Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

In the previous post, we showed how federal deficit cutting (austerity) and the misguided attempt to create a government surplus, harms the middle and lower income groups (the “99%”) by draining dollars from the economy.

We described how deficit cutting has been sold to the 99% as “prudent” economics, while in reality, it is a plan to widen the income/wealth/power Gap between the rich and the rest.

Not well understood is that the widening of the Gap is a self-perpetuating process that once begun, can continue and accelerate of its own momentum.

It’s much like being thrown from a cliff.

G-7 Throws Greece Under the Bus

Posted on June 8, 2015 by Yves SmithStatements coming out of (the G-7) signal that the U.S., Canada, Germany, France, Japan, Italy and the U.K are backing the creditor position.

The Obama administration had changed its position in February from pushing the lenders to come up with more pro-growth policies (meaning give relief to Greece) to stressing that Greece needed to “find a constructive path forward in partnership with Europe and the IMF to build on the foundation that exists.”

“There was unanimity of opinion in the room that it was important for Greece and their partners to chart a way forward that builds on crucial structural reforms” and returns to growth, White House spokesman Josh Earnest told reporters.

This means, continuing the analogy, that Greece, having been thrown from the euro cliff, now must find a way magically to fly back up, with no help.

Greece does not own sufficient euros to pay its bills. Austerity already has ravaged Greece’s economy, so it has no way to generate euros. The G-7 “solution” is more austerity, which will ravage Greece’s economy further in an unending, unstoppable fall.

The G-7, having applied leeches to Greece’s economic bloodstream, and seeing that the leeches caused the inevitable economic anemia, now demand that more leeches be applied.

Poverty begets poverty by making the climb out of poverty increasingly difficult.

Impoverished people suffer from poor primary education. The schools themselves are inferior.

Additionally, college may be unaffordable, and even those few colleges that are affordable don’t have the cache to provide entry to the best jobs.

Even less understood are the austerity effects on the people themselves. Poverty begets more poverty by changing the impoverished, in body and mind.

Less nutritious food, leading to physical exhaustion, inhibit work, study and thought. Job seeking and job keeping become less successful.

But there is even more:

Look What Austerity Does to a Child’s Brain

Posted on Jun 7, 2015The stressful conditions of poverty—“overcrowding, noise, substandard housing, separation from parent(s), exposure to violence, family turmoil”—can have toxic effects on the developing brain, permanently diminishing the ability to think clearly and calmly.

Profiling the work of Pat Levitt, a developmental neuroscientist who serves as science director of the National Scientific Council on the Developing Child, Madeline Ostrander writes at The New Yorker:

These conditions provoke the body to release hormones such as cortisol, which is produced in the adrenal cortex.

In a pregnant woman, the hormone can “get through the placenta into the fetus,” Levitt told me, potentially influencing her baby’s brain and tampering with its circuitry.

Later, as the same child grows up, cortisol from his own body may continue to sabotage the development of his brain.

The negative effect of poverty on the human brain has been documented.

In March, in the journal Nature Neuroscience, a group of researchers from nine hospitals and universities published a major study of more than a thousand children.

They took DNA samples, made MRI scans of the children’s brains, collected data on their families’ income level and educational background, and gave them a series of tests for skills like reading and memory.

The DNA samples allowed the scientists to factor out the influence of genetic heritage and look more closely at how socioeconomic status affects a growing brain.

As might be expected, more educated families produced children with greater brain surface area and a more voluminous hippocampus.

But income had its own distinct effect: living in the lowest bracket left children with up to six per cent less brain surface area than children from high-income families.

Wealth can’t necessarily buy a better brain, but deprivation can result in a weakened one.

In a longer-term study published two years ago, neuroscientists at four universities scanned the brains of a group of twenty-four-year-olds and found that, in those who had lived in poverty at age nine, the brain’s centers of negative emotion were more frequently buzzing with activity, whereas the areas that could rein in such emotions were quieter.

Elsewhere, stress in childhood has been shown to make people prone to depression, heart disease, and addiction in adulthood.

The above findings are expanded upon in the June 4, 2105 article, What Poverty Does to the Young Brain by Madeline Ostrander.

Bottom line: Greece’s austerity-riven economy is in a depression. The nation, deeply in debt, has insufficient sources of euros ever to pay that debt.

But the “troika” — European Central Bank (ECB), the European Commission (EC), and the International Monetary Fund (IMF) – knowing Greece never will repay, still insists Greece apply more of the same austerity that pushed Greece into depression.

The troika’s fear is that Greece will awaken, leave the euro, become Monetarily Sovereign by re-installing the drachma, and reclaim its sovereignty. That would put an end to the troika’s free lunch at Greece’s expense.

The myth, that Monetary Sovereignty would drive Greeks into a greater hardship than they already suffer, is ridiculous on its face (greater hardship than the current depression??)

The myth is promulgated by the banks, to dissuade Greece from freeing itself from their greedy clutches.

The troika’s even larger fear is that other euro nations, seeing Greece’s escape and resultant success, would themselves leave the euro, and then, for the rich banks, the feeding frenzy would be over.

Already impoverished, the Greek people face an increasingly difficult road, making emergence from debt ever more unlikely. The difficulties not only are financial, but physical and mental.

Ultimately, if the troika has its way, the Greek people would be turned into idiot slaves of the rich, desperate and with no hope or facilities for recovery, thankful for the crumbs the rich allow them.

Greece can put a stop to the torture of its people, simply by refusing to pay any more tribute to the troika.

This would require political courage, but just as George Washington led the United States to freedom from tyranny, the leader who leads Greece from troika tyranny, forever will be remembered as the “George Washington of Greece.”

Let us pray that, like George Washington, such a leader somehow emerges.

And let us pray that another George Washington arrives to save us from our own greedy and pusillanimous leaders, before we too are swallowed by the current austerity and the rich.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

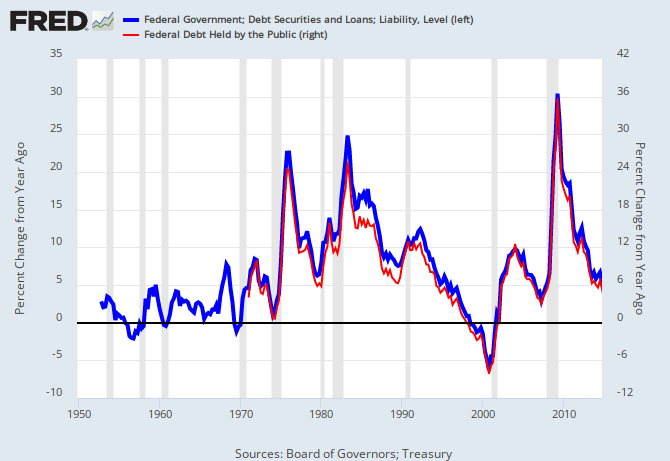

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY