Mitchell’s laws:

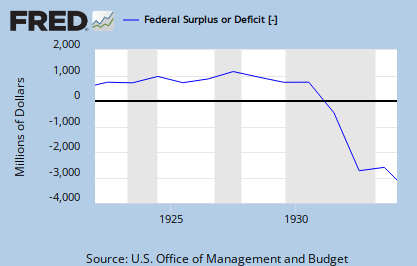

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

==========================================================================================================================================

In the past day or two, I’ve been involved in a Facebook discussion about the federal deficit. The discussion began when Stephanie Kelton (Chair of the economics department at the University of Missouri, Kansas City) and I were talking about her frequent efforts to educate regarding MMT and Monetary Sovereignty.

I wrote to Stephanie,

Good work with your continuing efforts to educate the public. Unfortunately, we’re working against misinformation spread by upper .1%, which funds our political leaders, and wants the income gap to widen.

It is 100% impossible that the Obamas, Geithners and Bernankes of the world do not understand Monetary Sovereignty. They understand, but they are paid by the .1% to fool the public.

I mention this, because it should be an important part of our message to the public. People ask me, “Why do you know this and our leaders don’t.” The implication is that I must be wrong. My response: “They know it, but don’t want you to know it.”

The people need an enemy, and that enemy is the .1%. Without an enemy, you can talk yourself blue, and no one will listen. That’s why religion has a devil, and that’s why the preacher always talks about the devil.

My suggestion: Every time you talk about the economy, explain the motive for federal “misunderstanding.” The .1% want the income gap to widen. If we all would do that, we could change the world.

She responded:

Rodger, I am mostly in agreement. I often tell stories that show this to be the case (albeit not in every interview or presentation). The one I like best is the Clinton-Eisner story. Robert Eisner had been Clinton’s teacher. When C was in office, he invited E to the White House, where he asked E what he thought of his economic policies. E responded, “Not bad, but you’ve got to know you’re dead wrong on SocSec.” [C talked about using the surplus to shore up SocSec, etc. E had written quite a bit on SocSec — my personal favorite was called Save Social Security from its Saviors.”] C responded, “I know, Bob. But you’ve got to understand — this is politics.”

I tell similar stories about conversations with lawmakers, including one with the chairman of the congressional black caucus, who listened to Warren and I explain government finance for about an hour and then looked at us and said, “I can’t say that.” Not “I don’t agree with that” or “you are wrong,” but “I can’t say that.”

Still, I think there are people like Bernie Sanders who genuinely believe that the government has to get the money from “somewhere” and that it really is not all that different from a household (except, perhaps, that it can remain solvent longer than you or I).

Then I responded to her:

Understood. They really may believe they can’t say it, or they may say they believe they can’t say it.. But you can say it. I can say it. Warren and Randy can say it. We all can say it. And we should say it and keep saying it as a fundamental part of our explanations.

People are more apt to believe if they not only see the logic, but understand why they’ve been told lies and who has been telling those lies. What we’ve been doing so far, hasn’t made much of an impact on the public. The people need a devil. We have to give them a devil.Religion has devils to convince the populace. It’s the only way we’ll undo the brainwashing by the .1%.

At that point, someone else joined the conversation. He objected to sounding “conspiratorial and having little evidence to back it up,” and “would avoid motives.”

I replied:

So you believe that President Obama and all his educated advisers, and Secretary of the Treasury, Tim Geithner and all his educated advisers, and Fed Chairman Ben Bernanke and all his experienced bankers, and all 535 members of the U.S. Congress, really do not understand that the U.S. is not running out of money? None of them?

You believe that Bernanke, the inventor of the “fiscal cliff” slogan, and all of the above experts, really do not understand that deficit reduction hurts the economy?

And despite our many years of trying to point out ignorance — an effort which has resulted in the above experts still “not understanding” and the vast majority of Americans also not understanding — you feel that educational effort, which has failed miserably, should continue as before?

And you believe the fact that all of the above educated people, specialists in their field, somehow cannot seem to grasp a concept so simple as Monetary Sovereignty — you feel that does not constitute evidence?

And you believe that sounding conspiratorial is reason enough not to say it . . . because if we say it, we might not be believed . . . just as we have not been believed all these years? (Was it Einstein who said, “Madness is doing the same thing over and over again, and expecting different results”?)

The question is: Why do they pretend not to understand? The answer: They are paid not to understand.

Who is paying them? The upper .1% income group.

How are they paid? Via political contributions.

Why are they paid? To increase the gap between the rich and the rest. Cutting the deficit increases the gap, because most federal spending benefits the lower income groups.

Why do the rich want the gap increased? The rich don’t care about absolute dollars. They care about comparative dollars. If everyone had a million dollars, no one would be considered rich. But if one person has a million, and everyone else has a quarter million, one person is rich. And if everyone else has a thousand dollars, that one person is very rich.

The more the .1% can press down the lower classes, the “richer” they will feel. So they spread the myth that deficits are too high.

For people to change beliefs, they need to understand the motive for the lie.

There is a conspiracy, and when that story is told, the public finally will accept that they have been brainwashed, why and by whom, and then — only then — will they be ready to accept Monetary Sovereignty.

We must do more than educate. We must tell people why they should be angry. We must tell them why they should be afraid. That is the only way they will be ready to accept a new idea.

Anger and fear are our strongest emotions. To effect changes in the brainwashed, we need to use those strongest emotions. Religion uses devils, anger and fear.

Or we can just keep doing what we have been doing, failing as we have been failing, and attributing it to ignorance. And we will be right. Our ignorance.

Shortly afterward, I followed up with:

there is one additional reason why the leaders lie to us, and it too has nothing to do with education, and will not be cured by education: They don’t trust us to use the information, properly.

They think, if the populace understood Monetary Sovereignty, the people would demand all sorts of free things, and this not only would close the gap (horrors!), but also could cause inflation. They think Congress would not be able to resist the calls for help, and so would spend uncontrollably.

The fault with that sort of thinking is that Congress always has the perfect bogeyman: Inflation. All Congress needs to say is, “We are in an inflation we can’t control by other means, so we have to level off our spending.” Done. Bernanke could name it the “Inflation cliff.”

Of course, that would happen many years down the line, after we have free Medicare for all, free schooling for all and a Social Security that pays an living benefit.

But the rich would hate it. How would they prove they are rich?

So that is how the rich are screwing you — by bribing and threatening our leaders with political support or non-support. How can you fight back?

Short of picking up pitchforks and torches, you can pick up paper and typewriter. You can contact your local newspaper and your national politician. You can tell them you know that the government cannot run short of dollars, and that it could provide free Medicare for everyone, and a living Social Security benefit, and eliminate FICA — all while cutting taxes.

You can tell the politicians, if they vote for these things, you’ll vote to keep them in office, but otherwise you’ll vote against them. And tell your newspaper you know about Monetary Sovereignty, and what they are publishing is bullsh*t, and you’ll keep writing until they come clean. Teach them anger and fear.

You can start or join a group that protests against austerity, i.e. cuts in social spending, cuts to the deficit and any tax increases. March in the streets. Tell one coherent story. “NO TO AUSTERITY. NO TO BUDGET CUTS. NO TO TAX INCREASES. NO TO LIES.”

Get angry. Cause fear among the politicians.

The rich are doing it to you. They rely on your lethargy and passivity. They depend on your being sheep. So far, they have been right.

Extreme right.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY