The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==========================================================================================================================================

*Contributions by Warren Mosler and Randall Wray

11/5/08: The dual needs to stimulate the economy and to provide more health care and retirement funds, provide us with the rare opportunity to do both at one stroke. I recommend we eliminate the FICA tax and instead, fund Social Security and Medicare the same way we fund the military and every other federal agency. Recognizing this is a controversial and counter-intuitive suggestion, I offer ten rationales for discussion:

1. The Social Security part of FICA is a severely regressive tax, unfairly impacting the salaried middle classes far more than the non-salaried or upper income classes. Currently, salaries above $102,000 do not pay FICA for Social Security. Non-salaried people pay nothing.

2. The Social Security part of FICA is a double tax. Salaried workers pay taxes on their FICA contributions and again pay taxes when they receive benefits. Although Social Security is quasi-insurance, no other insurance collects taxes on premiums and on benefits.

3. Eliminating FICA would put more money in the pockets of salaried consumers, stimulating consumer buying and saving – exactly what the economy needs now.

4. Eliminating FICA would give business more money for investment and payroll – the other thing the economy needs now.

5. There are 400+ federal agencies, including all the military agencies, all the Departments, and dozens you never have heard of. When the military needs money to pursue the wars in Iraq and Afghanistan, Congress quickly votes hundreds of billions of dollars to this effort. No tax covers this budget. When the economy needed a stimulus, Congress quickly voted $150 billion to this effort. No earmarked tax was passed. When Freddie Mac and Fannie Mae ran into financial difficulties, the Treasury immediately gave them a blank check. Recently, another $700 billion was voted, and again, no new taxes were levied to cover this government expenditure. The current, annual cost of Social Security and Medicare totals about $1 trillion, well within the government’s proven spending range.

6. The government neither needs nor uses FICA money. In 1971, President Nixon eliminated the final connection between gold and U.S. money. His purpose: To give the government the unlimited power to create money. Even with the current trillion dollar bailout, no additional taxes have been levied. In fact, both presidential candidates promise to reduce taxes, and no federal check ever has or will bounce. There literally is no limit to the amount of money the federal government can create, and no limit to the size of the debt it can support.

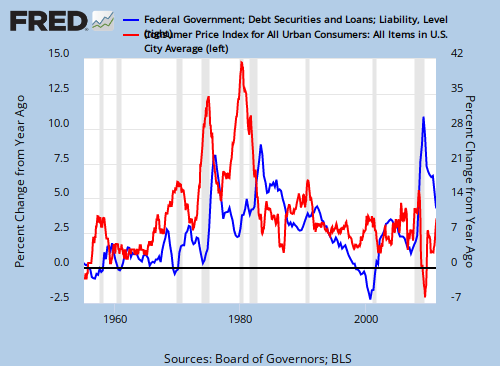

7. There is no historical data to demonstrate that deficit spending inhibits gross domestic product, causes inflation or limits any other indicator of economic productivity, nor must federal debt be paid by taxpayers. President Carter oversaw modest deficits with high inflation and low economic growth. President Reagan oversaw huge deficits – the largest in American history – with low inflation and high economic growth. History shows deficits correspond with economic growth, and the larger the deficit, the healthier the economy. To date, the government has spent $10 trillion that has not cost taxpayers a cent.

8. Relying on FICA restricts Social Security benefits, which are too low to support even a modest lifestyle, and are received by too few people. The belief that Social Security and Medicare, uniquely among federal agencies, must be self-funding, causes political leadership to search for impossible “fixes,” something akin to searching for two quarts of water in a one quart bottle. Inevitably, these fixes involve higher taxes and/or reduced benefits, both of which hurt our citizens, our businesses and our economy. The world’s wealthiest country needs to, and can afford to, eliminate FICA taxes while supporting more people with higher benefits.

9. Funding Medicare through FICA limits the number of people covered, now mostly older people. But 40 million Americans do not have health insurance. Either they can’t afford it or have pre-existing conditions. Medicare coverage for these other groups would solve that serious, national problem and stimulate the economy for all.

10. Funding Medicare through FICA limits the size of Medicare payments. America has a severe shortage of doctors and nurses. But limiting the size of benefits has the unintended consequence of discouraging our best and our brightest from entering medicine or from participating in Medicare. A growing number of “boutique” doctors, who do not accept Medicare payments, charge fees only wealthier patients can afford. Federal funding of Medicare could provide better health coverage for Americans.

I first recommended this in my 1995 book, The Ultimate America.

Rodger Malcolm Mitchell

For more information, see http://www.rodgermitchell.com