Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

Let’s say you own bonds with a current market value of $10,000, and you agree to sell them to the federal government for $10,000.

The government instructs your bank to increase your checking account by $10,000, and you now no longer own those bonds.

Has your wealth been stimulated? Are you richer? Has the U.S. economy been stimulated?

Of course not.

Because the federal government purchased those bonds, they no longer are part of the economy. There is no economic measure that includes federal ownership of bonds. It’s as though they never existed.

Since privately-owned bonds are part of the broad money supply, the total money supply has not changed. Money merely has been shifted from bonds to a checking account.

It’s a simple asset transfer. No dollars created or destroyed.

What I have described is known as QE (Quantitative Easing). It’s what the Federal Reserve has used again and again to er, uh . . . “stimulate” the economy.

You might ask how the above process stimulates anything. Indeed you might. And while you are asking, consider this article from The Street:

ECB Announces $1.2 Trillion Stimulus Program, Bigger Than Expected

BY Pete Guest, 01/22/15The European Central Bank has announced more than €1 trillion ($1.15 trillion) in stimulus for the eurozone, in the form of combined monthly asset purchases of €60 billion ($69 billion) until at least the end of September 2016.

The asset purchase program will begin in March, and will include investment-grade euro area sovereign, agency and EU institution securities, ECB president Mario Draghi said on Thursday.

“Investment grade” — good as money. No bad debts for those folks.

Every month, $69 billion worth of bonds, currently in private hands, will be handed over to the ECB, in exchange for $69 billion in euros. An even trade is a stimulus??

Now, if the ECB planned to add $69 billion to the EU economy — by sending money to the euro nations, no strings attached, that would be a stimulus.

But trading money for an equal amount of money is no stimulus. It’s called “busywork” — frantic, but meaningless activity as a substitute for real, meaningful action. The ECB wants to look like it is “doing something,” just as the Fed wanted to pretend it was “doing something.”

Draghi confirmed that the ECB had reached a compromise, and that euro area central banks will buy their own sovereign debt, meaning that stronger economies will not need to share the risk of heavily indebted peripheral countries.

“In addition, 20% of any losses on assets bought by central banks will be shared throughout the eurozone,” Draghi said.

If it seems to you that the above two sentences are in conflict, you’re pretty observant.

The ideal program would be unconstrained in size, would front-load the stimulus by quickly pumping a lot of money into the markets, and would be designed so that all of the eurozone economies would share the risk of sovereign bonds.

QE doesn’t pump any money. It exchanges one form of money for another. About the best that can be said is that for a very short time, more liquid euros will be exchanged for less liquid euros.

Consider it a temporary bandage that later will be ripped off, to disclose that nothing has been cured. The wound remains.

Markets had been unsteady on fears that the stimulus could be neutered by internal disputes and concerns by Germany — the eurozone’s largest economy — that stimulus might allow weaker economies to loosen their austerity regimes.

The compromise buying plan seeks to allay those fears.

And there you have it. Austerity must be maintained. To hell with the people. The more they suffer, the better, because in their suffering they become slaves of the rich.

The key is that the rich are not allowed to lose money, the poor are pressed down, down, down and the Gap between the rich and the rest is widened.

“For the eurozone, the problems they face are not problems that will disappear overnight as a result of QE,” Abi Oladimeji, head of investment strategy at Thomas Miller Investments said.

“The troika, the IMF, the EC and the ECB will have to accept the reality that Greece, basically, cannot repay its debt. Greece is not in a position to grow out of its debt. That reality has to sink in at some point.”

In essence, the troika are gangster loan sharks. They continue to lend money to someone who has no job and no assets, and tell him to get the money from his parents and children — or else.

Greece agrees to talk to creditors in EU debt progress

BY RENEE MALTEZOU AND INGRID MELANDER

BRUSSELS Thu Feb 12, 2015 2:28pm EST(Reuters) – Greece agreed on Thursday to talk to its creditors about the way out of its hated international bailout in a political climbdown that could prevent its new leftist-led government running out of money as early as next month.

Greece already has run out of money. Being monetarily non-sovereign Greece cannot create its sovereign currency out of thin air. (Like our local governments, Greece has no sovereign currency; it uses the euro.)

So where does the troika think Greece will get the euros to pay its debts? From the Greek people, of course. The poor and middle classes (aka the 99%), which have been suffering from austerity, are supposed to suffer more and more, with no end in sight.

The shift by Tsipras marked a potential first step towards resolving a crisis that has raised the risk of Greece being forced to abandon the euro, which could spark wider financial turmoil.

How awful. Greece could abandon the euro, re-adopt its own sovereign currency, and thereby eliminate any possibility of running short of money or of forcing austerity on its people.

What could be worse — worse for the rich — who might lose the slave labor of the Greek people. No more kneeling down by desperate people, who will do whatever they are told, in order to acquire a few crusts of bread.

Yes, the rich do not want that sort of “financial turmoil.”

Tsipras won election last month promising to scrap the 240 billion euro ($273 billion) bailout, end cooperation with the “troika”, reverse austerity measures that have cast many Greeks into poverty and negotiate a reduction in the debt burden.

Or, just get the hell out of the euro, the worst financial idea since answering Email letters from a Nigerian prince.

Chancellor Angela Merkel said, “Europe always aims to find a compromise, and that is the success of Europe. Germany is ready for that. However, it must also be said that Europe’s credibility naturally depends on us respecting rules and being reliable with each other.”

Translation: Hitler was stupid to try to dominate Europe with war. We’ve found a much better solution: Enslave you with a currency you can’t control, and keep you in perpetual austerity.

Deutschland über alles!

But lest you offer too much of your pity to the Greeks, French, Spanish and the rest of the euro nations (most of which will follow Greece in supplication), remember this: You are hardly better than the Greeks:

–Your government, particularly the Republican party, has brainwashed you that austerity is prudent and necessary.

–You have been brainwashed that FICA funds Social Security and Medicare

–You have been brainwashed that federal government financing is like local government financing or your own financing.

–You have been brainwashed that the federal government “can’t afford” [insert project or payment here].

So you believe Social Security, Medicare, Medicaid and all other aids to the poor and middle classes are “unsustainable,” without tax increases or benefit decreases.

And so long as you believe these lies, the rich own you, your family and your friends.

And when you ask yourself why you have so much difficulty saving money, or paying your mortgage, or putting your children through college — and why you will starve when you retire, while the 1% live luxury — the answer is this:

You believe the BIG LIE, just like the Greeks.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

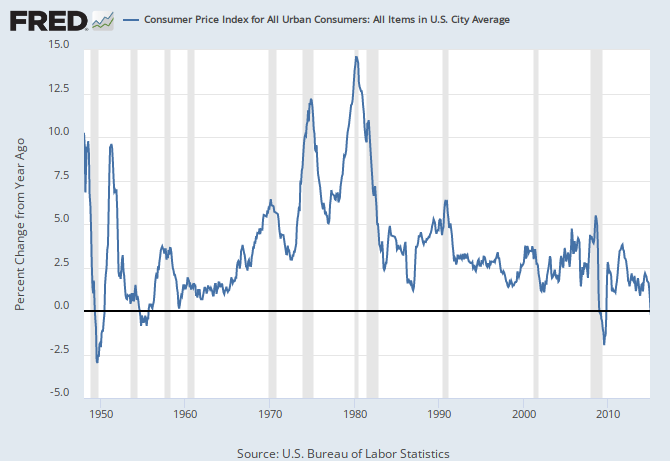

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY