We’ll introduce this short article with a few facts:

1. The U.S. federal government has infinitely more dollars than does Michael Bloomberg and the Bloomberg Philanthropies.

2. Unlike state/local taxes, which fund state/local spending, federal taxes do not fund federal spending.

The federal government creates new dollars, ad hoc, to fund all its spending.

3. When Bloomberg and/or his foundation give to any charity, this does not add as many growth dollars to the economy as federal spending.

(To the degree that charitable gifts reduce Bloomberg’s taxes, those dollars are not taken from the economy.)

4. America has a shortage of trained healthcare workers (See next:)

Staff Shortages Choking U.S. Health Care System, A growing shortage of health care workers is being called the nation’s top patient safety concern., By Steven Ross Johnson, July 28, 2022

The situation is quite serious and has been exacerbated by the COVID-19 pandemic.

Physician Shortage: The nation is facing a projected shortage of up to 124,000 physicians by 2033.

Nursing Shortage: There is an urgent need to hire at least 200,000 nurses each year to meet rising demands and replace retiring nurses. Among support personnel, a shortage of home health aides is most acute.

Overall Health Workforce: The health care industry employed 16.3 million people in 2022, making it the largest employment sector in the U.S.

Despite this, there is still a shortage, with a projected need for 1.1 million new registered nurses across the U.S. to address retirements and the growing demand.

Impact of COVID-19: An estimated 1.5 million health care jobs were lost in the first two months of the pandemic. Although many of those jobs have since returned, health care employment remains below pre-pandemic levels.

Patient Safety Concerns: Staffing shortages are now the nation’s top patient safety concern, leading to longer wait times and even patients being turned away in life-threatening emergencies.

This shortage is affecting various levels of healthcare provision, from hospitals to private practices, and is a major concern for the future of healthcare services in the country.

So, the title question is, Why Doesn’t the Federal Government Do This? (I’ll tell you the answer.)

Most Johns Hopkins Medical Students to Receive Free Tuition After $1 Billion Gift Story by Alyssa Lukpat

A majority of medical students at Johns Hopkins University are set to receive free tuition after the school received a $1 billion gift from Bloomberg Philanthropies, making Hopkins the latest medical school to go tuition free because of a large donation.

Hopkins said Monday that students from families earning under $300,000 would receive free tuition starting in the fall.

And, of course, free tuition isn’t enough for many families, so:

Students whose families earn as much as $175,000 will have their living expenses covered.

The school estimates nearly two-thirds of its students would qualify for either of the benefits.

A growing number of philanthropists and medical schools are pushing to make education free for aspiring doctors and reduce the financial barriers that can deter them.

Another financial barrier often is overlooked. Many families rely on their young people to quit school and get jobs to help support the family.

The federal government should pay students a salary so parents would not be tempted to dissuade students from attending college.

Buoyed by donations, the Albert Einstein College of Medicine and the medical schools at New York University and Columbia University have given their students free tuition or scholarships if they have financial need.

Also, Kaiser Permanente Bernard J. Tyson School of Medicine Waived all tuition and fees for students entering between the fall of 2020 and 2025.

Cleveland Clinic Lerner College of Medicine at Case Western University offers full scholarships to all admitted students, to name a couple more.

The schools mentioned are all well-known and prestigious institutions within the United States. They have national and often international reputations for excellence in medical education and research.

Donors to such institutions tend to receive significant recognition for their contributions. America needs much more help than wealthy donors seeking applause can provide.

The cost of medical school has kept aspiring doctors out of the field, where they can graduate with hundreds of thousands of dollars in debt.

The student loan program is one of the most shortsighted, economically ignorant inventions the federal government ever has created.

It forces monetarily non-sovereign (meaning, limited dollars) students, to pay dollars to the Monetarily Sovereign (having unlimited dollars) federal government.

It’s a perfect plan if you want to discourage young people from attending college.

By offering financial freedom to more students, schools can give medical students the flexibility to choose jobs in important but lower-paying fields like internal medical and pediatrics.

Billionaire Michael Bloomberg’s philanthropic organization said Monday that the U.S. has a shortage of medical professionals yet the cost of attending school for these jobs is often too high.

“By reducing the financial barriers to these essential fields, we can free more students to pursue careers they’re passionate about,” he said.

Bloomberg has used his philanthropic organization, Bloomberg Philanthropies, to donate billions to several causes including public health, the environment and improving city governments.

Hopkins said Bloomberg’s donation would also be used to expand financial aid for nursing and public-health graduate students, in addition to graduate students in other fields.

“This new scholarship formula will ensure the most talented aspiring doctors representing the broadest and deepest range of socioeconomic and geographic backgrounds have the opportunity to graduate debt-free,” Hopkins said.

No, it doesn’t assure that at all.

It assures the relative handful of aspiring doctors, who can afford not to have any income for the next few years, will be relieved of many college costs.

And as vital as healthcare is, what about all the other specialties that are short of practitioners?

