Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.” (You can find it in their publication titled “Why Health Care Matters and the Current Debt Does Not” from October 2011.)

3. Federal “BOND”: Typical misleading usage: “Proceeds from the sale of these bonds are used to repay outstanding U.S. debt.” (Copilot AI). Federal debt is the total of federal bills, notes, and bonds, so the government cannot use bonds to repay “debt.” Saying an entity with unlimited funds can use debt to repay debt is a double oxymoron that only an economist could believe. First, if you have infinite funds available to you, you don’t need help paying off debt, and you certainly don’t take on more debt to pay off existing debt. Today, the federal government could pay off 100% of the debt (T-bills, T-bonds, T-notes) by crediting the depositors’ checking accounts. This could be done at the touch of a computer key. In the private sector, a bond is evidence of a loan to a borrower. Since the federal government (unlike state and local governments) does not borrow, the word “bond” should more appropriately be replaced by the word “deposits.” Federal T-NOTES and T-BILLS refer to deposits of shorter maturity than T-bonds. As if that level of confusion wasn’t sufficient for those who call themselves “economists,” the paper receipts in your pocket are called “dollar bills” and “Federal Reserve notes.” Those paper things should be called “titles,” for that is what they are—bearer documents showing that the bearer owns a certain number of dollars. Just as a car title is not a car and a house title is not a house, a dollar bill is not a dollar. It is a title or a certificate demonstrating ownership. 4. Federal DEFICIT: Typical misleading usage: “The U.S. budget deficit is the amount the federal government spends annually more than it receives in revenue during that period.” Technically, the word is correct, but it’s misleading for two reasons. First, there is no financial connection between federal spending and federal receipts. The government pays for all its spending by creating new dollars ad hoc. The government does not spend tax dollars or use any other dollars it receives. Even if the federal government collected zero taxes, it could continue spending and paying for things forever.Alan Greenspan: “The United States can pay any debt it has because we can always print the money to do that.”

Second, the word “deficit” has pejorative connotations that fool the public into believing it should be reduced. Precisely, the opposite is true. When the “deficit” is reduced, or worse yet, when the government runs a surplus, we have recessions and depressions. You can see the reason by this formula: Gross Domestic Product (GDP) = Federal Spending + Nonfederal Spending + Net Exports. When the government runs a surplus, it takes dollars out of the economy, reducing GDP and causing a recession or depression. When the government runs a deficit, it adds growth dollars to the economy. If economists wished to avoid public confusion, they would say, “The economy had an income of $_____,” rather than,”The government ran a deficit of _____.” 5. “BUDGET DEFICIT”: Typical misleading usage: “The budget deficit should be compared to the country’s ability to pay it back. That ability is measured by dividing the deficit by gross domestic product (GDP).” This is one of the craziest concepts you will ever encounter. I assume the writer was trying to differentiate between “deficit” and “budget deficit,” so he/she invented a nonsensical definition. The federal “budget” is just a prediction of how much money will come in and how much will go out. A “budget deficit” means that more went out and/or less came in than predicted. A wrong prediction says nothing about the nation’s ability to pay for anything. Now, let’s get to reality: The federal government’s ability to “pay it back” (whatever “it” may be) is not related to GDP. The deficit/GDP ratio only estimates what part of GDP is Federal Spending and what part is Non-federal spending and Net Exports. I say “estimates” because GDP is a spending measure, not a deficit spending measure, so federal income is not considered. That said, if income (mostly taxes) increases, nonfederal spending will be forced to decrease. That’s where the money comes from. All three terms contribute to GDP. So how does the fraction show the “country’s ability to pay it back” (again, whatever “it” is)? It doesn’t. The U.S. federal government, being Monetarily Sovereign, can pay for anything that costs dollars. If you sent a legitimate invoice for a thousand trillion dollars to the federal government, it could pay it today without batting an eye.Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

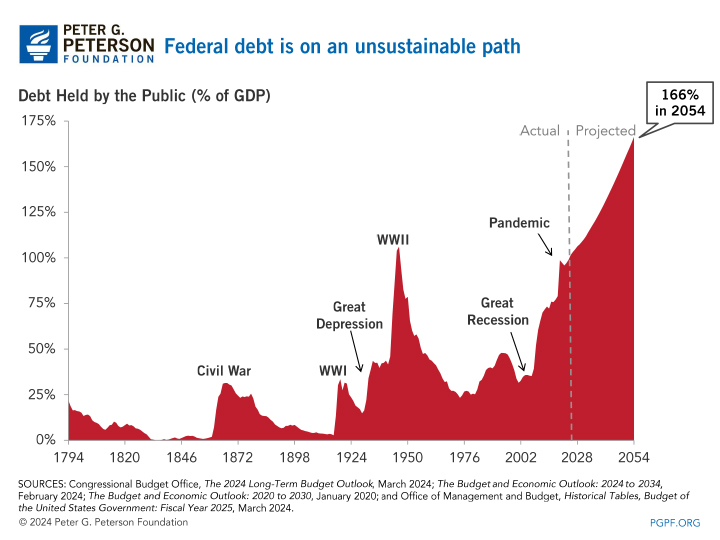

I suspect the writer was confusing deficit/GDP with Debt/GDP, another commonly referenced fraction that says nothing about the federal government’s ability to pay for anything. It, too, is a useless fraction that describes nothing, predicts nothing, and evaluates nothing. Look at this list of national debt/GDP ratios, and you will not be able to discern anything about a nation’s financial health. The ratios tell you nothing. When you hear or read about someone concerned about the debt/GDP or deficit/GDP fraction, that person spreads false information. They might as well be talking about the number of fairies dancing on the head of a pin. 6. “The federal government OWES“: Typical usage: “Who does the U.S. owe $31.4 trillion?” Supposedly, the government owes the depositors in Treasury Security accounts those T-bills, T-notes, and T-bond we’ve discussed. If those were real debts that were owed, the money would be used by the government, the supposed “borrower.” But it isn’t. The money is safely tucked away in T-security accounts, the contents of which remain wholly owned by the depositors. Just as a bank doesn’t owe the contents of its safe deposit box to depositors, neither does the government owe the contents of T-security accounts. Those dollars belong to the depositors, who retrieve them when the government sends them the contents of the accounts. This is not a financial burden for the federal government. Again, even if the government owed that money, it has the infinite ability to create it. 7. “Spend taxpayers’ money.” Typical misleading usage: “Social security is the government’s single largest expense and where 22% of tax dollars go.” As is irritatingly common, the article’s author seems to lack understanding of the differences between the Monetarily Sovereign federal government and the monetarily nonsovereign state and local governments. Because state/local governments do not have the infinite ability to create U.S. dollars, they must use tax dollars or borrowed money to pay their bills. The federal government has the infinite ability to create dollars, so it does not use tax dollars for anything.March 12, 2009 quotes from 60 Minutes: Scott Pelley: Is that tax money that the Fed is spending? Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

The federal government destroys all the tax dollars it receives. Taxpayers take tax dollars from their checking accounts—the private sector’s M2 money supply measure—and when the dollars reach the Treasury, they cease to be part of any money supply measure. They effectively are destroyed. As we said earlier, even if the federal government collected $0 taxes, it could continue spending, forever. The purpose of federal taxes is to control the economy by taxing what the government wishes to discourage and by giving tax breaks to what the government wishes to reward.

Every U.S. depression has been associated with federal surpluses.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807. 1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819. 1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837. 1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857. 1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873. 1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893. 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929. 1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

The reason is simple algebra. Federal surpluses are economic deficits. They subtract dollars from GDP, and by formula, when you subtract dollars, the economy shrinks, which is the definition of a depression. Living within one’s “means” describes a person whose income is sufficient to pay for his spending. However, the federal government’s finances are different from personal finances. The federal government does not use income to pay for spending. It creates new dollars for that purpose. So the government has no “means” to live within, or more accurately, it has infinite means. SUMMARY No scientist should use contronyms and homographs without making sure confusion doesn’t result. Yet economists do it repeatedly. The words “borrow, debt, deficit, owe, and bond” mean something different when referring to Monetarily Sovereign vs. monetarily nonsovereign entities. Federal “debt” is not the debt most people understand. The federal government does not borrow dollars, and Treasury bonds are unlike corporate bonds. A federal deficit is an economic surplus, and the U.S. government does not owe anyone dollars, nor does it spend taxpayers’ dollars. The government has no “means” to live within, and federal spending is infinitely sustainable. These words have repeatedly been used to confuse the public and make false points. If you are confused, that is exactly what those at the upper level of income, wealth, and power want you to be. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell; MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell; https://www.academia.edu/……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY