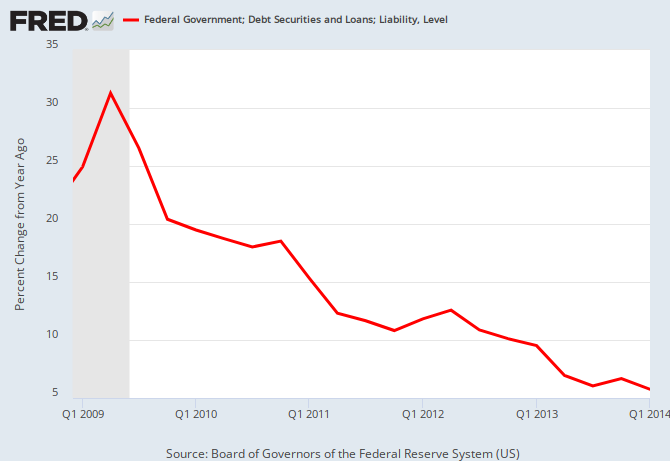

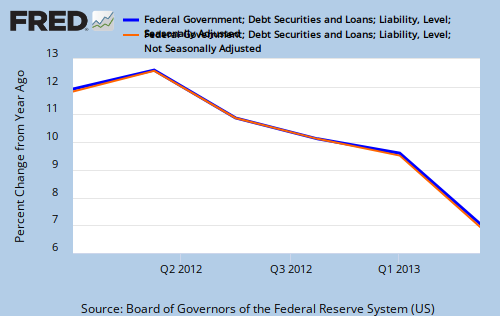

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY