Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

————————————————————————————————————————————————————————————————————————–

Visualize this: Someone asks you for a loan. He has several conditions:

1. You are not to know the amount of the loan. He simply will take it from your bank account as he wishes.

2. You are not to know the purpose, nor the terms, of the loan.

3. Neither you nor your lawyer can look at the loan agreement. It simply will be signed on your behalf.

4. Even if later you feel you have been cheated, you cannot complain to anyone, nor sue anyone, and if you do, you will be arrested.

5. Once the document is signed, anyone else can, by law, get from you similar loans with similar terms.

Not a very good deal for you?

Well, it very closely describes the Obama administration’s (aka Barack Obama’s personal) demand that Congress give him “fast track” authority over the proposed Trans-Pacific Partnership (TPP).

Here is an excellent summary as published by OpEd News

While the Obama administration has (as Senator Elizabeth Warren pointed out) given 500 or so corporate lobbyists inside access to TPP negotiations, it has left the public completely in the dark.

You see, corporate lobbyists are far more important than you are. Their corporations give big money bribes to Congress and the President, and promise lucrative employment after they leave office.

What do you do for the President and Congress (other than sometimes vote, if you feel like it)?

In fact, as Senator Warren went on to write, “It is currently illegal for the press, experts, advocates, or the general public to review the text of this agreement. And while … Members of Congress may ‘walk over … and read the text of the agreement’ — as we have done — [we] are prohibited by law from discussing the specifics of that text in public.”

Get that? Your Congresspeople are prohibited by law from telling you, their constituent, what is in TTP! What unmitigated (and unconstitutional) gall on the part of Obama and his sycophants.

We voters are not to know what is in a treaty — and not just a treaty, but the biggest trade treaty in U.S. history — our government will sign on our behalf.

If the Obama administration gets its way, Congress won’t even get a chance to really debate the TPP before it becomes the law of the land.

That’s because right now, with the full backing of the White House, the House and Senate are considering bills that would give President Obama “fast-track” powers in regards to the TPP and all other trade deals from now until the end of his time in office — and for the first four years of the next president.

How do you spell D-I-C-T-A-T-O-R-S-H-I-P ? From now on, every President would be able to sign any trade deal, without the public or even Congress having any say, whatsoever.

If Congress does give President Obama fast-track power, our elected representatives wouldn’t be allowed to make any amendments whatsoever to trade deals like the TPP.

Instead, the treaty would be sent right to the floor where it would only have to pass a simple up-or-down vote after debate limited to eight minutes per member.

Why is this needed? The administration falsely claims it’s necessary for the bargaining process. Total, 100% bullshit.

If it’s necessary for the bargaining process, then presumably it also is necessary for ALL federal treaties. The camel would have his nose in the tent for everything the President wants to do.

Everything in D.C. involves some sort of bargaining, so presumably everything could be kept secret from the public, and immune to Congressional debate, because “it’s necessary for the bargaining process.”

What little we know about it comes from leaks, and those leaks show that it’s basically a grab bag of all the terrible things Big Business has always wanted but is too scared to ask for in public.

The TPP would give big pharmaceutical companies virtual monopoly patent power, gut environmental and financial rules and, according to Wikileaks, let corporations sue countries in international courts over regulations that those corporations don’t like.

Under the Constitution, treaties have to be approved by two-thirds of the Senate to go into effect. But that wouldn’t need to happen if Congress gives President Obama fast-track powers.

You might as well tell your Senators and Representative: “Come on home, because you will have no purpose. The President simply will do what he wants — in secret — and maybe let you know when it’s done.”

Thank God for Elizabeth Warren:

Senator Warren wants Congress to reject fast track altogether and have a real debate about the TPP.

Call your elected representative today to tell them that you support the Constitution, and therefore oppose fast-track powers for the TPP.

Tell these boobs that is is a deal breaker — that if they vote to give the President the dictatorial powers of “fast track,” you will vote to give them a permanent vacation in the next election.

Or you can just lie back, do nothing, and enjoy the rape.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

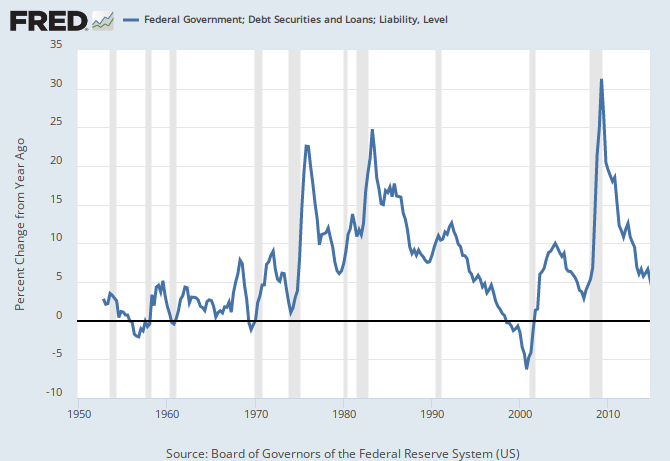

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY