Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

============================================================================================================================================================================================================================================================

Here are some quotes from the notorious Committee for a Responsible Federal Budget (CRFB), the rich man’s group. These are the people who tell you the federal deficit and debt are “unsustainable,” without ever explaining why.

Statement by Maya MacGuineas, President of the Committee for a Responsible Federal Budget on the budget plan released today by The House Budget Committee

March 15, 2016Chairman Price should be commended for releasing a plan that calls for reversing the growth of our national debt, reforming entitlement programs, improving the budget process, and facilitating concrete action to begin reducing deficits.

In conservative speak, “reforming entitlement programs” means cutting Medicare, cutting Medicaid and cutting Social Security benefits.

Does that sound like a good idea to you?

Since the richest 1% of Americans don’t care about those benefits, the CRFB deems them unimportant. Do you?

House Budget Committee Chairman Tom Price (R-GA) today released the FY 2017 House budget resolution to formally kick off the Congressional budget process.

The budget proposes about $6.5 trillion of spending reductions, which along with a war draw down, economic effects, and interest would lead to $7.9 trillion of total savings — enough to balance the budget by 2026.

While balancing budgets are good for states, counties, cities, businesses, you and me — all of which are monetarily non-sovereign — balanced budgets are an economic disaster when our Monetarily Sovereign federal government does it.

(Conservatives don’t want you to understand the vast differences between federal financing and your personal financing.)

–Federal deficit reduction reduces the U.S. money supply, which starves a growing economy of money.

–Federal deficits put spending dollars into the pockets of consumers, who use those dollars to grow businesses and to increase wages and employment.

The budget would put debt on a clear downward path, falling from 76 percent of GDP in 2016 to 57 percent by 2026.

As you can see in the “Recession Clock” (chart below), reductions in spending as a % of GDP cause recessions. Then, growth in spending as a % of GDP cures recessions.

The budget generates the bulk of its savings from health care and other mandatory spending programs.

This includes $2 trillion of savings from repealing the coverage expansions in the Affordable Care Act (while leaving the spending cuts and essentially the tax increases in place), $1 trillion from block granting Medicaid and capping its growth, and $449 billion from Medicare savings policies, including reforming cost-sharing rules and switching to a premium support system in 2024.

There you see a litany of “screw the poor and middle classes” ideas, courtesy of the conservatives.

The Affordable Care Act protects those who least can afford health care coverage. That is the primary reason why the conservatives repeatedly vote to eliminate ACA.

Block granting Medicaid means that instead of the federal government paying for Medicaid, the government would give the states “block grants,” and the states would pay. Of course, the block grants would be insufficient — that is the whole purpose — so the states would have to cut coverages to the poor.

Capping the growth of Medicaid means that as prices rise, benefits would fall.

“Reforming” cost sharing rules is conservative speak for: “You pay more; the government pays less.”

The “premium support system” is a Rube Goldbergian process similar in nature to block grants, except it relates to premiums received by insurance companies. The private sector would support federal savings — similar to a tax.

The budget also calls for $1.5 trillion of savings from other mandatory programs, citing policies such as block granting food stamps and reforming housing, education, and job training programs as ways to get there.

In real language, the conservatives propose cutting food stamps, housing assistance, education assistance and job training programs. Who would you say that hurts, the 1% or the 99%?

Here is where the “savings” come from:

Policy Changes in the House FY 2017 Budget

Budget Category 2017-2026 Savings

Affordable Care Act $2,013 billion

Medicaid and Other Health $1,028 billion

Medicare (net) $449 billion

Social Security $14 billion

Other Mandatory $1,471 billion

Discretionary and Highway $690 billion

Revenue $0 billion

Interest $818 billion

Subtotal, Policy Savings $6,482 billion

Economic Effect of Deficit Reduction $241 billion

Economic Effect of ACA Repeal $254 billion

Claimed Savings with Economic Effects

$6,977 billion

And there it is: No tax increases (The rich hate tax increases but love cuts to your social benefits), and billions deducted from Social Security, Medicare, Medicaid, highway repair, and “other” (those food stamps, housing, education, and job training programs we mentioned).

These people even have the gall to predict that the elimination of “Obamacare” benefits would grow the economy (“Economic Effect of ACA Repeal”).

If you are within the upper 1% income / wealth / power group, and you don’t give a fig about what happens to the rest of the people in America, you should vote conservative. This is the plan for you.

It widens the Gap between the rich and the rest, exactly what the rich want.

Otherwise, repeat after me:

“Deficit reduction is good when states, counties, cities, businesses and I do it.

Deficit reduction is bad when the federal government does it, because it reduces the nation’s money supply.”

Repeat it ten times, or as often as necessary, until you understand it. Click this link: Monetarily Sovereign for further infomation.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

========================================================================================================================================================================================================================================================================================================

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

THE RECESSION CLOCK

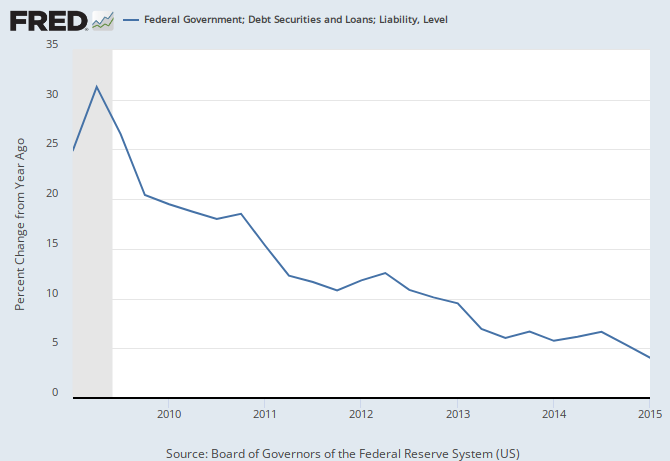

Recessions begin an average of 2 years after the blue line first dips below zero. A common phenomenon is for the line briefly to dip below zero, then rise above zero, before falling dramatically below zero. There was a brief dip below zero in 2015, followed by another dip – the familiar pre-recession pattern.

Recessions are cured by a rising red line.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

————————————————————————————————————————————————————————————————————————————————————————————————-

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•No nation can tax itself into prosperity, nor grow without money growth.

•Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

•A growing economy requires a growing supply of money (GDP = Federal Spending + Non-federal Spending + Net Exports)

•Deficit spending grows the supply of money

•The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

•The limit to non-federal deficit spending is the ability to borrow.

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

MONETARY SOVEREIGNTY