Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

It has been two years since we’ve discussed this specific fact: We can have a federal deficit without a federal debt, and a debt without a deficit.

See:

“Dick Durbin succinctly expresses the basic source of Congressional economic ignorance,”“Letter to Tony Hunter, president, publisher and CEO of Chicago Tribune Company,”

“How to enjoy the debt ceiling debates,”

“The great semantic misunderstandings of our time: Debt, deficit, fundamentalists, originalists”

and “Monetary Sovereignty: The key to understanding economics.”

So it seem like it’s time for a reminder.

When you and I spend more than we earn, we say we are running a personal “deficit,” and the total of these deficits is our personal debt. For us, debt and deficit fundamentally are connected. To have a debt, we must run a deficit.

Not so with the U.S. government, for which federal debt and federal deficit are not fundamentally connected. The U.S. government can have deficits without having any debt, and it can have debt, without running deficits.

The same words — “debt” and “deficit” — have different implications, when applied to federal finances vs when applied to personal finances.

The government runs a “deficit” when its spending exceeds its tax income. The federal government runs a “debt” when it sells Treasury securities.

The two actions are connected, not by fundamentals, but only by a law requiring their connection.

The law requires the federal government to issue T-securities in the same amount as the deficit. These T-securities do not pay for a deficit, do not offset a deficit, do not fund a deficit. They merely are issued in the same amount as the deficit.

The federal government could double its spending and eliminate taxes, to create a monster deficit, without selling a single T-security.

Similarly, the federal government could sell trillions in T-securities, while having no deficit — no difference between spending and taxing.

If you are a “lender” to the federal government, you have taken dollars from your bank checking account and deposited them into your T-security account at the Federal Reserve Bank. A T-security account essentially is a bank savings account.

Your deposit has increased the so-called “debt,” but has had no effect on the deficit. You simply have made a bank deposit, but rather than calling it a “deposit,” the media, politicians and mainstream economists misleadingly call it “debt.”

To “pay off” the federal debt, the Federal Reserve Bank does exactly the same as any bank does when “paying off” your savings deposit: It transfers dollars from your T-security savings account to your personal checking account.

Period. Done.

All the hand wringing about the federal deficit and the federal debt merely serves to confuse the public and to blur the line between personal finances and federal finances. The purpose: To reduce spending that benefits the poor and middle-classes.

In short, the argument about the debt and deficit is to make you believe the gap between the rich and the rest should be wider.

It’s done at the behest of the rich.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

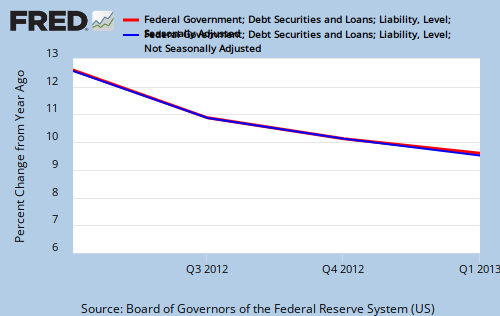

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY