Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

Yesterday, we published, “Obama’s tiny trial balloon regarding education. Let the struggle begin.” Friday, Jan 9 2015

It described President Obama’s preliminary recommendation that the federal government pay for part of community college costs. As a fundamental (i.e. government should pay for education), the recommendation not only is sound, though long overdue.

The states and cities, which being monetarily non-sovereign, have limited financial resources, but they pay for 12 grades of education. Why? Because education is the one thing that can keep America’s world leadership.

Unfortunately, because the states and cities are cash strapped, the quality of education in America has declined, thus threatening the very foundations of our nation.

Here’s The New Ranking Of Top Countries In Reading, Science, And Math

JOE WEISENTHAL, DEC. 3, 2013,The OECD is out with new global rankings of how students in various countries do in reading, science, and math. Results of the full survey can be found and delved into here.

You can see below how Asian countries are obliterating everyone else in these categories. The United States, meanwhile, ranks below the OECD average in every category. And as the WSJ notes, the US has slipped in all of the major categories in recent years:

Is it that the citizens of these nations are naturally smarter than Americans? No, its that they receive better educations. We are cheating our children, our nation and ourselves, of the benefits of education.

For reasons that must relate to America’s “can-do,” self-sufficient, “John Wayne” history, we tend to expect individuals to take care of themselves.

So, for instance, unlike the majority of first-world nations, we look down on universal health care as some sort of weakness — as though anything given free will be abused by lazy, free-loaders.

We demean “food stamp mamas” as low-life cheaters, who should “get a job” and not expect the government to feed them.

And we say, if you can’t afford college, get a job and work your way through; don’t expect a handout from the government.

That is the American attitude — a self destructive attitude that has diminished our national health care, national nutrition and national education. This American attitude has, in many ways, made us a 2nd world nation, if not 3rd world.

Were it not for our powerful army, our large population and good plumbing, we indeed would be a 3rd world nation.

Unfortunately, President Obama’s recommendation, as meager as it is, now has begun to face the nay saying of those who never have had an idea, and who despise those who do.

Right away, even the President has to apologize for a government benefit. God forbid education should be free. There has to be some sort of mountain to climb, because as America has been taught, free is bad.

The president’s plan, which would require congressional approval, would call for the federal government to pay 75 percent of students’ community-college tuition and for states to pick up the rest of the tab. White House aides said the initiative, modeled on a fledgling program in Tennessee, would cost U.S. taxpayers about $60 billion over its first 10 years.

There is no good reason to force cash-poor states to pick up any of the tab. This requirement is guaranteed to make the states fight the program, and has no financial purpose. Question: Does Obama want the program to succeed or to fail?

Also, that Big Lie about costing U.S. taxpayers about “$60 billion” is wrong, wrong, wrong. It would not cost federal taxpayers one cent. Federal taxes do not pay for federal spending.

“No one should be denied a college education just because they don’t have the money,” the president said. “Two years of college will become as free and universal as high school is today.”

Absolutely correct. By why just two years? Why not four years? Why not post-grad? There are no good reasons other than the wrong-headed Big Lie that the federal government “can’t afford it.” That, together with the belief that no one should be given anything, are why the U.S. is sinking among nations.

But perhaps the most important reason: The rich do not want the rest of us to be educated, because education helps narrow the Gap between the rich and the rest. And that is why you will see the Republicans fight this with all their strength.

The president said his proposal is “not a free lunch” because students would need to keep their grades up to qualify.

“There are no free rides in America,” Mr. Obama said. “Students would have to do their part by keeping their grades up. This isn’t a blank check.”

There’s that evil word “free.” No free lunch. No free ride. No blank check. “Do their part.” What is this strange obsession Americans have with self-sufficiency?

Democratic lawmakers reacted favorably to the proposal. But Republicans in Congress questioned how the administration intended to pay for it.

Answer: By simply creating the dollars to pay for it. That is the fundamental purpose for a nation to be Monetarily Sovereign.

Rep. Diane Black, Tennessee Republican, noted that the state’s program is paid for by a lottery reserve fund that she said doesn’t result in added cost to taxpayers.

Uh, excuse me Rep Black, but who are those people buying stupid lottery tickets? Aren’t they taxpayers? And aren’t the vast majority in the lower 99% income groups?

“By contrast, the president’s proposal appears to be a top-down federal program that will ask already cash-strapped states to help pick up the tab,” she said. “Will the president offer proposals to make his plan budget-neutral, or will he attempt to charge it to the credit card?”

Get it? Republican Rep. Black doesn’t want the “cash-strapped states” paying for it (which is a legitimate concern), but she also doesn’t want the federal government to “charge it to the credit card.” In short, she doesn’t want anyone to pay for it.

Cory Fritz, a spokesman for Speaker John A. Boehner, Ohio Republican, said the plan lacks details. “The speaker is for making college opportunities more available but the White House needs to fill in the blanks, starting with the cost to taxpayers,” Mr. Fritz said.

Oh yes, the Speaker surely wants to make college opportunities more available, so long as there is no cost to the federal government. How that works, no one knows. It’s just more of the “cost to taxpayers” Big Lie. Maybe if we shout it would help: FEDERAL TAXPAYERS DO NOT PAY FOR FEDERAL SPENDING.

The federal government should pay for public college and beyond, just as the states and cities pay for public grades K-12. (In fact, the federal government, having unlimited funds, should pay for K-12 too.)

But many things stand in the way of American progress:

-The silly, “no free lunch” attitude.

-The equally silly, “John Wayne self sufficiency” attitude.

-The false hubris that “we already are the best.”

-The desire by the rich to keep the rest down, so as to widen the Gap between the rich and the rest.

-The Big Lie that says the federal government “can’t afford” to spend more on education (and that his will cause hyperinflation).

-The desire of the idea-devoid Republicans to smash down anything Obama.

And that little trial balloon floats among the pins, threatened by pricks.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

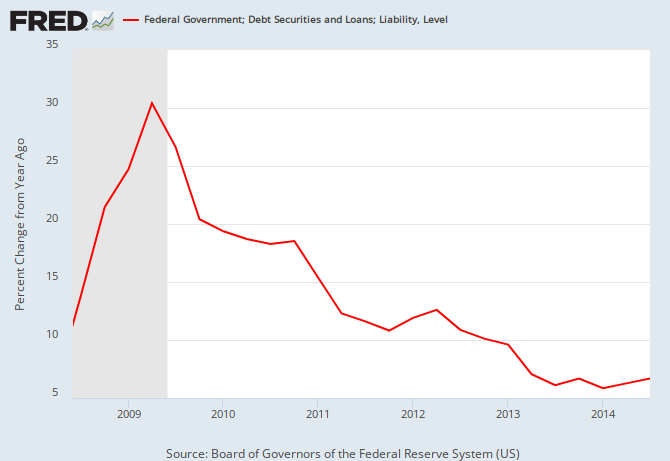

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY