Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

======================================================================================================================================================================================================================================

In comment #4. in the post titled, “Obama joins the Tea Party,” Tyler F. asked, “If you had 3 minutes to speak at a town hall meeting, what would you say?”

Well, three minutes could be a problem, only because so many questions remain unanswered, and for something most people are not prepared to understand, much less believe, the racetrack approach doesn’t work.

Nevertheless, given perhaps five minutes, I might say something like this:

In just five minutes, I can show you how to cure America’s economic problems.

The U.S. became Monetarily Sovereign in 1971, when we went off the gold standard. That change was so counter-intuitive, few economists, politicians or media writers understand it.

Unlike you and me, unlike the states, counties and cities, unlike Greece and Ireland, a Monetarily Sovereign nation has the unlimited ability to pay its bills. I must live within my means. The federal government has no means to live within. You must have a source of money before you spend. The government creates money by spending. The financial rules that apply to you and me, do not apply to the government.

Something else counter-intuitive: The dollar does not exist. Just as the number seven does not exist, the dollar merely is a balance sheet number. If you own a home, you have a title; it is evidence you own the home. But the title is not the home. Similarly, that dollar bill in your wallet is not a dollar. It is a title; it is evidence you own a dollar.

Because a dollar is just a balance sheet number, the federal government has the power to create and destroy dollars, merely by changing numbers. When you receive a government check, that check is not money. It is a set of instructions telling your bank to change the number in your bank account.

Your bank account number goes up, and a government balance sheet number goes down. No dollars move from the government to you. Dollars can’t move because dollars don’t exist. Your bank could be on Mars, and the government could pay you by changing the number in your bank account. That is the meaning of Monetarily Sovereign – infinite control over sovereign currency.

So, how is it possible for a Monetarily Sovereign nation to run short of its sovereign currency? Why would a nation, that can pay all its bills by changing bank account numbers, ever need to borrow its own currency? Why would a nation with infinite control over its sovereign currency, need tax money to pay its bills?

The answers are: The U.S. government never can run short of dollars. The U.S. government no longer needs to borrow money or to levy taxes. Borrowing and taxing are relics of the gold standard. To pay its bills, the U.S. government simply changes numbers in bank accounts.

So, what is the purpose of the debt ceiling? Answer: It has no purpose. It too is a relic of the gold standard.

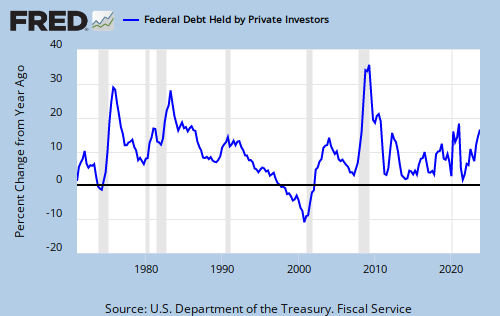

By definition, a large economy contains more dollars than does a small economy. So, to grow from smaller to larger, an economy must have a growing supply of dollars. The government adds dollars to the economy by deficit spending, that is by changing numbers in bank accounts.

Why then does Congress wish to reduce deficit spending? Because Congress does not understand Monetary Sovereignty.

So, what about inflation? The value of money is based on supply and demand. Demand is based primarily on the reward for owning money, which is interest. So, preventing inflation requires reducing the money supply or increasing interest rates. However, reducing money supply growth historically has led to recessions and depressions. That is why the Fed controls inflation by raising interest rates.

To summarize, There is a simple and direct solution for our economic problems: Grow the economy with federal deficit spending, and use interest rate control to prevent excessive inflation.

Yes, this could be cut to three minutes, but people need more time to absorb a counter-intuitive concept. Even five minutes doesn’t really do it.

That’s why town hall meetings are not informative but rather are stage shows for the amusement of the audience.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY