Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

If you are poor, or really, even middle-income, do not expect help or sympathy from the right-wing. Your lack of money, wealth and power is all your fault for being a lazy cheater.

So goes the right-wing mantra.

A Republican state lawmaker in Missouri is pushing for legislation that would severely limit what food stamp recipients can buy.

The bill being proposed would ban the purchase with food stamps of “cookies, chips, energy drinks, soft drinks, seafood or steak.

“The intention of the bill is to get the food stamp program back to its original intent, which is nutrition assistance,” said Rick Brattin, the representative who is sponsoring the proposed legislation. – Washington Post, April 3, 2015

Never mind the fundamental idiocy of a Congressman who believes one can determine what is bought with food stamps vs. what is bought with dollars — in the same store.

(“Here is a $10 bill plus $10 worth of food stamps. Now be sure to charge the steak to the dollars and charge the vegetables to the food stamps, and not the other way around.”)

Instead, let’s move on past idiocy to identifying these “Welfare Queens,” who, unlike us good honest folk, buy (gasp!) cookies, chips, soft drinks, seafood and steak.

As everyone knows, these foods are only for . . . well, just about everybody in America.

SNAP: Frequently Asked Questions

SNAP eligibility rules require that participants be at or below 130% of the Federal Poverty Level. Recent studies show that 49% of all SNAP participants are children (age 18 or younger), with almost two-thirds of SNAP children living in single-parent households.

In total, 76% of SNAP benefits go towards households with children, 16% go to households with disabled persons, and 9% go to households with senior citizens.

Yes, we must protect ourselves against those low income children, disabled persons and senior citizens, so they don’t sit back in the lap of luxury, eating cookies and steak.

In 2013, the average SNAP client received a monthly benefit of $133.07, and the average household received $274.98 monthly.

Wow, a whole $274.98 a month for a household? With those kind of big bucks coming in, no wonder these Welfare Queens are able to gorge themselves on seafood.

All SNAP retailers must sell at least seven varieties of food in each of four basic categories (meat, poultry, or fish; bread or cereal; vegetables or fruits; and dairy products) on a continuous basis.

Obviously, the meat, poultry or fish, etc., are not considered “nutrition assistance” by Rep. Brattin.

There are 15 Thrifty Food Plan market baskets, each formulated to fit the nutritional requirements of specific gender or age groups in the United States.

TFP market baskets include ratios of grains (including whole grains), vegetables, fruits, milk products, meat and beans, and other foods as determined by the Recommended Dietary Allowances and Dietary Guidelines for Americans issued by the USDA.

The baskets are arranged with the goal of obtaining minimal cost for sufficient nutrition.

Being poor, lazy cheaters, they must be told exactly what they are allowed to eat.

But sometimes the poor are not obedient. This disobedience is especially galling to us right-wingers who don’t like the federal government telling us what to do. Uh, wait . . . uh . . . oops.

SNAP has frequently been a target for accusations of fraud and abuse of the system. SNAP beneficiaries are accused of cheating the system by receiving greater benefits than would befit their income status or exchanging SNAP benefits for cash.

In reality, fraud within the SNAP system is extremely low. With the introduction of the EBT cards, most opportunities for fraud have been removed, and an electronic trail now exists to facilitate the tracing of abuses in the system.

According to a recent USDA analysis, SNAP reached a payment accuracy of 96.19% in 2012 (the highest that the program has ever seen). Trafficking rates—the number of benefits exchanged for cash—are at 1%.

Well, we don’t care about facts. We once heard of somebody who bought a steak with food stamps. So there!

Many Americans believe that the majority of SNAP benefits go towards people who could be working. In fact, more than half of SNAP recipients are children or the elderly.

At least forty percent of all SNAP beneficiaries live in a household with earnings. In fact, the majority of SNAP households do not receive cash welfare benefits (around 10% receive cash welfare), with increasing numbers of SNAP beneficiaries obtaining their primary source of income from employment.

AKA known as the “working poor,” people often are stuck with the most difficult, backbreaking, disgusting jobs our society has to offer.

Undocumented immigrants are not (and never have been) eligible for SNAP benefits.

Documented immigrants can only receive SNAP benefits if they have resided within the United States for at least five years (with some exceptions for refugees, children, and individuals receiving asylum).

So, in America, even if you are here legally, you won’t get nutritional help from our government for at least five years.

Right-wingers like Rick Brattin use class-warfare brainwashing to convince you that you are paying for a luxurious lifestyle, by ne’er-do-well, lazy cheaters, who use your money to live like kings.

So, of course you should learn to hate these people, which will justify denying them even the relative pittance they now receive.

Never mind that you and I do not pay for SNAP or any other federal benefit. Federal taxes do not fund federal spending.

And never mind that but for the grace of God, we could find ourselves impoverished and starving, however much we may want to deny it.

Beating on the poor is amusing to the Rick Brattins of the world. He can laugh as he watches the poor jump through hoops, and no matter what they do, it will not be enough to please him.

It’s especially entertaining that we can watch them suffer, and they can’t fight back.

Beating on the poor is exactly like that other, popular pastime we teach our children to enjoy: Hunting.

Rodger Malcolm Mitchell

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

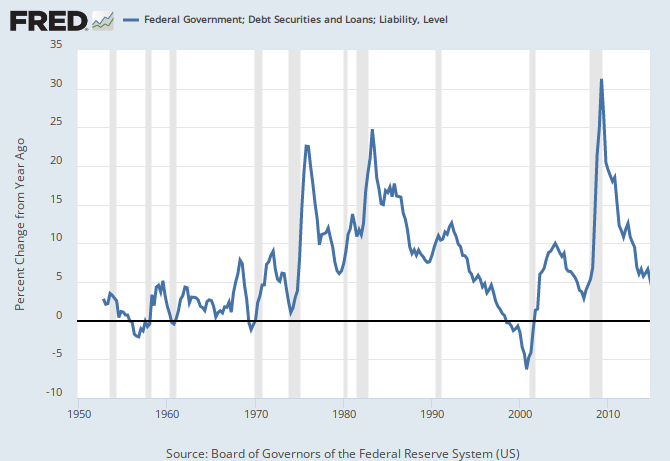

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY