Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================================================================================================

If you drove your car onto a railroad track, while a train was bearing down on you, would you worry about the price of gas, or would you step on the accelerator to get out of the way?

Clearly, the more immediate problem is the train. But according to debt-hawk thinking, you should ignore the immediate problem and wait until gas prices come down. Today, the Tea/Republican party is worried that federal servicing of deficits causes inflation . They wrongly claim that for the federal government to service larger deficits, it must “print” so much money eventually there will be inflation, even hyperinflation..

As always, the Tea/Republicans are wrong: Federal government borrowing does not increase the money supply. Borrowing is a simple asset exchange, in which T-securities are created and traded for dollars, which are destroyed. The servicing of federal debt is the exact opposite. Dollars are traded for T-securities and the T-securities are destroyed. During the entire process, no inflationary money is created.

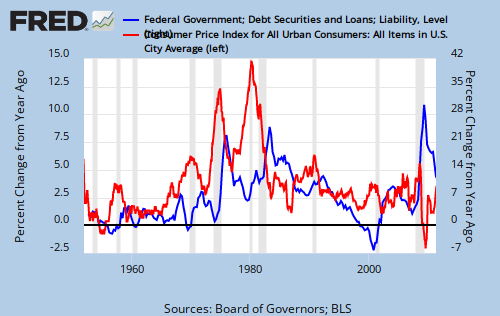

Which is one reason federal deficit spending has not been associated with inflation since 1971, when we went off the gold standard and became Monetarily Sovereign. (See the following graph)

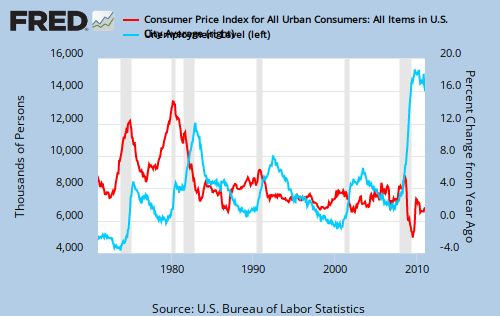

Yes, let’s forget that the Tea/Republicans simply do not know what they are talking about from a factual standpoint, and instead let’s focus on priorities. Look at the graph below, and tell me whether today’s priority is inflation or recession/joblessness.

Clearly, today’s priority is the weakness of the economy and unemployment. The economy is starved for money. To treat a starving patient, you must feed him. How do you feed a starving economy? By giving it money. How do you give an economy money? Via federal deficit spending.

But, debt-hawk Tea/Republicans will tell you that adding ”infinite” money to the economy (a straw man nobody is recommending) will cause inflation and even hyperinflation. Oh really?

Here is an excerpt from an article in Time Magazine:

Inflation Falls: Is the Economy Saved or Doomed?

Posted by STEPHEN GANDEL Friday, July 15, 2011Gas prices fell last month, prompting the first drop in overall prices in a year. (Lucy Nicholson / Reuters)

Inflation in June fell for the first time in a more than a year. The Consumer Price Index (CPI), which is the government’s most widely watched gauge of what the things average Americans buy cost, fell 0.2% last month. The drop was mostly driven by a fall in gas prices, which were down nearly 7% alone in June.

Lest you think that gas prices were the sole cause of low inflation, take another look at the first chart. The red line is total Consumer Price Index. The black line is CPI less food and energy. Both are headed down.

And, even when inflation eventually crops up, the Fed can increase the value of the dollar (fight inflation), by raising interest rates to increase the demand for money. That is the way the Fed has controlled inflation for many years.

So tell me, which is the more immediate problem, the recession/joblessness or inflation? Are you the type who would not drive off the tracks until gas prices come down? If you are, then welcome to the Tea/Republican Party.

Historians will look back at 2011 and shake their heads at the suicidal bent of the Tea/Republicans and even the Democrats. The notion that federal deficit spending, which adds money to the economy, should be reduced at a time of economic starvation, is so unbelievably wrong-headed, future economists will say, ‘What were these fools thinking? At just the time they should have been adding money to the economy, they were searching for ways to bleed money out of the economy.

Of course, The debt debate has nothing to do with the economy. It’s just economic blackmail for political power. Neither the Democrats nor the Tea/Republicans give a damn about the people of this nation. The sole concern is who wins the next election. So when you see these phonies, giving their speeches (inevitably standing in front of American flags, the bigger the better), realize they don’t care about America. Not even a little bit. It’s all about them and their lust for power.

What would you call a person, who deliberately endangers America, who actually is willing to sacrifice America, just to advance his own career? I’d call him a traitor.

That will be the legacy of today’s politicians, and the media and old-line economists who went along with this travesty, and that is the pain our generation will cause our children and our grandchildren.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY