Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

THE BIG LIE

In U.S. economics, the BIG LIE is exemplified by several widely believed, though utterly false, statements:

1. “We Americans are the federal government. Government deficits are our deficits; government debts are our debts. Our children will pay for government debt.“

ECONOMIC SCENE

Cutbacks and the Fate of the Young

By Eduardo Porter, Published: October 9, 2012During the presidential debate last week, Mitt Romney reminded us that it is our children, and grandchildren, who will end up paying for our budget deficits. His comment about the immorality of passing on such a large bill is a welcome reminder that our generation bears responsibility for the well-being of the next.

That is an example of the BIG LIE.

Federal debt is nothing more than the total of deposits in T-security accounts at the federal reserve bank. If you own a T-security, you have a deposit in the Federal Reserve Bank. you very well may pass that bank deposit on to your children, as an interest paying asset.

To “pay off the debt,” i.e. to cash in your deposit, the federal government merely will transfer dollars from your T-security account at the Federal Reserve Bank to your local bank checking account.

Neither you, nor your children nor the government are burdened by this asset transfer between two of your bank accounts.

2. “Like us, the federal government must live within its means.”

(Barack Obama, Feb 12, 2011: “So, after a decade of rising deficits, this budget asks Washington to live within its means, while at the same time investing in our future. It cuts what we can’t afford to pay for what we cannot do without. That’s what families do in hard times. And that’s what our country has to do too.)

That is an example of the BIG LIE.

Families are monetarily non-sovereign. They do not have a sovereign currency. The same can be said of states, counties, cities, businesses and euro nations. None has a sovereign currency.

However, the U.S. is Monetarily Sovereign. It created the dollar, its sovereign currency, by creating laws.

Being sovereign over its currency, the U.S. government has the unlimited ability to create dollars. Unlike a family, which can run short of dollars, the U.S. never can run short of dollars. It has no “means” to live within.

3. “The federal debt is a burden on the federal government, a burden on us, and will be a burden on our future generations.“

Rep. Tom Cotton, R., Arkansas, Feb 22, 2014: “President Obama’s policies spend too much money – they’ve irresponsibly added trillions of dollars to our national debt. The debt slows economic growth today and it places an immoral burden on our kids and grandkids.”

That is an example of the BIG LIE.

The federal debt, being deposits in the Federal Reserve Bank, is not a burden on the U.S. economy. It is not a burden on our future generations, who will not have to pay it.

Bank deposits do not burden anyone.

Future generations won’t be involved in any way, with liquidating deposits in the Federal Reserve Bank or any other bank. Only banks “pay off” deposits — by transferring dollars from savings deposit accounts to checking deposit accounts.

4.“ We taxpayers pay for federal spending, just as we pay for state and local spending.“

In fiscal year 2012, the federal government spent $3.5 trillion, amounting to 23 percent of the nation’s Gross Domestic Product (GDP). Of that $3.5 trillion, nearly $2.5 trillion was financed by federal revenues.

The remaining amount (about $1.1 trillion) was financed by borrowing; this deficit will ultimately be paid for by future taxpayers. http://www.cbpp.org/cms/index.cfm?fa=view&id=1258 Center on Budget and Policy Priorities

That is an example of the BIG LIE.

Neither borrowing nor taxing finances a Monetarily Sovereign government. It has the unlimited ability to create its own sovereign currency.

All dollars going to the federal government disappear from the money supply and thus, are destroyed upon receipt.

The U.S. government itself has no dollars. It pays its bills by creating dollars ad hoc, but it does not retain those dollars. The entire money supply is in the private sector. The government has none.

Here is what one of the most dominant personalities of the 20th century wrote about the BIG LIE:

“In the big lie there is always a certain force of credibility; because the broad masses of a nation are always more easily corrupted in the deeper strata of their emotional nature . . .and thus in the primitive simplicity of their minds they more readily fall victims to the big lie than the small lie, since they themselves often tell small lies in little matters but would be ashamed to resort to large-scale falsehoods.

“It would never come into their heads to fabricate colossal untruths, and they would not believe that others could have the impudence to distort the truth so infamously.

“Even though the facts which prove this to be so may be brought clearly to their minds, they will still doubt and waver and will continue to think that there may be some other explanation.

For the grossly impudent lie always leaves traces behind it, even after it has been nailed down, a fact which is known to all expert liars in this world and to all who conspire together in the art of lying.”

Adolph Hitler, in ‘Mein Kampf’

And that is why the broad masses of Americans don’t just believe the BIG LIE, but argue strenuously, even angrily, against anyone who exposes them to facts.

They are the ones with “primitive simplicity” of mind, about whom Hitler wrote.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

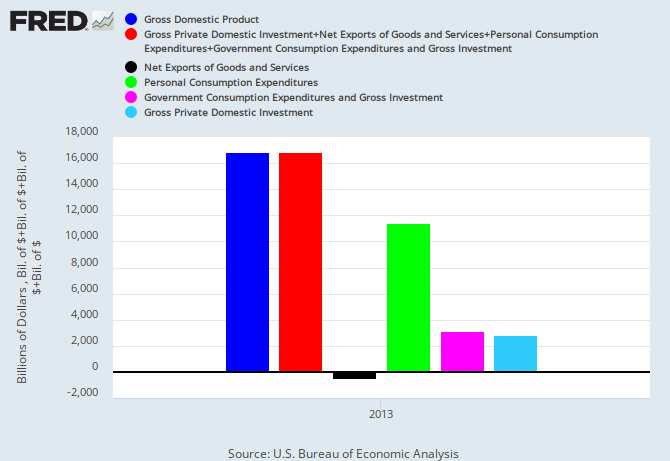

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise. Federal deficit growth is absolutely, positively necessary for economic growth. Period.

#MONETARY SOVEREIGNTY