An alternative to popular faith

I recently read an article containing wonderment that despite good news (the April jobs report showed payrolls grew by 290,000) the stock market crashed. The author, John Curran, speculated: “One reason is that the Euro crisis in spite of all efforts remains very much a crisis, and that threatens the global economy. The second reason is that Thursday’s stock market blowout pointed up a dangerous vulnerability in the financial markets, one that we’ve known of (high frequency trading) but sort of forgotten. Third, the Labor Department’s jobs report while positive in some respects also contained a bit of negative news […] (increased unemployment).

While the Greek/EU situation is serious, it will not seiously affect the U.S. economy, so long as our government continues to deficit spend. Second, while high frequency, automated trading can cause short term, manic effects on the stock market, the longer term effects are minimal. Finally, the way unemployment is calculated (only those looking for a job are counted), makes it inevitable that when times improve, unemployment statistics rise. People who had given up, start again to look for jobs. So from that standpoint, the stock market is wrong.

There is one other scenario, that could have far greater significance than any of the above: The off shore oil well blowout. Not only will it cause enormous destruction in of itself, but it will prevent further offshore drilling for an unknown time. Weeks? Certainly. Months? Possibly. But weeks and months are no big deal.

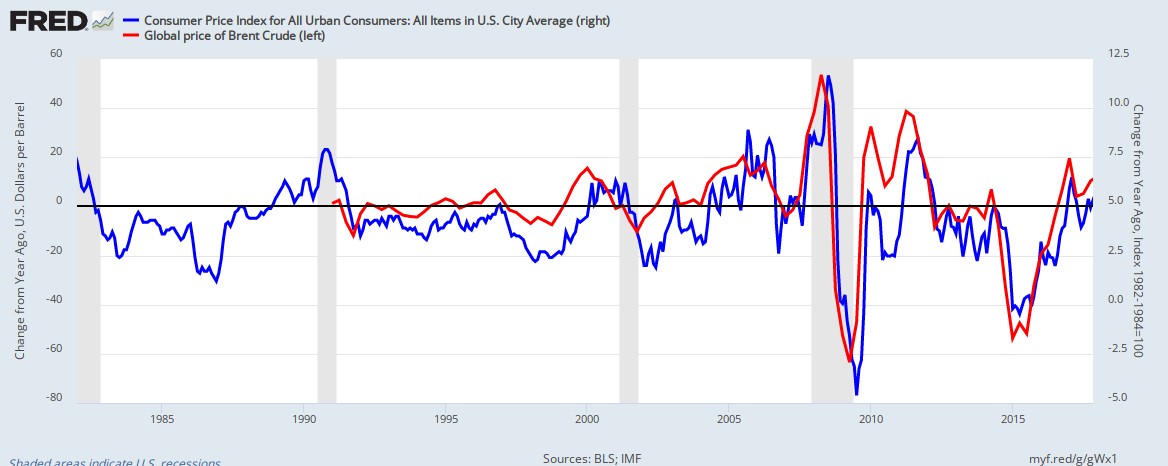

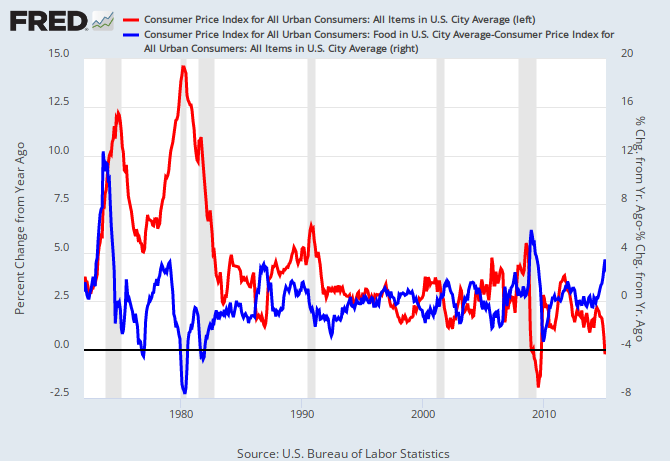

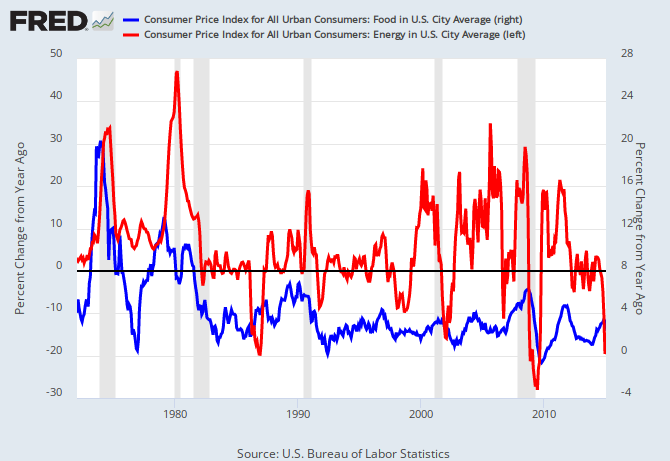

Perhaps even years, and that is a big deal for our economy. For the past few decades, inflation has been caused, not by deficit spending, but by Oil Prices.

Even with the worst case scenario, the actual supply loss won’t be felt soon, but if the projected loss of oil production is significant, it will cause oil prices to rise, thus causing inflation. The debt hawks will assume (wrongly) the inflation is caused by deficits, and will demand that taxes be increased and spending decreased — either of which will stall economic growth and move us into a recession.

And that will drop the stock market.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity