Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

A good point in this article:

Economy’s biggest issue: People don’t have money to spend

By John Crudele, June 3, 2015 | 10:26pmAnyone with even a quarter of a brain now understands that the US economy got off to a bad start this year.

There was an economic contraction in the first three months — when the nation’s gross domestic product fell at an annualized rate of 0.7 percent — that some quarter-brainers are still blaming on the cold weather, strikes at ports, the strong dollar, solar flares, Martian landings and (insert your own poor excuse here).

The truth: Most of these excuses are part of the problem.

But the biggest part is that people don’t have enough money to spend.

Interest from savings is down to zero, people don’t liquidate stock gains to make purchases, and job and income growth has been sketchy.

The economy isn’t doing much better in the current quarter either. The Federal Reserve Bank of Atlanta, an independent observer if ever there was one, measures growth so far in the second quarter at an annual rate of just 1.1 percent. That means growth — un-annualized — is a paltry 0.275 percent with less than four weeks left in the quarter.

It’s quite possible that we will eventually be told, after all revisions are made, that the economy met the official definition of a recession in the first half of 2015, which is two straight quarters of contractions.

Right. When people don’t have enough money to spend, we have a recession. Pretty basic.

So where is all the money?

There are two answers, which together encompass the two fundamental problems with our economic leadership

Answer #1. The federal government is not creating enough money.

U.S. dollars come from two sources: Lending and federal deficit spending. Bank (and other lenders’) lending is a large, but temporary source of dollars — temporary because loans must be paid back, which destroys dollars.

Federal deficit spending is a smaller, but permanent, source.

Economic growth requires growth in the money supply. The misguided drive for “smaller government” and lower deficits, translates into a drive for reduced economic growth.

Reduced deficit growth always begets reduced economic growth and recessions. Depressions have resulted from the extreme version of deficit reduction: Federal surpluses:

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

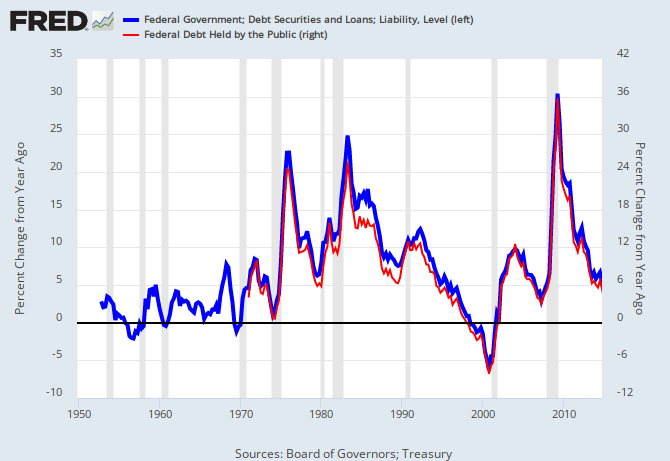

As you can see from the graphs shown below, we have been in a long period of slower and slower deficit (i.e. money creation) growth, which is exactly why we’ve named the graphs “The Recession Clock.”

The Obama administration proudly predicts the government soon will run a surplus, i.e. the government will take dollars out of the economy. This proud act is causing a recession, and unless reversed, will cause a depression.

(There may not even be enough money to build that opulent Obama Presidential Library to extol the recessionary / depressionary successes of President Obama.)

Answer #2. An increasing percentage of the money has gone to the very rich (the .1%).

The .1% spends proportionately (to their income) less on food, clothing, shelter, education and transportation than you and I do. They invest, which helps account for the “mysterious” increase in stock prices, together with the equally “mysterious” decrease in GDP growth.

In summary, the combination of reduced deficit growth (headed toward federal surplus), and the increased Gap between the rich and the rest, has reduced the ability of consumers to spend.

And that spells: “R E C E S S I O N.”

Here is the cure for the current recession and the prevention of future recessions: Increase federal deficit spending via the Ten Steps to Prosperity (below).

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY