Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

The Detroit we now know, is melting, melting away. There is a solution.

The Continuing Depopulation of Detroit

The latest perversity Detroit officials are inflicting on city residents: the potential eviction of tens of thousands, possibly as many as 100,000 people, all at precisely the same time.

Those (residents who didn’t pay their past due property taxes), the city warned, would lose their homes to tax foreclosure, the process by which a local government repossesses a house because of unpaid property taxes.

Just over 60,000 homes, about half of them occupied, are slated for the auction block.

Mary Crenshaw had come to save her family home in Highland Park, a small city enclosed by Detroit whose once occupied homes sported oak floors and beveled glass windows.

Now, more than half of them are empty, lawns overgrown, windows boarded up, the former homeowners having already ridden earlier foreclosure conveyor belts out of the neighborhood.

This current tax foreclosure crisis comes right on the heels of the city’s last great displacement: the 2008 housing crash, which descended on Detroit like a tidal wave, sweeping nearly a quarter of a million people out of the city and leaving in its wake tens of thousands of vacant properties.

The fact that the city is now threatening to evict a seventh of its remaining inhabitants in a single year, all because of unpaid property taxes, seems like an absurd proposition until you begin to connect the dots: the mass water shutoffs, the shuttering of dozens of public schools, the neglect of fire hydrants in particular neighborhoods, and now this deluge of foreclosures.

For the city’s low-income, black, and elderly residents, Detroit isn’t a city on the rise, but one under siege.

As always, it is the poor and politically weak, on whose backs fall the burdens of recession, local or national or worldwide, while the rich swoop in to gather the belongings left behind.

Like the good Germans who stole the homes of their neighbors (away travelling to Auschwitz), the rich will bid pennies on the dollar for the homes of the Detroit poor and politically weak, sowing great misery and reaping great profit.

There is a solution.

Think of Detroit as an unemployed person. Like all persons, Detroit is what is known as “monetarily non-sovereign.” It owns no sovereign currency.

While it uses the dollar, it cannot create dollars at will (unlike the federal government, which is Monetarily Sovereign and does create dollars at will).

So while the federal government always can avoid running short of dollars (merely by creating more dollars), Detroit can and has run short of dollars.

To survive long–term, you require net income — income at least equaling your spending. Similarly, every business, every city, county and state — all being monetarily non-sovereign — require net income to exceed spending.

No state, county or city can survive on it own internal taxes alone, for that would be like a person surviving by eating his own hand for sustenance. Eventually, one runs short of hands.

What kind of net income? Suburban towns receive income from residents who work outside the town, perhaps in a big city, but spend in the town. This transfers dollars from the big city to the suburb.

Big cities may receive income from their state or from tourism and net exports. States receive income from tourism, net exports and from the federal government. (Most states have a positive cash flow from the federal government.)

Detroit does not receive enough income from tourism, net exports or from the State of Michigan to pay its bills, and presumably, Michigan is unwilling or unable to help Detroit sufficiently.

Consider the cash flows of the thousands of governments, large and small, throughout the U.S. Mathematically, it would be improbable for all to have positive cash flows, so today, as you read this, many monetarily non-sovereign governments struggle with debts they cannot pay.

The long-term survival of every financial entity requires that income at least equal outgo. The federal government uniquely solves this problem by creating dollars ad hoc, when it pays bills, i.e. when it runs deficits.

The U.S. could not financially survive long term unless it ran the deficits that create dollars. And in fact:

U.S. depressions tend to come on the heels of federal surpluses.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

And therein lies the weakness of world finance, for relatively few entities are Monetarily Sovereign. The U.S., UK, China, Canada, Australia and various other nations are. But France, Italy, Germany and the other euro nations are not.

They use the euro, over which they are not sovereign. This is the primary reason the euro nations are in financial trouble. They are short of euros.

Returning to the United States, how are our cities, counties and states expected to survive long term? How are they all expected to have positive dollar flows?

There is but one way for U.S. cities, counties and states to have positive dollar flows, and that is for the federal government to cut federal taxes and/or to increase federal spending, that is, to run significant deficits.

Federal taxes remove dollars from the cities, counties and states by removing dollars from the citizenry, and federal spending adds dollars.

There is a solution:

Implement Steps #1-#7 and #10 of the Ten Steps to Prosperity (below). It is the answer for Detroit. It is the answer for all of America.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

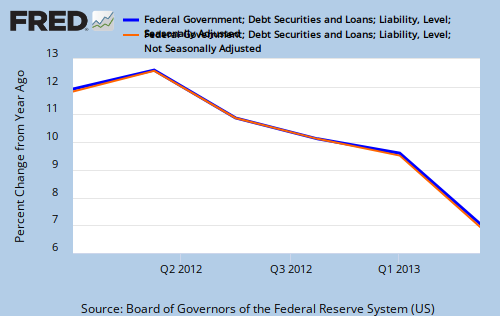

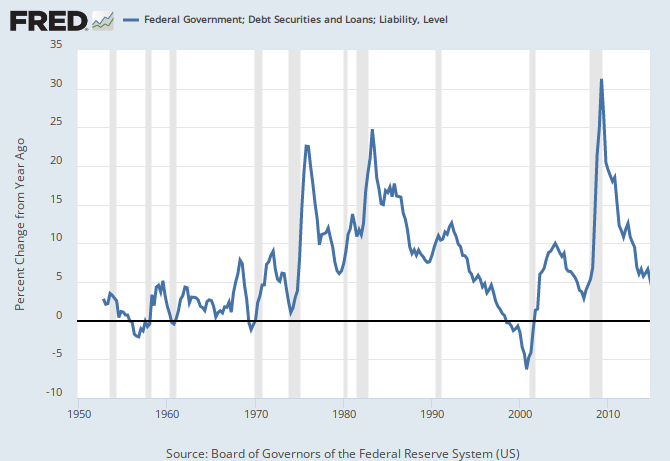

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY