Mitchell’s laws: Reduced money growth never stimulates economic growth. To survive long term, a monetarily non-sovereign government must have a positive balance of payments. Austerity breeds austerity and leads to civil disorder. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

Hide your wallet. The idiot patrol (aka The Committee for a Responsible Federal Budget) is on the loose, again.

Committee for a Responsible Federal Budget | 1899 L Street, Suite 400 | Washington | DC | 20036

House and Senate Join Together in “Go Big” Effort November 16, 2011Today, in a rare bipartisan, bicameral showing, Republican and Democratic members of the House and Senate joined together to call for the Super Committee to think big on debt reduction. In recent weeks, 100 members of the House and 45 senators from both sides of the aisle have urged the Super Committee to propose at least $4 trillion in savings over ten years, well above the Committee’s $1.2 trillion mandate.

“If it wasn’t clear before that there’s a serious bipartisan and bicameral effort in support of a $4 trillion savings package, then it is now,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “What the Super Committee is working on by putting everything on the table in search of a compromise is so important, and those 12 lawmakers should know that they are supported by a large group in the House and Senate on both sides of the aisle.”

Today’s renewed support for a Go Big approach to debt reduction comes as the 12 members of the Super Committee enter the final days of negotiations. The Committee has until November 23 to vote on a final package of reforms.

“It’s up to the Super Committee and leaders in Congress to heed the calls that so many of their colleagues are making and to capitalize on this unique opportunity of a fast-track process and the undivided attention of the American public,” added MacGuineas. “But this group of lawmakers is not alone — there are business leaders, small business owners, everyday Americans, former government officials, economists, policy experts, and many others also supporting this effort to ‘Go Big.’ This is such an important moment, and with the world watching, failure just cannot be an option. Getting a big deal passed may actually prove to be easier from a political perspective, and it has the added benefit of being what we need to do for the fiscal and economic health of the nation.”

Hey, you call $4 trillion “big”? That’s nothing. Why not $10 trillion? Or $20 trillion? Why not really bankrupt the nation?

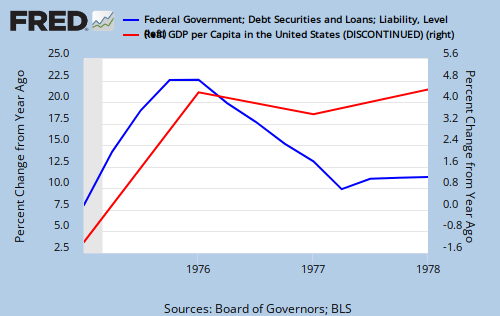

But, I continue to fret about one small question. I almost hate to mention it, but: How do deficit cuts reduce unemployment or grow the economy? We never see any answers to that question.

As a reminder, here are charter members of the idiot patrol: Bill Frenzel, Jim Nussle, Tim Penny, Charlie Stenholm, Maya MacGuineas, Barry Anderson, Roy Ash, Erskine Bowles , Charles Bowsher, Steve Coll, Dan Crippen, Vic Fazio, Willis Gradison, William Gray, III, William Hoagland, Douglas Holtz-Eakin, Jim Jones, Lou Kerr, Jim Kolbe, James McIntyre, Jr., David Minge, June O’Neill, Paul O’Neill, Marne Obernauer, Jr., Rudolph Penner, Peter Peterson, Robert Reischauer, Alice Rivlin, Chuck Robb, Martin Sabo, Alan Simpson, John Spratt, Gene Steuerle, David Stockman, John Tanner, Laura Tyson, George Voinovich, Paul Volcker, Carol Cox Wait, David M. Walker, Joseph Wright, Jr.

At some point in the future, they all will deny having any association with the idiot patrol, and will admit that cutting the money supply to stimulate economic growth is like applying leeches to cure anemia.

Five dunce caps, not just for failure to understand Monetary Sovereignty, but for ignorantly lending their names to an organization whose efforts could help destroy our nation:

That brings to 1083 the total dunce caps awarded. Soon, I expect members of the idiot patrol to demand I “go big” by reducing my unsustainable dunce cap awards.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. The key equation in economics: Federal Deficits – Net Imports = Net Private Savings

MONETARY SOVEREIGNTY