Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

As you must know by now, the major banks are the biggest criminals in America. Given the unlimited, unpunished, infinite opportunity to plunder, they have plundered — and continue to plunder — billions from the American public.

The major banks caused the Great Recession. They bought and sold worthless mortgages to the suckers who actually believed the banks were reputable and wouldn’t lie.

The suckers lost billions and the banksters made billions. All is well in Greedland.

Later, told to help struggling, underwater mortgagees via the Home Affordable Refinance Program (HARP), the banks stalled and stalled and forced people to jump through hoops, until the people couldn’t hold out any longer, and lost their homes to the rich manipulators.

For committing forgery, for lying to Congress, for stealing and for numerous other frauds, the banks paid “slap-on-the-wrist” fines totaling mere millions out of their billions in ill-gotten gains (aka “the cost of doing business”).

Steal a dollar; pay a penny; then complain about it.

Further, the banks were excused from criminal prosecution, while their executives were not personally liable at all. No fines or jail time for them.

In fact, they used the Federal dollars generously bestowed upon them, by the Obama/Paulson/Geithner sycophants-to-the rich, to grant themselves obscene paychecks and bonuses.

(Few Americans seemed to mind this charity for wealthy criminals. Rather, their desire has been to prevent unemployment benefits and food stamps from going to the poor souls desperate to support their families.)

If you are given a parking ticket, you will pay more than Jamie Dimon, the head of JPMorgan paid for grabbing hundreds of millions.

You might feel the heat and go to jail. The only heat Dimon feels is in a plush Caribbean resort, after a quick jaunt in his private plane. .

So runs rich-man’s justice in America, courtesy of Mr. “Everyman,” who has been brainwashed into believing the rich deserve their wealth, power, privilege and legal immunities, while the poor deserve their poverty.

At this point of the story, you reasonably might believe President Obama was the primary suck-up to the wealthy. After all, Obama is the fake “liberal” who pushed for his “Grand Bargain,” to cut deficits by reducing corporate taxes while increasing taxes on the 99% and cutting Social Security benefits.

And this pretend liberal, in cahoots with the Republican Party, desperately tried to rush through his Trans-Pacific Partnership without Congressional review. “Damn the details; full speed ahead.”

But all that is mere diversion. The truly rich are well aware of which side their gluttony is buttered on.

March 27, 2015, 10:09 am

Wall Street banks mull freezing Dem donations over WarrenFour major banks are threatening to withhold campaign donations to Senate Democrats in anger over Sen. Elizabeth Warren’s (D-Mass.) attacks on Wall Street.

Representatives from financial powerhouses Citigroup, JPMorgan, Goldman Sachs and Bank of America recently met in Washington and discussed the growing hostility towards big business within the Democratic ranks, according to a Reuters report Friday.

Bank officials cited Warren and Senate Banking Committee ranking member Sherrod Brown (Ohio) as the two main lawmakers leading the charge against them. But the banks have not agreed on how to respond together, with each firm making its own decision on donations, Reuters reported.

The so called “attack” is Warren’s demand that the banks operate in a safe and honest way. To the banks, this is heresy.

“Safe and honest? How do you expect us to receive our $100 million bonuses if we act safely and honestly?”

Citigroup representatives said their firm is already withholding donations to the Democratic Senatorial Campaign Committee (DSCC) to avoid boosting Warren and other progressives critical of Wall Street.

JPMorgan, meanwhile, has so far given Democrats only a third of its annual contribution. Sources there said company representatives have urged Democrats to soften their attacks on the financial sector.

Here are a few details of Senator Warren’s awful “attacks” that have the banksters running scared:

Elizabeth Warren Calls for Breaking Up the Banks

Sen. Elizabeth Warren, D-Mass., called Wednesday for breaking up big banks through structural reforms that would bring a decisive end to “too big to fail.”

Warren told a Levy Economics Institute conference she has worked with other lawmakers to advance a bill that would build a wall between commercial banking and investment banking.

Right. The Great Recession was caused by greedy banksters using their vast monetary resources to gamble in the markets and to sell worthless securities. Had they merely functioned as banks, the Recession would not have happened.

“If banks want to access government-provided deposit insurance, they should be limited to boring banking,” she said. “If banks want to engage in high-risk trading, they can go for it, but they don’t get access to insured deposits.”

Warren is one of those “libs” who (shame on her) actually cares about the 99%, and is willing to stick her thumbs in the eyes of the rich and powerful Jamie Dimons of the world.

She is unlike the self-proclaimed “family values,” self-proclaimed “religious,” self-proclaimed “patriotic,” but actually anti-poor, anti-middle, anti-black and brown, anti-gay, Tea/Libertarian/Republicans, who do the bidding of the rich like starving dogs on short leashes.

“Sit. Stay. Do as you’re told boy, and you get fed,” the rich tell these corrupted politicians. And they obey, voting as a group to help the banksters get richer and richer, at your expense.

Sadly, Warren doesn’t go far enough. There is not a single public purpose served by banks being privately owned, greed machines.

Private ownership of banks, and the resultant profit motive, with no possibility of punishment, is an open invitation to all the liars, crooks and swindlers in America to come together and feast on our money.

Crime rewarded is crime unlimited.

Step #9 of the Ten Steps to Prosperity calls for “Federal ownership of all banks.” It is discussed at

The end of private banking: Why the federal government should own all banks. and at The end of private banking. Part II

I truly am sorry Elizabeth Warren won’t run against those abysmal, lap-dog-to-the-rich candidates the Republicans have put forth.

But, what what about Bernie Sanders?

Not perfect, by any means, but surely better for the American middle class and poor, than yet another “Vote Bush For The 1%”.

We’ve been Bushed way too much, already. Crime rewarded is crime unlimited.

Rodger Malcolm Mitchell

Monetary Sovereignty

==========================================================================================================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded free Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (the “.1%”) more, with higher, progressive tax rates on all their forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.-

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

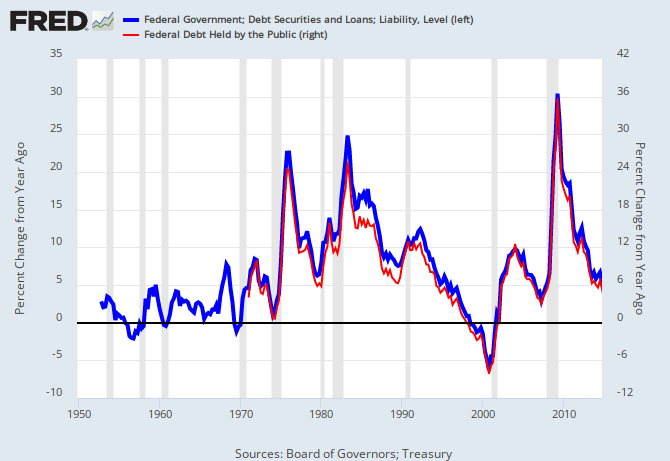

THE RECESSION CLOCK

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY