The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

================================================================================================================================================

Each day I become more convinced that being a member of the Tea Party is a litmus test for childishness. Back in April, I wrote the post “What does the Tea Party want?” in which I explored some of the truly inane pronouncements by this group. It is an amazing attribute of the human species that anything sober and logical (Monetary Sovereignty) will be rejected by a large group, but anything outrageously juvenile (Lady Gaga) will be revered by an even larger group.

In the earlier post, I commented not only on the Tea Party’s adoration of such sages as Sarah Palin and Christine O’Donnell, but it’s hopelessly confounding message:

Unfortunately for Tea Party “logic,” they not only want lower taxes, but lower deficits and less government. At the same time, they want a stronger army, better schools, federal supervision of banks and other financial firms, better roads, defense of our borders, less crime, more guns, defense against terrorism, safer food, better retirement, better unemployment insurance, police, health care, rescue from hurricanes and other disasters, more jobs and a better environment.

I reminded readers that what the Tea Party wants costs money, the money they don’t want the government to spend. But now that bit of TP logic has been superceded by the next puerile demand, to which the eagerly submissive GOP has agreed. Not only must the House of Representatives waste an hour or a day listening to someone read the U.S. Constitution aloud (“Now follow along, children. See Spot jump.”), but every new bill must contain a statement by the lawmaker who wrote it citing his constitutional authority to enact the legislation.

Puleeze. The most contentious bill passed by Congress – hated by the TP – already contains such a statement, and that hasn’t prevented two judges from ruling one way and a third judge from ruling the other. What is called the “Individual Mandate” of the Patient Protection and Affordable Care Act already includes these sentences:

The individual responsibility requirement provided for in this section (in this subsection referred to as the requirement) is commercial and economic in nature, and substantially affects interstate commerce . . . In United States v. South-Eastern Underwriters Association (322 U.S. 533 (1944)), the Supreme Court of the United States ruled that insurance is interstate commerce subject to Federal regulation.

Well, I guess that should satisfy the TP.

The problem is that the Constitution was written 200+ years ago to address problems of the time, and must be interpreted to address today’s problems. And while “originalist” Justices Antonin Scalia and Clarence Thomas claim to have special insight into the original intent of the Constitution framers, they don’t, they don’t even try, and anyway, why should anyone want that?

The Supreme Court has nine members rather than just one, because the Constitution, like the Bible, is either vague, outdated or repeatedly misconstrued concerning almost all we wish to know. Every Justice has pledged to obey the Constitution, yet seldom do we see a 9 – 0 decision. Does this mean some Justices intentionally disobey the Constitution every business day?

Reality check: The true issue is not whether a law obeys or disobeys the Constitution, but rather, whether the sponsors are Democrats or Republicans (aka TP sycophants). But that bit of truth does not perturb the TP members, who live in a magical world of dreams, where all wishes come true, even (especially?) those that are self-conflicting.

It seems our Representatives prefer time-wasting, populist, pandering nonsense, to actually learning about, and coming to grips with, real problems, which is why the recovery has been so slow, and why millions of Americans have no jobs, no homes, no health insurance and no retirement.

What next from the Guns ‘n’ God Group? A rule that the House must stand and recite the Pledge of Allegiance every day?

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

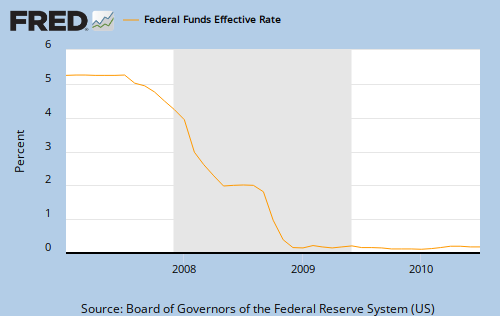

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”