Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

The U.S. dollar is disappearing from the U.S. in massive amounts. The process is called “Net Imports:”

Back in 2011, we published, “Which is better for the U.S.: Increased exports or increased federal deficit spending? Thursday, Aug 11 2011″

It quoted from a Time Magazine article by Roya Wolverson, who wrote:

Many economists think that, for the U.S. economy to get back on track, exports have to grow faster.

Virtually every economist, and the public at large, seems to believe that economic growth in enhanced by exports. And I agree.

But why is this so? After all, “exports” means we sweat and strain, using our nation’s assets, to create valuable goods and services, and send them overseas.

Why do we want to do that? Because exports of goods and services actually are imports of dollars. The greater our net exports, the greater are our imports of dollars, and this growth or our dollar supply stimulates our economy.

Very simply, increasing the dollar supply increases purchases from businesses, which grows those businesses, which increases the job supply, all of which grow our economy.

But, in the past 15 years $6 – $7 trillion dollars have left the U.S. economy. That’s close to $20,000 lost to each man, woman and child in America.

Where do we get the dollars, not only to overcome that loss of $500 billion dollars per year, but additional dollars to grow the economy?

Virtually all U.S. dollars are created by U.S. lenders, including banks. It works this way:

1. Every form of lending, for which there is a written repayment obligation, creates dollars. One example: Banks are allowed to lend a percentage (10% – 15%) of their capital. They do this merely by crediting borrowers’ checking accounts, which instantly creates dollars.

(To visualize, contrast a loan with a gift, which transfers, but does not create, dollars)

2. Banks create dollars when they obey federal instructions. When a federal agency pays a bill, it sends instructions (not dollars) to the creditor’s bank, instructing the bank to increase the balance in the creditor’s checking account. At the instant the bank obeys these instructions dollars are created.

(Thus, the federal government itself has no dollars, but being Monetarily Sovereign has the infinite ability to create and send dollar-creating instructions to banks.)

Federal spending creates dollars, and federal taxation destroys dollars. In short, federal NET spending (i.e. deficit spending) creates the dollars that are lost via Net Imports and needed for economic growth.

To finish the title sentence: A federal surplus = a deficit for the private sector.

And here is the big question: Since the private sector’s (yours and mine) ability to create dollars is limited, and the federal government’s ability to instruct banks to create dollars is unlimited, why did President Clinton run a federal surplus, and why does President Obama want to do the same? Why do they want the economy to run a deficit?

Let’s take a closer look:

Uncle Sam runs $114 billion surplus in April

Federal coffers saw a 7% increase in individual income taxes and payroll taxes, a 15% increase in corporate income taxes, and a 37% increase in money paid to Treasury by the Federal Reserve.

Aside from the fact that the federal government has no “coffers,” increases in taxes are bad for the economy.

Areas that saw the biggest drops included unemployment benefits and homeland security (both down 31%), agriculture (down 12%) and defense spending (down 5%).

Reductions in: Unemployment benefits, payments to employees of homeland security, farmers, soldiers and defense manufacturers, also are bad for the economy.

Again, since all deficit reduction steps — increased taxes and reduced spending — are band for the economy, why does President Obama, and indeed, the entire Congress want to run a federal surplus?

Equally important, why have they worked so hard to convince Americans that sending more to the government, while receiving less from the government, benefits the people? And why do the people believe it?

The people believe it because they think federal financing is like personal financing.

For you and me, deficits are bad and surpluses are good. The same is true for state and local governments and for businesses. So, to the economically innocent mind, the same must be true for our federal government.

You and I, and states and counties and cities and businesses can run short of dollars. The federal government, being Monetarily Sovereign, cannot.

And the President and Congress know it.

So why do they tell us, what has become known as the “Big Lie”?

Here’s why:

1. Surpluses weaken the economy and cause recessions and depressions.

2. Recessions and depressions are marked by unemployment.

3. Unemployment leads to lower wages for the 99% (middle and lower income/wealth/power group)

4. Lower wages for the 99% widen the Gap between the 99% and the upper 1%, and widening the Gap is the primary goal of the 1%. (The gap is what makes them rich, and the wider the Gap, the richer they are).

5. The rich are the primary contributors to the politicians, so the politicians do the bidding of the rich.

And it is just that simple.

The next time someone tells you that a federal surplus is “prudent” or good in any way, know that they are parroting the myth promulgated by the rich, to make the rich richer and you poorer.

Meanwhile, $500 billion will leave the economy this year, and as the federal deficit declines, minute by minute, you and I will lose those dollars.

A federal surplus = a deficit for the private sector (and that’s you.)

The recession clock (see below) is Ticking, ticking, tick . . .

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

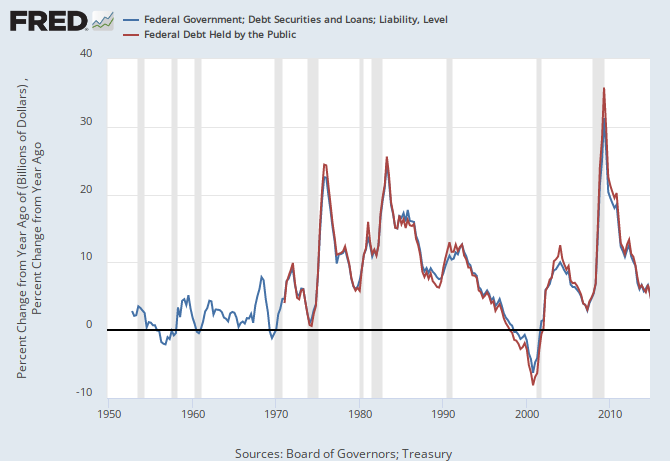

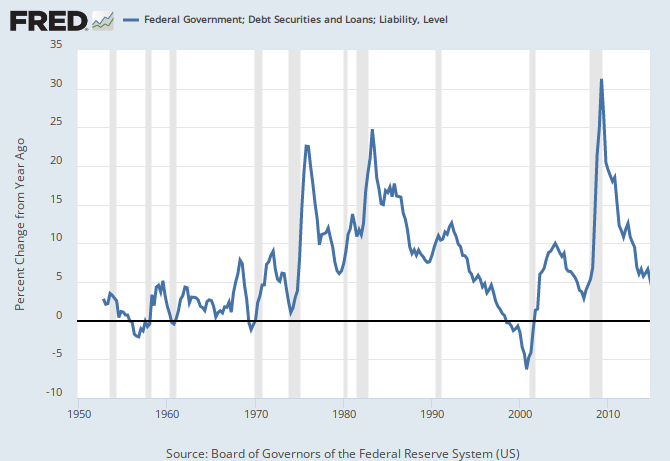

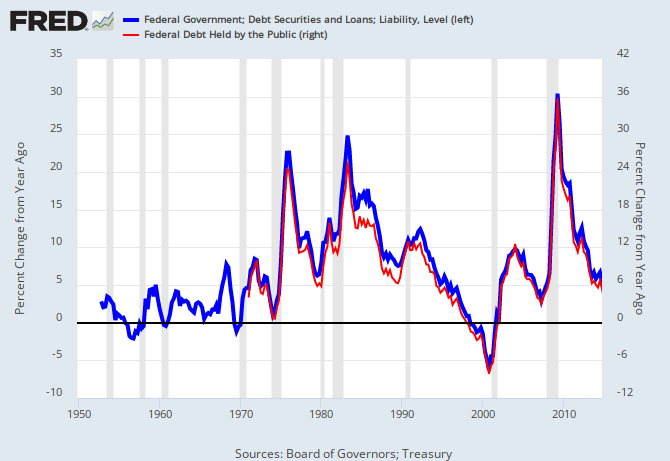

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY