The debt hawks are to economics as the creationists are to biology. Those, who do not understand Monetary Sovereignty, do not understand economics. If you understand the following, simple statement, you are ahead of most economists, politicians and media writers in America: Our government, being Monetarily Sovereign, has the unlimited ability to create the dollars to pay its bills.

==========================================================================================================================================

Some have asked what is the difference between Monetary Sovereignty (MS) and Modern Monetary Theory (MMT). Others use the terms interchangeably.

Actually, while both share many features, there are differences. Both understand that the U.S. federal government is Monetarily Sovereign, while euro nations, and U.S. states counties and cities are monetarily non-sovereign. Monetarily Sovereign governments uniquely:

–Have the unlimited ability to credit bank accounts (pay bills), including their own

–Neither need nor use taxes or borrowed funds to support spending

–Rely on continually increased deficits, rather than on exports, to support economic growth

And, there are additional similarities, related to, and/or derived from, the above.

Two differences should be noted, one not particularly important and one quite important. Of lesser importance: MMT says the purpose of taxes is to create demand for money. The requirement that taxpayers use dollars creates the need for taxpayers to accept dollars as payment for debts.

MS doesn’t deny that taxes help create demand for dollars, though other factors may be sufficient. Perhaps the most important factors are: Dollars are legal tender and dollars are commonly used and accepted by the vast majority of Americans and the world (which does not pay U.S. taxes).

Yet, even were the MMT position to be correct, it is clear that federal taxes are not necessary for demand purposes, as there are adequate state and local taxes, all of which are paid in dollars, making the point moot. After some discussion, I believe MMT now accepts the position that federal taxes are not necessary to create demand for dollars.

The more important difference between MS and MMT is the handling of inflation. MS suggests increasing interest rates when inflation threatens. MMT holds that increasing interest rates exacerbates inflation by increasing costs, and that the correct prevention/cure for inflation is to reduce federal deficits, with higher taxes and/or with reduced federal spending.

MS says:

1. Deficits have not been related to inflation for at least 40 years. Instead, inflation has been related to oil prices. Since deficits have not been the cause, reducing deficits is not the cure.

2. Reduced federal deficits lead to recessions and depressions, meaning the MMT approach leaves a poor choice between inflation and recession, or a very difficult balancing act between the two.

3. Reducing federal deficits cannot be done quickly or incrementally. The questions surrounding which taxes to raise or which spending to cut are slow, difficult, cumbersome and politically charged, as witness the repeated battles over the debt ceiling. Deficit control is ill suited to inflation fighting, which needs fast, incremental action.

4. Interest is a minor cost for most businesses, and an increase in interest rates represents a minuscule increase in business costs – not enough to affect pricing significantly.

5. Money is a commodity, the value of which is determined by supply and demand. Demand is determined by risk and reward. The reward for owning money is interest, so when interest rates increase, investment tends to flow to money (i.e. bonds, CDs, money markets), increasing the value of money. When interest rates fall, investment tends to flow to non-money (stocks, real estate), reducing the value of money. Increased money value is the prevention/cure for inflation.

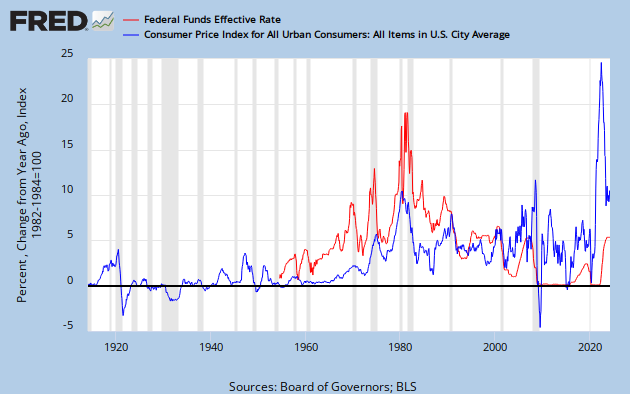

There isn’t definitive evidence supporting either the MMT or MS position, though there are some hints. There actually is something of a parallel between higher Fed Funds rates and higher inflation, which at first glance might support the MMT position.

However, because the Fed raises interest rates in anticipation of inflation, this parallel is to be expected. Timing is key. If high rates fight inflation, one would expect to see rates rise as inflation rises, with the highest rates followed by reductions in inflation. The above graph seems to show a Fed raising interest rates in anticipation of inflation, then reducing rates as inflation moderates.

(Unfortunately, the picture is blurred by the Fed’s use of interest rates not just to cure inflation but in a misguided attempt to stimulate the economy.)

In any event, the Fed’s following of the raise-rates-to-prevent/cure-inflation prescription seems to have been successful. Despite massive deficits in the past, particularly during and after the Reagan administration, and despite significant increases in the price of oil (the prime driver for inflation) the Fed has been able to keep inflation close to its 2%-3% annual goal. Tax policy has not been involved.

Though substantial reductions in deficits could cut inflation (by causing recessions or depressions), I’ve encountered no good arguments this would be a wise strategy. Recessions and depressions are a poor solution for inflation.

I do see historical evidence that interest rate control has been an effective means for inflation control.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. It’s been 40 years since the U.S. became Monetarily Sovereign, and neither Congress, nor the President, nor the Fed, nor the vast majority of economists and economics bloggers, nor the preponderance of the media, nor the most famous educational institutions, nor the Nobel committee, nor the International Monetary Fund have yet acquired even the slightest notion of what that means.

Remember that the next time you’re tempted to ask a dopey teenager, “What were you thinking?” He’s liable to respond, “Pretty much what your generation was thinking when it screwed up the economy.”

MONETARY SOVEREIGNTY