Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==============================================================================================================================================================================

There are two worlds. You live in one; they live in another.

And yes, money doesn’t buy happiness, and sometimes money even buys sadness. But to be perfectly honest: I’d rather live in their world.

Plutocrats, By Chrystia Freeland

Let me tell you about the very rich. They are different from you and me.” So says the narrator at the start of F Scott Fitzgerald’s short story “The Rich Boy”. He explains that people who are born rich believe “deep in their hearts that they are better than we are.”

The world is now experiencing a boom in personal wealth akin to that of the last years of the 19th century. We are, as Freeland puts it, in the second gilded age.

In almost all walks of life the very top have been getting disproportionate rewards compared with the competent middle-rankers.

Why is this happening, and why are people left behind?

One aspect of the way the very rich are able to twist things to their advantage even in sophisticated democracies is relevant right now: how the American rich are shaping US tax policy.

(In) the US the middle class have barely increased living standards for 30 years.

Why? You not only permit it, but you endorse it — not only endorse it, but you defend it with all your might.

For the uber-wealthy, a new threshold for luxury-priced homes: $100 million and up

Rather than settle for garages of antique cars or a museum’s worth of paintings, billionaires are increasingly willing to pay $100 million for homes that can serve as showcases for their fortunes.

Five homes sold around the world for more than $100 million in 2014, and a record 18 were listed for sale at that level, according to the Christie’s (real estate brokerage) report.

Last year’s purchases include a $146 million French Riviera mansion. Each square foot of the home cost $22,577 — roughly equivalent to a new Honda Accord.

The luxury market contrasts with the still-struggling U.S. real estate market as a whole. Millions of homeowners still owe more on their mortgages than their homes are worth — a vestige of the housing crash that triggered the Great Recession in late 2007.

Buyers remain sensitive to changes in mortgage rates and price swings that could make ownership costlier. At the same time, access to credit remains tight for some. Sales have been running below a pace associated with healthy markets.

Here in America, the politicians, Koch-bribed via campaign contributions (Thank you right wing Supreme Court) and promises of lucrative jobs later, tell you Social Security is running short of money.

So, they say, your benefits must be reduced and your taxes increased.

It’s part of the Big Lie that the federal government is running short of money and deficit spending will lead to a Wiemar/Zimbabwe/Argentina hyper-inflation.

And, of course, the capital gains the rich receive, with no effort, are taxed much less than the salary you receive at great effort. Are the 1%’s capital gains more valuable to America than the 99%’s salaries?

No, but how much will you contribute to your political representative’s election effort? And will you give him an excessively compensated job when he leaves office?

The rich will.

And if I suggest you learn Monetary Sovereignty — if I suggest you contact your political representatives and demand that FICA be eliminated, and demand a fully paid, comprehensive Medicare for every man, woman and child in America, and demand they embark on the Ten Steps to Prosperity — if I suggest you make these demands, will you tell me I’m a communist, a socialist and a fool, without even trying to understand Monetary Sovereignty?

Do you really prefer to live in your world, where you struggle to provide for your family and for yourself, while you also struggle to provide for the rich?

Would you really rather struggle just to accept the status quo, than struggle to change the way everything favors the rich, in our so-called “land of equality”?

Do you really accept the idea that money is speech, so the rich are entitled to buy elections and buy lower taxes and buy the right to make people work harder and longer for less and less?

Do you really buy the notion that the poor are lazy and only the rich work hard?

If not, when was the last time you contacted your politicians? When did you last vote?

And if you voted, did you vote for someone who will defend the poor and the middle — or are they in league with the rich?

What are you doing to help your family and yourself?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

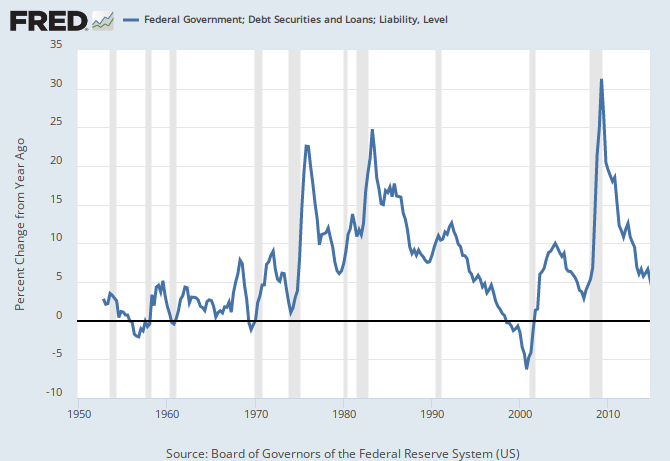

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY