The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

======================================================================================================================================================

Here is an article from the Washington Post, demonstrating how ignorance of Monetary Sovereignty is destroying our economy.

Recession-bruised states’ revenue sank 30 percent in 2009, Census Bureau reports

By Michael A. Fletcher, Washington Post Staff Writer , Wednesday, January 5, 2011; 11:09 PMThe recession blew a huge hole in the already shaky finances of state governments, causing them to lose nearly one-third of their revenue in 2009, according to a Census Bureau report released Wednesday. . .

At the same time, states are grappling with swollen social service caseloads, underfunded pension funds and flat revenue – a situation that will worsen as federal stimulus aid comes to a halt in the coming months.

Future federal help is considered highly unlikely, as Congress and President Obama have put a greater emphasis on reducing spending and trimming the huge federal budget deficit.

The new census report adds to the bleak portrait that has emerged from other studies documenting the damage caused by the economic downturn, while making plain that states are likely to continue struggling fiscally for years.

“This report paints a fairly compelling picture of the impact of the recession on states,” said Susan K. Urahn, managing director of the Pew Center on the States. “There are many states predicting that they’re not going to return to pre-recession levels of revenue until 2014.”

Our Monetarily Sovereign, federal government, which has the unlimited ability to create money and pay bills of any size, refuses to give the states the support they need. Meanwhile the monetarily non-sovereign states, which do not have money-creating ability, suffer, and more importantly, we citizens suffer from reduced services and increased taxes.

Education, police and fire protection, roads and bridges, medical services, pensions and on and on, all reduced while our federal government sits on its unlimited pile of cash. Our federal leaders believe they are being fiscally prudent, while in fact, they are destroying America.

Their ignorance hurts us all.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”

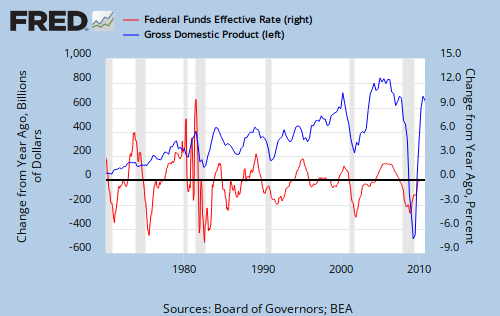

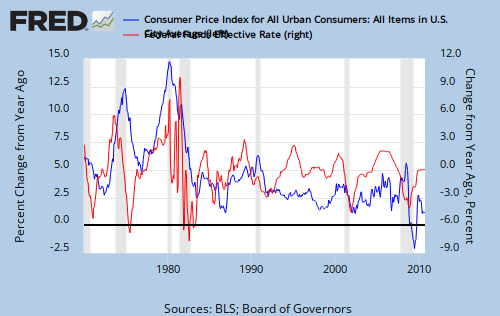

that seems to indicate interest rate increases are followed about one year later by inflation decreases.

that seems to indicate interest rate increases are followed about one year later by inflation decreases.