Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

================================================================================================================================================================================================================

Thirteen months ago, I published a post titled, “Is federal money better than other money.” I believed it was one of the more interesting posts in this long series, because it showed that while reduced federal debt growth led to recessions, increased non-federal debt growth also led to recessions.

At the time, the data stopped at February, 2002. I now have brought the data forward, and am republishing. These new data support the previous findings.

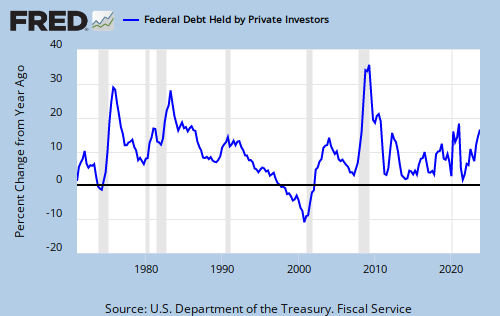

In other posts on this blog, we have discussed how reductions in federal debt growth, as shown by the following graph, “Federal Debt Held By Private Investors,” immediately precede recessions. This comes as no surprise, since a growing economy requires a growing supply of money, and deficit spending is the federal government’s method for adding money to the economy.

Clearly, federal debt/money growth is essential to keep us out of recessions. Yet, when we look at “Debt Outstanding Domestic Nonfinancial Sectors” which includes not only Federal debt, but also outstanding credit market debt of state and local governments, and private nonfinancial sectors (tan line), we do not see the same pattern.

In fact, when we subtract federal debt from total debt, leaving only state, local and private debt, we see the opposite pattern. Recessions follow increases in state, local and private debt!

STATE, LOCAL AND PRIVATE DEBT, PERCENT CHANGE FROM YEAR AGO

Now in one sense, money is money. Your buying on your credit card creates debt/money, just as federal deficit spending creates debt/money. Presumably, both should have the same stimulative effect on the economy. They do, but not long term. Why?

Because, unlike the federal government, you, your business and local governments cannot create new money endlessly to service your debts. Your debts can pile up to the point where you must liquidate them by paying them off or by going bankrupt. When non-federal debts become too large, a growing number of people, states, cities and businesses must pull back and stop further borrowing, i.e. stop creating money, or even destroy money by paying off loans. When that happens, we have a recession.

(As an aside, this is one reason the early stimulus efforts had so little effect. People used the stimulus money to pay off loans, so while the federal deficit spending created money, the loan pay-downs destroyed it. Debt reduction destroys debt/money.)

During the recession, and for a short time after, we tend to cut back on our personal borrowing and liquidate debt/money. Then we begin to resume borrowing, more and more, until again, we hit our personal limits and cut back, causing yet another recession. The sole prevention of this cycle, which averages about 5 years in length, is to make sure that federal deficit spending grows sufficiently to offset periodic money destruction by the private sector.

In summary, federal deficit spending is good for the economy, always good, endlessly good (up to the point of inflation). Private and local government spending/borrowing also is good, but not endlessly. Unlike the federal government, the private and local-government sectors eventually reach a point where debt is unaffordable and unsustainable.

To prevent recessions, the government continuously must provide stimulus spending, then provide added stimulus spending to offset the periodic reduction of money creation by the private sector.

__________________________________________________________________________________________________________________________

These data call into question the popular belief that encouraging bank lending stimulates the economy. While short-term effects may be positive, long-term bank lending seems to lead to recessions, as servicing loans becomes ever more onerous for the monetarily non-sovereign sectors. In contrast, Federal deficit spending easily is serviced by the government, and therefore is preferable to private borrowing as a stimulus.

__________________________________________________________________________________________________________________________

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty says: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY