Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

This is the fifth in a series of posts titled, “You never will know what you have lost” (Part I, Part II , Part III) and Part: IV

Each post describes the invisible, but real costs of federal deficit reduction, aka “austerity.”

The first of the posts contained these paragraphs:

The list goes on and on: The lame who might have walked. The blind who might have seen. The children who might have given to America. The tornadoes and hurricanes and earthquakes that might have been foreseen.

The money that investors might have saved. The inventions never invented. The recessions and depressions that might have been avoided. The wars that might have been won or prevented. The life-saving drugs that might have been developed. The people who might not have died too soon. The beauty never created. The ideas lost. The better world that might have been.

You never will know.

Day by day, we die the death of a thousand invisible cuts, at the hands of people who know not or care not what they do. Like doctors who would treat anemia by bleeding the patient with leeches, they bleed the economy of its blood, its dollars, in the name of frugality.

In 1972, who would have guessed that 43 years later, we still would have no plans to walk there again, or to explore further there, or to build a station there?

Why did we stop? Because we were told the federal government — which has the unlimited ability to create dollars — somehow could not create sufficient dollars to pay for the trip.

And, we are told, deficit spending causes inflation, though no such relationship exists.

But really, who cares about such exploreation? What possible good is walking on the moon, or any other space exploration?? Or, for that matter, what possible good is any basic research that does not have an easily seen payout?

Of course, if such research isn’t done, you never will know whether anything has been lost.

Recently, in the Rosetta mission, the European Space Agency landed “Philae” on the surface of comet “67P.” Huh? Landing on one of the millions of comets and other bodies circling the solar system? How is that supposed to help me?

Here are excerpts from an article in NewScientist Magazine:

Rosetta’s real revolution is right here on Earth

From heart surgery breakthroughs to robotic sniffers and bedbug detectors, space tech spin-offs from the mission have a real world purposeBEDBUGS suck our blood while we sleep and evade detection by dint of their nocturnal lifestyle and millimetre-scale bodies. A portable bedbug detector that sniffs out the chemical signals they send to one another is just one of many unusual spin-offs from the Rosetta mission.

“Space stands for low-weight, robust, temperature-resistant technology that has to work,” says Frank Salzgeber, head of technology transfer for the European Space Agency, which launched Rosetta.

Geraint Morgan of the Open University in Milton Keynes, UK, who helped design the Rosetta instrument, is also involved in another sniffer spin-off. This time the aim is to detect Helicobacter pylori, a bacterium that causes stomach ulcers and can raise risk of stomach cancer.

Other putative spin-offs using Rosetta’s gas-sniffing technology range from a system to monitor air quality on the UK’s proposed new fleet of nuclear submarines to a robotic nose that will “detect the complex, changing mixtures of airborne molecules encountered by consumers in everyday situations” – a device that the perfume company Givaudan wants to use in developing new fragrances.

It’s a similar story for Rosetta’s atomic force microscope MIDAS. As a dust speck passes through MIDAS, a finely controlled needle gently scans the grain’s geometry, creating a three-dimensional picture of it. The company that developed the system, Cedrat Technologies, based near Grenoble in France, is now using the needle’s sensitive actuators in a device for fiddly coronary artery bypass operations.

More prosaically, the company is working with skiing equipment manufacturer Rossignol to see whether a similar system could make skis vibrate less at high speeds.

A European Space Agency spin-off, Giaura, based in the Netherlands, is hoping to find terrestrial uses for the porous beads that scrub carbon dioxide from the air aboard the International Space Station. The idea is to capture atmospheric CO2 to boost the growth of greenhouse tomato plants, make carbonated drinks and cement or – in the first prototype – to pump it into aquariums to help keep water plants healthy.

Steel workers struggle with conventional underwear as cotton retains heat, and can easily catch fire from a stray spark. “Thunderwear” – prototype flame-resistant bras and underpants developed in collaboration with ESA – is made from Nomex, a fabric used in spacesuits.

The Vatican Library’s collection of 180,000 manuscripts and 1.6 million books is being digitised using a system developed by ESA and NASA to store data from satellites.

The anti-science ignoranti ask, “How does research for space help us in our terrestrial world?”

Bedbugs, cancer and ulcer treatments, air quality monitoring, perfume manufacture, coronary bypass, skis, tomato plant growth, carbonated drinks, cement, aquariums, steel workers’ underwear, digitized libraries — the list is as extensive as it is varied. And it is but the tip of the iceberg.

In the years to come, thousands of discoveries, inventions and processes will evolve from what our space efforts teach us. If there were no space effort, many of these discoveries and inventions would not exist.

But you never would know what you have lost — all because the government told you the federal deficit was “unsustainable” or will cause hyper-inflation (the two elements of the Big Lie.)

The bigger question is: What are we and our children losing now, every day, because deficit spending is cut?

It’s something important, that we are forced to do without. What is it?

We never will know.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

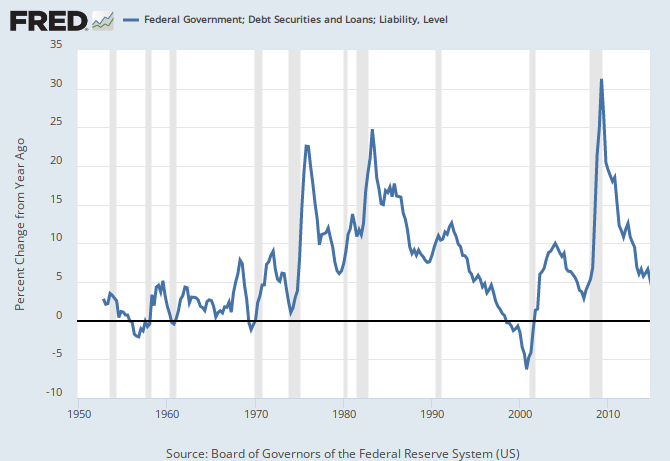

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY