The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==========================================================================================================================================

The Fed raises interest rates to fight inflation. To fight recession, the Fed does the opposite. It cuts interest rates.

This may sound logical except for one, very small detail. The opposite of inflation is not recession. The opposite of inflation is deflation. So doing the opposite of what you would do to counter inflation makes no sense when trying to counter a recession.

We could have a recession with deflation. We could have a recession with inflation, which is called “stagflation.” The history of Fed rate cuts, as a way to stimulate the economy, is not a good one. The Fed, under Chairman Greenspan, instituted numerous rate cuts. The result: A recession that President Bush’s tax cuts cured.

The Fed, under Chairman Bernanke, instituted numerous rate cuts. The result: The 2008 recession.

Why does popular faith hold that cutting interest rates stimulates the economy? Because popular faith views only one side of the equation. But, for each dollar borrowed a dollar is lent. $B = $L.

Cutting interest rates does cost borrowers less. A business needing $100 million might be more likely to borrow if interest rates are low than when they are high. Further, consumers are more likely to spend when borrowing is less costly. So making borrowing less costly stimulates business growth and consumer buying. At least, that is the theory.

What seems to be ignored is the lending side of the equation. When interest rates are low, lenders receive less money. And who are the lenders? Businesses and consumers.

You are a lender when you buy a CD or a bond, or put money into your savings account. When interest rates are low, you receive less money, which means you have less money to spend on goods and service — which means less stimulus for the economy.

In short, interest rates flow through the economy, with some people and businesses paying and some receiving. Domestically, it’s a zero-sum game — except for the federal government.*

A growing economy requires a growing supply of money. Cutting interest rates does not add money to the economy. That is why there is no historical correlation between interest rates and economic growth. During periods of high rates, GDP growth is not inhibited. During periods of low rates, GDP growth is not stimulated.

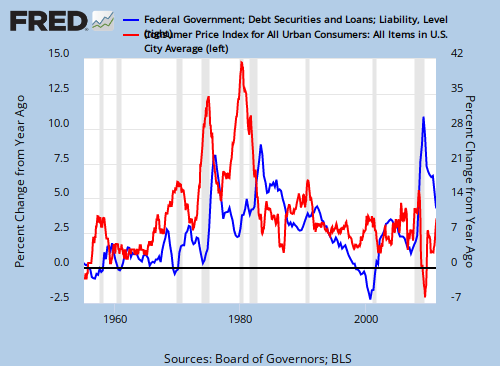

Please review the following graph:

Blue is interest rates. Red is GDP growth. Not only are low interest rates not associated with high economic growth, but the opposite seems to be true. There seems to be a correlation between high interest rates and high GDP growth. How can this be?

*When interest rates are high, the federal government pays more interest on T-securities, which pumps more money into the economy. This additional money stimulates the economy.

This shows why the Fed’s repeated rate cuts do not seem to stimulate the economy. The action has been shown, time and again, to be counter-productive. Cutting interest rates to stimulate the economy is like pouring water on a drowning man.

Do you remember these headlines: “Employers slashed 80,000 jobs in March.” “The U.S. central bank has lowered rates by 3 percentage points since mid-September” “The loss of jobs signals another interest rate cut by the Federal Reserve later this month.” “Federal Reserve Chairman Ben Bernanke acknowledged Wednesday that the country could be heading toward a recession, saying federal policymakers are ‘fighting against the wind’ in combating it.”

Rate cut after rate cut did nothing. So what was the Fed’s plan? More rate cuts. During the previous recession, the Fed also attempted rate cut after rate cut, also to no avail. The recession, finally ended with the Bush tax cuts. The Fed has not learned from experience, but stubbornly adheres to the popular faith that interest rate cuts stimulate the economy.

Rate cuts do not stimulate the economy. They never have. They never will.

“Stimulating” an economy means making it larger. A large economy requires more money than does a smaller economy. Therefore, the only thing that stimulates the economy is the addition of money.

Rate cuts, by reducing the amount of interest the federal government pays, actually reduce growth of the money supply. We are on the edge of a recession, because the economy is starved for money. The coming “stimulus” checks will help, but they are too little and too late. This should have been done months ago, and the amounts should be far larger.

The only way to prevent or cure a recession: Federal deficit spending. There is no excuse for recession or inflation. These problems are not economic failures. They are leadership failures.

Rodger Malcolm Mitchell

For more information, see http://www.rodgermitchell.com