Consider the serious shortage of engineers.

Every year, the US will need about 400,000 new engineers.

Yet the next-generation skill sets that those engineers will require are sorely lacking, presenting the alarming possibility that nearly one in three engineering roles will remain unfilled each year through at least 2030.

This persistent talent gap risks short-circuiting the progress of several essential industries.

It may also seriously inhibit various US government initiatives intended to boost the economy and US competitiveness, such as the 2022 Build Back Better Act (BBBA) and the 2022 Chips and Science Act.

We also are short of trained people in Information Technology (cybersecurity experts, data scientists, and software developers) and Teaching, particularly in STEM (Science, Technology, Engineering, Mathematics) subjects and special education.

Of course, this doesn’t include our shortages in trades not ordinarily associated with colleges but still requiring training: Electricians, plumbers, welders, HVAC technicians, truck drivers and logistics coordinators, agricultural workers, and skilled manufacturing workers who can operate complex machinery and robotics.

America relies on the private sector to pay for all this schooling and training.

Our state universities and colleges, for instance, are largely funded by the private sector, either through local and state taxes or private contributions and endowments.

All suffer from one common problem: Affordability.

1. Potential workers cannot afford to take the time and pay the costs involved in formalized training, whether in a college, university, or specialized school.

2. The private sector cannot afford to pay students and trainees for their time and costs involved in receiving training.

3. Schools and other training facilities cannot afford to provide their services without remuneration.

The federal government suffers no such limitations. It can:

1. Pay students salaries and personal expense allowances for attending schools and training facilities.

2. Remunerate students for their education and training costs

3. Remunerate educational and training facilities to provide their services without charge.

The private sector (which does not have unlimited funds) already does some of this—just not enough.

Sixty years ago, the company that employed me paid my tuition to Northwestern University for my MBA. They didn’t pay for my books, transportation, or time (night school), and I was locked into that company for the 3 years I attended, but it’s what a monetarily non-sovereign company chose to do.

The presumptive goal of government is to protect and improve people’s lives. Funding training and education is an important step in accomplishing that mission.

Why is funding left to the monetarily non-sovereign private sector?

Why are you forced to pay local taxes for grades K-12—taxes that, in most places, are insufficient to fund excellent schooling—when the Monetarily Sovereign federal government could easily fund higher teacher salaries and better facilities without charging you a penny in taxes?

Yes, it’s commendable that Mr. Bloomberg, in exchange for tax breaks and accolades, will provide a vanishingly tiny support for what the nation needs.

But why do we need to rely on the Bloombergs of the world when the money is there, waiting for the populace and our leaders to acknowledge its need and availability?

The tax breaks already demonstrate the government’s willingness and ability to fund about one-third of the support at Mr. Bloomberg’s whim.

There is no financial reason why the federal government cannot provide the entire nation with everything that Mr. Bloomberg provides to a select few.

What is the real reason it already is not happening? There are two reasons:

- The ignorance of the populace who have been brainwashed into believing that federal finances are like personal finances, and can’t afford to fund what America needs.

- The rich, who run America, do not want benefits that would narrow the income/wealth/power Gap between the rich and the rest.

Ignorance is the most expensive thing we can buy, yet each day, we pay mightily for another dollop of ignorance and allow the federal government to cry, “Poor.”

Rodger Malcolm Mitchell

Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

The U.S. federal government is

The U.S. federal government is The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

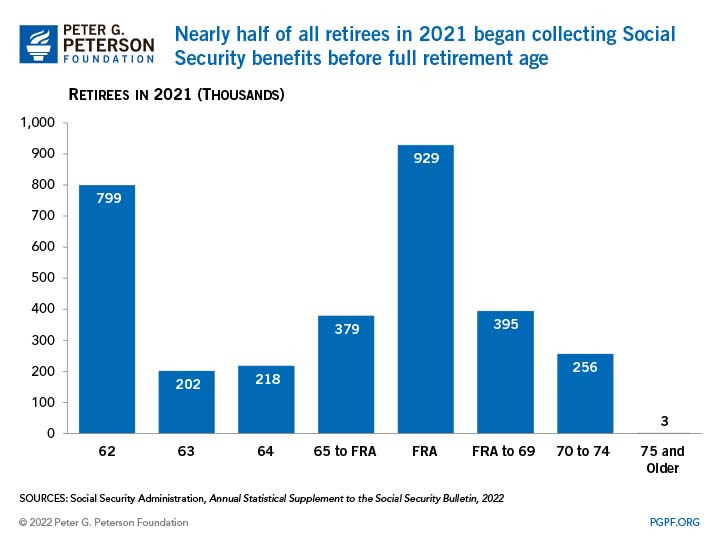

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.

The government also has the infinite power to change Social Security laws, as demonstrated by the 12 benefit changes shown in this chart.

More than half of all Social Security recipients take benefits before the official retirement age when benefits are reduced.

This demonstrates an early need for benefits by those in lower-income groups.